Let me tell you a story about the art of the grocery store war, one that Amazon and supermarket Whole Foods just took to the next level.

Chinese general and military strategist, Sun Tzu, was all about winning when the competition was fierce and the stakes were very high and he wrote a book to prove it. His thirteen-chapter book written in the 5th century B.C. – The Art of War – lays out his very strategic approach for how to do that. This 2,500-year old best seller was first translated into English in 1910 and has influenced the actions of military leaders, business executives, political figures, trial lawyers and sports team coaches in modern times.

Tzu’s core principle for winning at war may at first sound counterintuitive – it’s to avoid big battles. Instead, he believed, attacks on the enemy should be so carefully and strategically planned that one strike should be capable of destabilizing them – you win and they lose because they’re incapable of fighting back. Doing that successfully, he wrote, requires a discipline of thought and a precision of execution: understanding the enemy and their vulnerabilities, having clarity about the outcome long before an attack is made, honing and keeping good sources of intelligence, having all of the troops united and aligned, and staging short, but decisive attacks.

And the element of surprise.

“In conflict, direct confrontation will lead to engagement, and surprise will lead to victory,” Tzu wrote. The element of surprise not only catches the enemy off guard (obviously) but those who are capable of carrying out such a well-executed surprise attack, Tzu believed, are also much more capable to seize the opportunities created as the enemy retrenches amidst the chaos.

The announcement of Amazon’s intention to acquire Whole Foods for $13.7 billion on Friday, June 16, 2017, clearly took the idea of using the element of surprise to a new level in grocery retail.

A surprise because Amazon has never acquired anything that costs more than $1 billion.

A surprise because Amazon has always used digital tools and technologies to crush existing brick-and-mortar retail and shift those sales to digital channels.

A surprise because no one ever expected Amazon to buy a beleaguered 431-store brick-and-mortar grocery store chain whose sales per square foot were second only to Costco in 2015, but with a business model that’s now under attack from competitors who’ve taken a bite out of their once strong but very pricey organic food foothold.

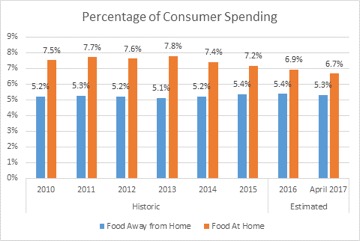

A surprise, because it’s much more about changing how consumers spend the roughly 12 percent of their household budgets allocated today to groceries and food – food eaten in the home and food eaten in restaurants – than going head to head with grocery stores.

And Amazon is doing it at precisely the moment in time where consumers are shifting that food spend and adjusting those grocery food shopping and eating preferences.

The acquisition of supermarket Whole Foods did what Tzu said the element of surprise always does: destabilizes the competition as rival grocery stocks tanked. It also gives Amazon the opening it needs to leverage the assets they’ve assembled to reshape how and how much consumers spend on food, while the rest of the grocery sector is back on its heels figuring out what to do next.

And while the restaurant segment may not yet know what’s about to hit them.

Or mobile wallets, either.

Amazon’s Walk On The Wild Grocery Side

This is a plan that PYMNTS readers got a sneak peek about two years ago.

In April of 2015, I wrote a piece about whether Amazon would do to grocery what they did to books – demolish the large chain brick-and-mortar grocery stores into oblivion. My piece was motivated by three things: the launch of the Dash Wand, the voice-activated device that could scan barcodes, add those items to a shopping list and be fulfilled by Amazon in April of 2014; the launch of Amazon Pantry that same month and year; and the launch in April 2015 of the Dash buttons that everyone thought was an April Fool’s joke.

All products available only to Amazon Prime Members.

I wrote then that Dash buttons and Amazon Pantry could accelerate the shift online for frequently purchased commodities and that Dash buttons and the Dash Wand were clever ways to contextualize that ordering because they were literally within reach of the places in the home where consumers used those products. Amazon Pantry even gamified the purchase of commodity products online by asking consumers to fill boxes with the items they wanted to purchase.

I also posited that this could also change the way consumers went grocery shopping and where they might go to do it. My theory then was that if Dash buttons caught on and expanded to include more brands, and if consumers got used to the convenience of having the big bulky stuff delivered to the house, they’d stop using the grocery store to buy those things.

And maybe stop going as often.

Instead, their visits to the grocery store would be to buy the things that they wanted or needed to inspect – produce, meats, dairy and frozen foods – instead of everything they needed to buy on a weekly basis. I also suggested that consumers might even change where they shopped to make those purchases – produce at the local farmer’s markets, meet at the butcher, fish from the fish market, etc.

Two months later, in June of 2015, Amazon launched Echo with Alexa after a closed pilot began in November of 2014. Amazon immediately opened Echo and Alexa to developers by making its SDK available to anyone who wanted to create a voice-enabled skill.

Including the ability to build a shopping list of things that could be ordered on Amazon and shipped home in two days or less.

Since then, as part of its grocery efforts, Amazon has:

All of this has happened at the same time that Amazon has added tens of millions of consumers to its Prime rosters.

Piper Jaffray’s 33rd annual research on teens published this month reports that 82 percent of households with annual incomes of $112,000 are Prime members, and 69 percent of households overall are too. If that’s correct, and assuming that there are 125 million American households with 2.53 people each living in them, that would put the number of American consumers capable of tapping into a Prime Membership using any one of the various devices and channels that are now available to them to order from Amazon at 174 million.

To Eat At Home – Or Not To Eat At Home? That Is The Question

Bloomberg reported in 2015, that for the first time since 1992, Americans spent more eating out then they did eating in. Fueling that trend, were the millennials, the generation that loathes cooking and cleaning up so much that they have stopped eating cereal because it requires washing the cereal bowl and spoon, once done.

What a difference a year makes.

A Reuters/IPSOS study of 4200 consumers in January of 2017 reports that a third fewer consumers are eating out as often as they once did. Nearly two-thirds – some 62 percent – report the reason for that shift is cost.

The rising cost of labor has driven restaurant menu prices higher at the same time that food prices and inflation are at historic lows. Reuters reports that the cost of eating out increased 2.4 percent while the cost of eating at home has declined by 1.9 percent.

This is at the same time that foot traffic to restaurants has flatlined – zero growth in 2016 – has been that way since 2009, according to NPD.

This is at the same time that foot traffic to restaurants has flatlined – zero growth in 2016 – has been that way since 2009, according to NPD.

The competition for that overall food spend isn’t coming only from people deciding that it’s cheaper to buy groceries and cook at home.

Supermarkets, eager to get more feet inside of their stores and blunt the impact of on-demand food delivery services have turned to prepared foods as a high-margin alternative for those who prefer the convenience of having someone else cook the food that they can take home, heat up and eat with the family and kids.

NPD reports that 40 percent of Americans purchase prepared foods from their grocery store, including millennials, who haven’t yet developed a taste for grocery shopping. NPD says that consumers made 2.4 billion such visits to grocery stores accounting for $10 billion in consumer spending in 2015. Moody’s says that that one in every 10 meals eaten every day are prepared food bought from a grocery store to eat at home.

Millennials, a group who eats out more than 3 times a week and spends 44 percent of their food budget doing so, have suddenly discovered that the restaurant-quality prepared foods section of their local grocery store may be a healthier alternative to the fast food, delis and pizza joints that have typically been their go-to. And cheaper too, as they realize that not only is the cost of eating out getting more expensive, but so is spending $8 to have a $12 meal delivered to them. Twenty-four percent of millennials shop at Whole Foods already.

From “Whole Paycheck” To “Whole Food” Spend

Some have said that the acquisition of Whole Foods will give Amazon an opportunity to slash its costs and reduce prices so that they can cater to a less affluent group of consumers.

While cost reduction thru purchasing and logistics and inventory management efficiencies seems like a no-brainer, it’s unlikely that Amazon will use Whole Foods to go down-market. As fulfillment centers to deliver to a variety of customers, including those who may not visit Whole Foods today but who buy groceries from Amazon today, likely. To get those same consumers into those stores – not so clear. Still, the Whole Foods acquisition is likely a significant building block in dominating grocery shopping and spend. Even though Walmart grocery shoppers won’t be fleeing anytime soon to Whole Foods, Amazon’s move has probably deeply unsettled folks in Bentonville.

Others have said that this is just another of Amazon’s big retail experiments without any clear sense of how they plan to optimize that asset, inferring that Amazon’s focus on grocery since 2014 has been sort of a wild and crazy crap shoot too. I think that Amazon knows exactly what they want to do with Whole Foods – and why they were quick to write a $13 billion check.

Amazon has been collecting data on how consumers buy groceries since 2014. Over that time, they’ve obviously seen much of what our recent study with Visa on the use of connected devices to buy and pay concluded: consumers go grocery shopping today because they have to buy food but they find the experience unproductive, and time consuming. They want options to ease the pain.

Nearly two-thirds of the ~2600 consumers we studied – 64 percent – went to the grocery store in the seven days we asked them to keep their diaries and 48 percent bought groceries online during that same period. Only 41 percent ate out.

All of these consumers own a smartphone and 75 percent own more than four connected devices. Fourteen percent own a voice-activated device and many of those devices are Amazon’s since they’ve been in the market the longest.

Nearly 70 percent want to use connected devices to improve the efficiency of their shopping experience – the devices they have now and those that may still be in the lab. Fear of learning how to use them when they hit the streets isn’t a problem, consumers told us, and using those devices to buy groceries is top of their list.

Including using them to “auto pay” in a store when they go. In other words, The Amazon Go experience.

Amazon, with Whole Foods, has the chance to use all of its many connected end points to those consumers to remove the friction from grocery shopping – and capture a big chunk of what consumers spend to eat as they do. This move is the classic – and highly disruptive – blurring of the on and offline worlds: the one-stop shop for buying groceries in store, or buying them online, or asking Alexa to build a shopping list, or deliver freshly prepared foods on Mondays and Thursdays at 530 for dinner with the kids, or Saturday at 3 for the cookout with the neighbors.

And the blurring of how much consumer’s spend to eat – all linked to the one payment method that ties all of those options and end points together – Amazon’s – in the store and online.

It’s possible that Amazon and Whole Foods could accelerate the growth of the grocery category that’s said to be a hook for getting millennials into grocery stores – a concept that analysts have dubbed the Grocerant. These stores sell groceries but are anchored around the delivery of a variety of food experiences – cooking lessons, expanded selections of prepared foods and separate places where those foods can be eaten in the store with friends – or taken back home.

Taking a chunk out of restaurant sales as they do.

And although it might be a while for the true “auto pay” Amazon Go experience to be operational at scale, it might not be as long before we see the Amazon’s physical book stores payments experience in full bloom. Those bookstores use bar codes on shelves that can be scanned for details on pricing and even for ordering and paying. Bar codes are de rigueur in grocery stores – store shelves and products all have them – codes that can be scanned on items that can be added to a shopping list for auto checkout with Amazon – no POS encounter needed – and even delivered a couple of hours later.

Taking a chunk out of mobile wallet and mobile pay shares along the way – but not just at Whole Foods.

If Whole Foods and Amazon are successful in reshaping the grocery category to overlap with some aspects of food more typically consumed outside the home, then the next element of surprise to hit will be felt in other physical supermarkets, other online outlets for buying groceries, fast food/QSR, pizza joints, and all of the many aggregators that today deliver food to people who don’t want to cook.

Maybe Amazon will reconfigure the Whole Foods store footprint to include food marketplaces, where smaller, specialty players are brought into the Amazon ecosystem and given a chance to sell to a captive audience of buyers in search of a healthy and unique food experience, just like they’ve done online.

Many of the same places where mobile wallet and mobile pay providers have spent time cultivating acceptance and usage given the frequency of spend in those places. Sure, Whole Foods accepts most digital wallets today, but Amazon Prime members won’t ever see a checkout lane or a terminal.

Just like consumers say they want it.

When Bezos started Amazon online in 1994, he started selling books because it was something that all consumers bought – CDs followed for the same reason. So, it shouldn’t come as a surprise that his big jump into physical retail is in a category that follows that same philosophy: all people have to eat and they generally do three times a day.

What he’d probably say, though, is that the element of surprise with the Whole Foods acquisition isn’t so much about beating the competition, but observing what consumers want and then giving it to them. But if that also means destabilizing the competition, then all the better.