B2B Check Use Continues, But Why?

It’s becoming an increasingly popular question, but why are so many companies and their vendors so hesitant to give up using checks to settle their transactions? Surely they want to reduce their costs and increase efficiency. Much of the issue stems from reliance on old habits, but pressure is mounting for change as more companies are pushing ePayment and eInvoicing services designed to move progress forward.

A lot has been discussed recently about the need for businesses to shift their check use to settle invoices to electronic versions, both to speed up settlements and to create more efficiency in the process. And while for some companies the process has been slow, there are a growing number of alternatives available to move the process forward.

Indeed, PayPal, NvoicePay, Intuit, Ariba and Dwolla represent but a few of the companies that offer plausible alternatives to paper checks that make it simpler and more cost effective for small and midsize buyers and suppliers to transact digitally. Bigger entities have been moving invoicing funds electronically between banks for years, as Market Platform Dynamic CEO Karen Webster noted recently in a commentary article “Does The US Really Trail The Rest Of The World In Payments Innovation?

So why have smaller B2B players been relatively slow to follow suit? In many cases, it’s because companies want to use payment cards to settle their debts, and many vendors aren’t equipped to accept such payments. Moreover, many sellers also don’t want to incur an expense they’re not used to by accepting cards. But that’s no excuse for not accepting payments via the automated clearinghouse system, where the cost is but a fraction of the expense of accepting payment cards and likely will provide a return on the investment.

The check evolution

Check use may be continuing, but it’s also changing, as more companies are convert their checks to electronic payments through check imaging or conversion to ACH debits. And U.S. businesses now have an expanding range of payment choices to help in their migration from paper to electronic methods. That is, theoretically they should help in that cause.

Also helping to generate more electronic payments is the greater use of electronic invoicing. Various companies, such as Basware and Taulia, have turned eInvoicing into a business opportunity. A recent report available from Research and Markets predicts the global eInvoicing market will grow at a compound annual growth rate of 23.3 percent through 2018.

As more companies receive their invoices electronically, it should ease their conversion to using electronic payment methods. Again, theoretically it should.

Put into perspective

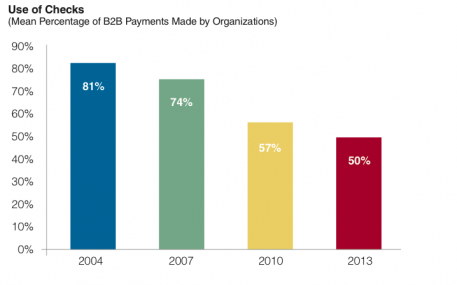

A recent report, the 2013 AFP Electronic Payments Survey, which JPMorgan Chase sponsored for the Association of Financial Professionals, puts the issue of continued B2B check use into a clearer perspective using data. Some 70 percent of organizations it surveyed are struggling to convert to electronic payments, and most companies cite customer/supplier hesitance to adopt and IT barriers as the top obstacles.

Such constraints, the report notes, also are impeding progress in other areas, such as mobile and cross-currency payments. Only 11 percent of organizations today use mobile technology to initiate payments, with only 32 percent planning to do so over the next five years, according to the AFP’s survey. Moreover, 50 percent of organizations that facilitate cross-currency payments via foreign-currency accounts rely on banking providers, which leads to unnecessary banking relationships and cost, the report notes.

According to the report, practitioners can overcome these challenges and break through the status quo of limited ePayment adoption by “greasing the organizational rails” with a multi-year business case that includes fee reductions, internal efficiencies, working capital optimization, enhanced forecasting, fraud exposure reductions, improved disaster recovery, and the strengthening of data privacy, according to the report.

The association’s research department sent a 35-question survey in September to its corporate practitioner members with the following job titles: cash manager, director, analyst and assistant treasurer. The survey generated a total of 484 responses, which were the basis of the report.

Check-use trends

In terms of B2B disbursements among major suppliers, the vast majority of organizations, 92 percent, still use checks when paying at least some of their major suppliers. Moreover, many also rely on multiple ePayment methods, with 82 percent using wire transfers to pay major suppliers, 81 percent using ACH credits, 50 percent using purchasing cards, 34 percent using ACH debits and 13 percent using single-use accounts, the report notes.

Checks continue to be the most widely used method of payment to major suppliers, but their use has declined significantly in recent years, according to the report. The average company makes an estimated 43 percent of its payments to major suppliers by check. In the AFP’s 2010 and 2007 surveys, the shares were 49 percent and 65 percent, respectively, illustrating a downward trend.

Thirty-one percent of payments made to major suppliers are made using ACH credits, while 16 percent are made via wire transfer. Purchasing cards, ACH debits and single-use accounts are used for far fewer payments to major customers, according to the report.

Thirty-one percent of payments made to major suppliers are made using ACH credits, while 16 percent are made via wire transfer. Purchasing cards, ACH debits and single-use accounts are used for far fewer payments to major customers, according to the report.

“Larger organizations are more likely than smaller ones to use ACH credits to pay major suppliers. Consequently, their percentage of check payments is smaller,” the report notes. “The share of ACH credits in a large organization’s payments mix is a third greater than that in smaller organizations (38 percent versus 27 percent).”

In terms of collecting payment, 93 percent receivechecks from their major business partners, but their B2B customers also use the full range of electronic payments, according to AFP’s report. Eighty-one percent of organizations receive payments from major customers via ACH credits, 75 percent collect via wire transfers, 22 percent are paid through ACH debits, 20 percent receive purchasing card payments, and six percent are paid via a single-use account.

Moreover, 42 percent of all payments made by major business customers still involve checks, though the use is declining. Forty-seven percent of payments that organizations received from major customers in 2010 were via check, declining from 57 percent in 2007. The typical organization also collects 26 percent of its payments from major customers through ACH credit, 20 percent via wire transfer, 4 percent by ACH debit, 2 percent by purchasing card and 1 percent by single-use accounts, according to the report.

The numbers tell the story. Check use continues, but the trend illustrates a continued decline. The market remains wide open for specialists looking to push the trend harder, but they’ll need to do better job convincing companies and their vendors of the benefits of change if they want to pick up the pace.