PayPal’s Big Vision

“This isn’t about minor upgrades — like replacing the card swipe with a tap — this is about fundamentally rewiring the commerce experience.”

— Bill Ready, SVP Global Head of Merchant & NextGen Commerce at PayPal

In life, it often boils down to making one of two choices.

Go big, or, go home.

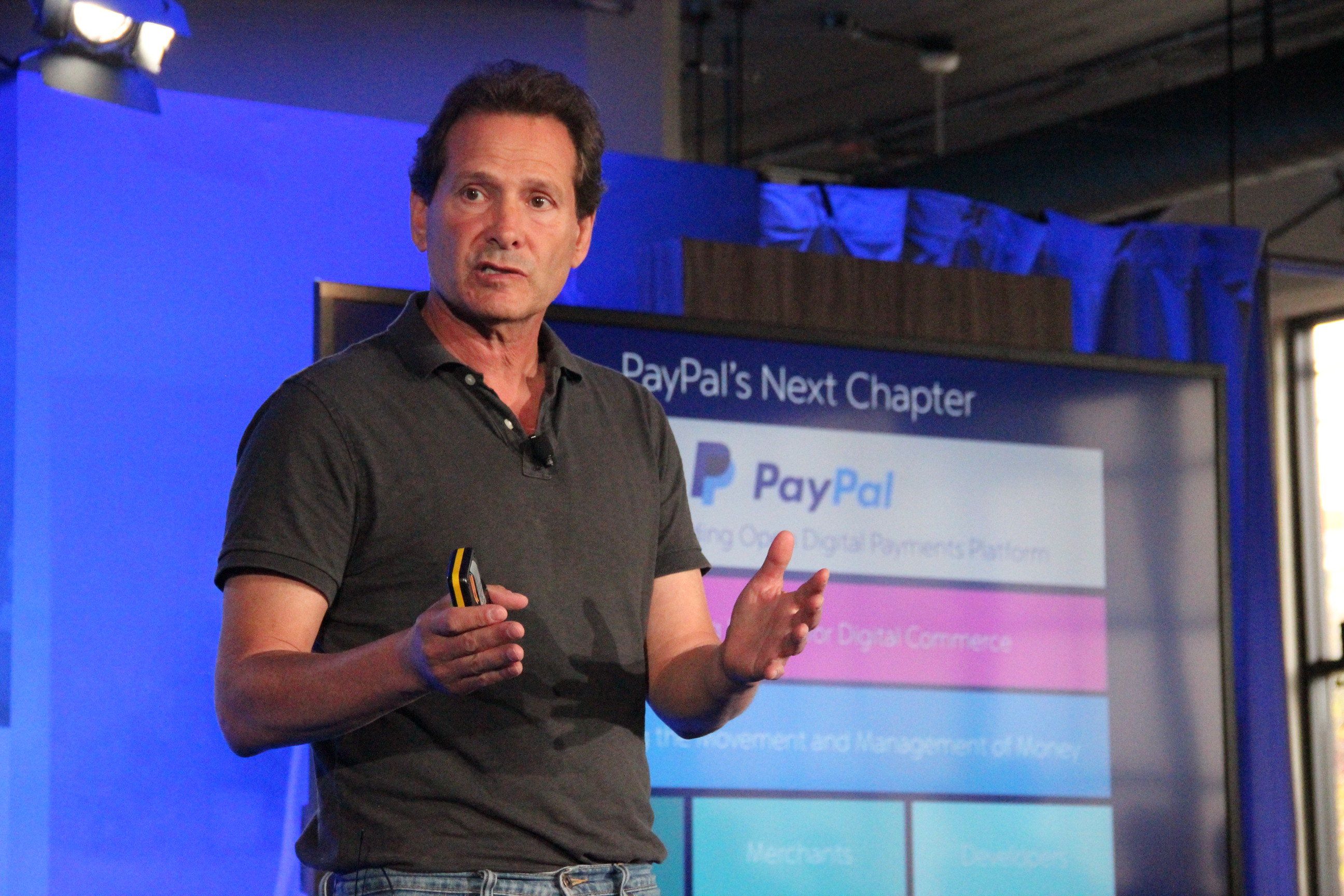

And while its spin-off into its own company hinted at its choice, at an event in San Francisco yesterday (May 21) PayPal’s president Dan Schulman hit the point, well, home.

Home is not a place that PayPal is going anytime soon.

No, it seems instead that PayPal is going big. Or perhaps more appropriately after absorbing the 90 minutes of presentations and demos made at the event – ginormous – since, as Schulman pointed out repeatedly during his remark, PayPal today is already pretty big.

“Last year we did over $8 billion in revenues – that would put us in the Fortune 500 and going into the first quarter [2015] that revenue grew at 17 percent,” Schulman noted. “We did over 1 billion in transactions during the first quarter of [2015].”

Schulman also referred to PayPal’s 165 million users, availability in over 200 markets, 14,000 developer partners and 8,000 member customer service team throughout the course of his remarks – establishing that though PayPal as an independent entity may be new to the marketplace in the coming months, PayPal the digital player is an established force in the world of payments.

And, therefore, Schulman asserted, it’s ready to lead the way in the rapidly evolving world we call digital commerce.

“I think in the next three to five years, we will see as much change [in commerce] as we have seen in the last 20 or 30 [years] in financial services. The difference between online commerce and offline commerce is basically blurring and disappearing,” Schulman noted. “As a result you are seeing online commerce being replaced by mobile commerce while online is moving to in-app and in-app is moving to in-store.”

And he added, “What you are beginning to see is this transition to a different form of commerce take place which we call personal or digital commerce. And merchants are trying to figure out how to ride that wave to connect to their customers.”

But being “just a button on a merchant’s website …that a consumer uses to make a transaction,” is just a small part of PayPal’s big vision.

Instead, Schulman explained, PayPal’s next evolution is to take full advantage of its 16 years of experience as a digital commerce platform – growing up as a digital commerce player as the Internet itself was growing into commerce – to become the flexible and nimble service platform that today enables a variety of financial and payments activities for consumers and businesses. Starting as a digital platform, Schulman believes, gives PayPal a running head start in operating an “open platform” for both their consumer end users and the merchants they enable.

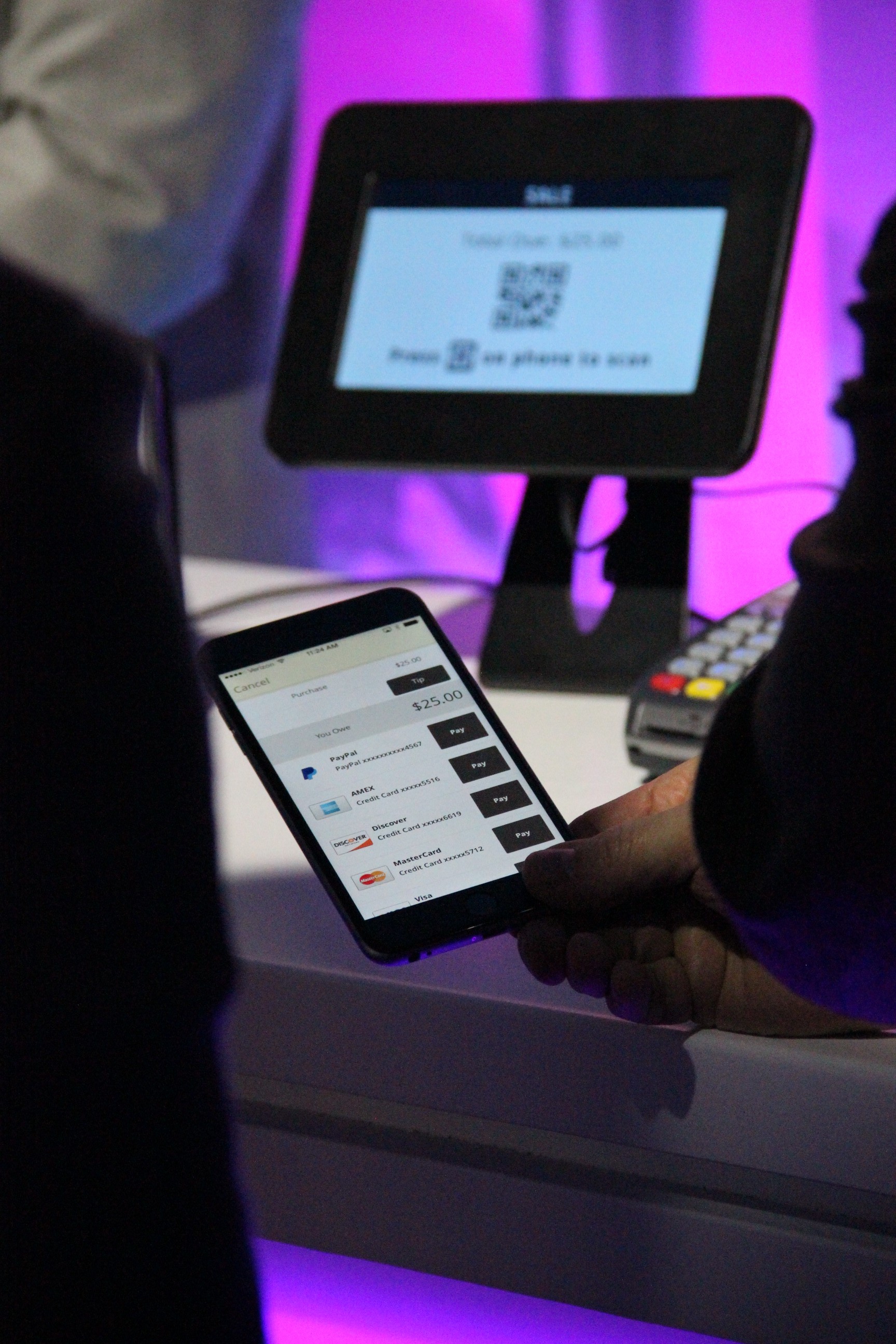

On the consumer side, Schulman explained, that means being payment form agnostic – allowing consumers to access debit cards, credit cards, ACH, rewards points or as many other payment methods as feasibly allowable – and to do that across any shopping channel and digital platform.

“We want to be able to make consumers use any form factor they want. If a consumer wants to use an Android phone, Apple tablet and Windows OS at home, they should be able to have a common app and operational experiences among all of them,” Schulman noted.

For merchants, that means giving them the options to create a better customer experience in their physical stores – thinking well beyond a line-‘em-up-at-the-front-of-the-store mentality to checkout that simply substitutes a phone for a plastic card. And does nothing to add value to the consumer shopping experience and, therefore, the incremental revenue opportunity for the merchant.

This, Schulman noted, means offering their retail partners the ability to enable the options that their consumers prefer, including “competing” services like Google Wallet or Apple Pay.

“For our merchants, we want to be a full service partner. They [can] write their own apps because they know their customers better than anyone else, and we [can] provide the payments and rewards part of that by plugging in with an API,” Schulman noted.

Schulman also emphasized PayPal’s global scale, risk management and security protocols that enable PayPal to authorize consumers and detect and manage fraud – without slowing down transactions. Job No. 1 for PayPal – from Day 1 – was to convince merchants and consumers that they were a secure platform that could enable commerce in a totally new environment called the World Wide Web.

“We are the world’s most trusted brand when it comes to a digital wallet. In parts of the world they trust PayPal more than anything else – which is even better than we do in the U.S.,” Schulman added.

Schulman concluded by talking about something that those who know him know he has a personal passion for: using technology to bring financial services to those who most need them.

“Technology can offer consumers a better, easier and cheaper way to move their money. There are too many people that live on the margins of our system and technology has the potential to move those people into the mainstream and we should strive for nothing less than the democratization of money.”

For PayPal, going big also means going broad, using its global heft – and heart – to democratize financial services for consumers and businesses worldwide.

So what will the new broader and deeper PayPal look like? Mostly like one where PayPal is expanding its efforts in every corner of the business. Online it means a pair-up with e-commerce infrastructure provider Bigcommerce to tie in its 90K retail partners seamlessly via Braintree’s v.zero SDK and an expansion of PayPal Credit products that will allow more shoppers to divide larger purchases into monthly payments.

On Mobile – where a third of PayPal’s business comes from today (and they expect a majority could come from in the future) – PayPal has extended OneTouch payments to being part of the mobile web commerce experience (as opposed to in app only). In the physical store, PayPal remains focused on “replacing physical experiences with digital ones” to further blur and remove the line Schulman referred to in his speech. PayPal will also be leveraging its acquisition of Paydiant to help more retailers build their own commerce apps that engage the consumer in store, on the way to the store and even after they have left.

Finally, PayPal will be ramping up its international efforts with a continued focus on cross border, particularly in China.

“PayPal China Connect, which will link Chinese consumers directly with our network of global merchants,” PayPal noted on its blog. “We are also announcing a new collaboration with UnionPay International to provide Chinese cross-border shoppers with a more robust lineup of global merchants on the UnionPay Shop The World website, and fewer steps to complete their transactions via UnionPay Online Payments.”

Schulman and PayPal’s ambition appears grounded in the investments in innovation that PayPal has made over the last 16 years of its existence. The Payments Innovation Index, Pii360, the only objective and quantifiable ranking of payments innovation, ranked PayPal in the Top 10, ahead of Google, Discover and Alibaba.

“We have over 16,000 people in the company [and] the only thing we focus on is digital and mobile payments. That’s it. We’re not doing this for anything else, we’re doing this to be the best digital payments platform in the world.”