Well, we’re just about 3 weeks away now from Apple’s “big reveal.” September 9, 2014, is the date that Apple is expected to debut its new iPhone 6 and break its silence about all of the various consumer bells and whistles that this new device (devices?) will have. Pundits have predicted for the last three years that one of those bells would be NFC. They’ve been wrong, as I’ve predicted, so far.

But, I’ve talked to enough people now and followed enough breadcrumbs to believe that this time will be different.

And it appears that the “big reveal” could go something like this: The iPhone 6 will include NFC and a secure element in the phone that Apple will control. Apple will give consumers the chance to register one card to their iTunes account from several large issuers that Apple has negotiated deals with. This token-based “wallet” can be used with that card to pay for items in stores that accept NFC payments. TouchID will authenticate the user and Apple will be paid a fee by participating issuers when cards are first registered and then each time a transaction is made. Since there are now about 270k merchant locations, including the Apple Store, that accept NFC, those will be the places that consumers can first use this new mobile payments capability. [Speaking of the Apple Store, anyone interested in understanding how Apple reinvented its own retail experience should read the book called The Apple Experience, which lays out some interesting insights into their retail methodology, which is modeled after the Four Seasons Hotel chain]. A big question is whether the “wallet” will work with other acceptance methods besides NFC—more on this later.

So, that makes the question of the day, will an iPhone with NFC do something that we’ve not managed to do so far anywhere in the world: ignite mobile payments?

Apple is clearly a mobile payments “Black Swan” – one my colleagues and I have been talking and writing about for the last several years. Eight hundred million iTunes accounts with registered cards, a beloved brand that people trust and a customer group that is largely affluent and drives roughly 66 percent of spend in the U.S., according to our calculations, are three pretty big reasons that they could singularly influence the direction of mobile payments. Of course, Apple knows this, too, thus the little toll that it is said to have negotiated on each of the transactions that will come thru its iWallet.

Advertisement: Scroll to Continue

But determining whether Apple handsets with NFC is the ticket to mobile payments nirvana requires a bit more context.

According to the analysts that track mobile phone shipments, Apple could sell as many as 80 million iPhone 6 units in 2014. If it did, it would break Apple’s previous sales records of 51 million in a single quarter. What experts say will juice larger than average sales is the larger screen size, something that is particularly popular in developing markets where phones are the primary access to the internet. Those 80 million units are worldwide numbers.

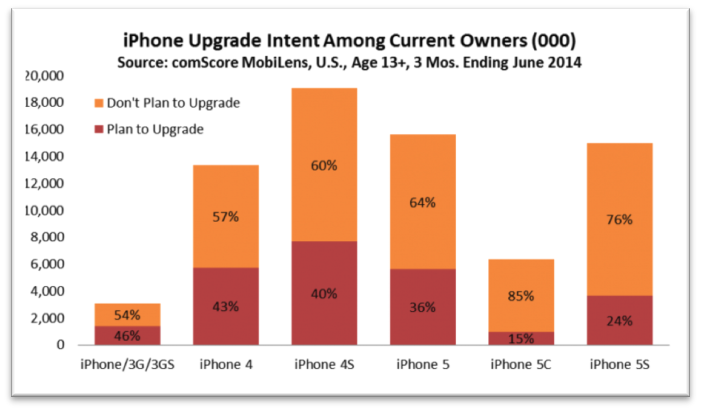

Analysts project that Apple’s iPhone 6 could sell 185 million units worldwide. comScore estimates that about 35 percent of iPhone customers in the US with expiring contracts or about 25 million people, will buy a new iPhone. Many more probably won’t care and will buy one anyway.

But sticking with the numbers that others have researched for the moment, Apple’s role in igniting mobile payments based solely on the presence of NFC in the phone comes down to this simple math problem: how many of those 25 million people in the U.S. will take the extra step to register one card to an iWallet and use it regularly—and is that enough to get merchants to care? (Bear with me here, NFC may be only part of the story.)

That will depend on where and how consumers can use NFC in their new Apple iPhones.

Let’s start with the where.

Today, NFC payment capabilities are available in 270k merchant locations. There are roughly 9 million merchants in the U.S.. That means that NFC has some pretty serious ground to gain before it’s available in enough of the merchant locations that matter to establish the frequency of use and habituation that will ignite its use for mobile payments – Apple’s embrace of NFC notwithstanding. And that, as we’ve said consistently, is NFC’s Achilles Heel: the longer that it takes for a critical mass of the right merchants to have the capability available to enough consumers with NFC-enabled phones, who want to use it for payment, the more at risk NFC technology is to be leapfrogged by something else that merchants can implement more easily and that is more appealing to consumers.

The timing of Apple’s expected announcement regarding NFC, of course, comes at the same time that merchants are taking delivery of (and ordering) new terminals so that they can become EMV compliant. The hope is that Apple’s inclusion of NFC in its iPhones will convince merchants that have dissed NFC before to reconsider now since new EMV terminals will ship with NFC capabilities.

So far, that road’s had a lot of potholes in it.

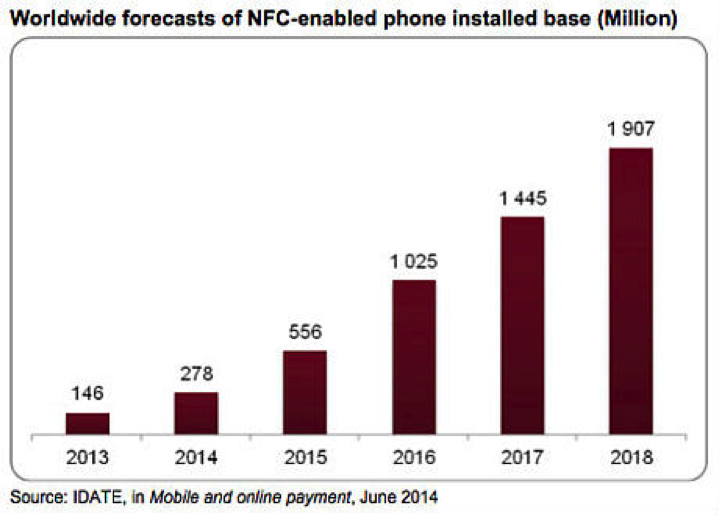

This year, there were 278 million people with NFC-enabled Android phones, according to iDATE. Based on the current availability of NFC terminals in the U.S., a whopping 14 percent of all transactions in the US could be done using NFC payments. Yet usage is miniscule and concentrated mostly in transit. Google Wallet and ISIS haven’t made a dent. Meanwhile, a survey of ~900 consumers about their awareness and use of mobile payments that was presented for the first time at PYMNTS Summer School revealed that more consumers had heard of and used Bitcoin than NFC payments.

In the U.K., where NFC payments have been available for some time, the story isn’t much different. YouGov reports that more than half, 56 percent more precisely, say they don’t care to use NFC because of security concerns and only 22 percent had ever actually done it. And it, too, accounts for a minute share of transactions.

So will 25 million more handsets make any difference in the U.S.?

At least until now, NFC hasn’t offered enough of a compelling use case for consumers to bother. Consumers who, for the most part, don’t feel that payments are broken enough for them to switch to using a mobile device. That’s any mobile device, nevermind NFC, to pay for something in a few stores here and there.

On the merchant side, even though consumers may not think payments are broken, a whole lot of merchants (rightly or wrongly) really do. They think acceptance is too expensive and have been busy suing the networks over that point for the last 15 years. NFC has been thought of by merchants as something that ties them to an “expensive” way for consumers to pay them and a technology that forces them to support other operational complexities. HCE only eliminates one of the big obstacles for them: the mobile operator. And, without consumers clamoring for NFC payments, merchants have had one of two reactions to appeals to turn it on: they’ve flat out refused and some that have the capability enabled, have turned it off – even as recently as March of this year (2014).

Why is that? Well, most certainly, one answer is that Google Wallet, ISIS, and Android phones just haven’t had enough sex appeal for consumers. They also, in some cases, come bearing lots of baggage for merchants. Will Apple wrap enough cool stuff around NFC to make consumers really want to use it for payments? And will that, in turn, persuade merchants to accept it? Is this finally the match that will ignite NFC and, therefore, mobile payments?

How many consumers active their iWallets for payment using NFC will 100 percent depend on how magical the experience is in the retail stores that are capable of accepting NFC payment today and how many more merchants will want to (and can) emulate that experience. Without something else wrapped around NFC technology, it’s hard to imagine that enough consumers would care enough to make the outcome any different than it is today–which is that consumers don’t really care.

There’s still a whole lot we don’t know about Apple’s plans and won’t until they speak on the 9th of September. For example, when and for what amounts do the contactless no signature rules apply? Having an iPhone that enables NFC payment and then having to sign for anything more than $50 would be a real bummer and an experience that Apple probably doesn’t want to be famous for. Okay, so you have to really go nuts to spend $50 at most of the places that enable NFC payments today–QSRs and drug stores.–But since NFC payments will likely be enabled at Apple stores, for NFC to be a practical mobile payments technology that can, in turn, ignite mobile payments more broadly, this will have to be addressed.

We also can’t anticipate how consumers will use their new Apple iWallets and how that will impact the cost of acceptance to the merchant. Will consumers attach a debit or a credit product to it? Will merchants be paying CNP or card present rates on those transactions? If consumers attach a debit product to what is really an EMV contactless transaction, what about routing? The resolution of these issues will determine how appealing this is for a consumer – one card per iWallet – and for the merchant – how much it costs them to serve that consumer against other alternatives.

My bottom line—for Apple to have made the decision and investment in NFC, there has to be something more that will provide the magic for consumers and merchants and give Apple control over the the payments experience.

Say hello to iBeacons.

As much talk as there is about Apple and payments, I actually don’t think that they give two hoots about it. Payments is a low margin/high volume business and requires lots of other expertise to do it well – like managing risk and security and getting broad acceptance. It’s also boring. Apple’s massive revenue stream is derived from the sale of devices and rev share on apps in its iTunes store that reinvent and enable entirely new experiences that are meticulously planned and executed. Payments isn’t exactly the sort of thing that “puts a dent in the universe” – to borrow from one of Steve Job’s and Apple’s innovation mantras. Apple’s smart enough to know though that doing it wrong could put a serious dent in its financials and possibly its reputational standing with consumers.

But Apple does care about the consumer and does absolutely nothing ever that it can’t control in every way in an iOS ecosystem that it owns, can grant access to and then monetize. It also does nothing to advantage its competitors. So enabling payment via NFC has to have other things wrapped around it that Apple can control, monetize and prevent others from leveraging in order to be consistent with the Apple way of doing business.

Apple has invested a ton into its iBeacon infrastructure and its launch last year spawned a massive ecosystem and wave of innovation that rides that technology. The investment in innovation around iBeacon, in just one year, has dwarfed investments made in enabling NFC infrastructure over the last decade by a country mile. iBeacons enable an entirely new way for merchants and consumers to communicate and I believe it will become a critical capability for Apple to monetize as it enables payments beyond the iTunes store.

iBeacon technology is cheap for retailers to install and instantly opens a line of communication with any customer who uses its latest iOS operating system – which is roughly 93 percent of all iPhone users. As a result, there are a massive number of use cases deployed in retail: malls, department stores, specialty retail, farmers markets, airports, and just about everywhere consumers and merchants gather in the physical world to transact. If a mall is “iBeaconized,” consumers can be directed to stores that have products of interest or things on sale. Once in those stores, if a retailer is “iBeaconized,” then a consumer’s dwell time in front of a product can trigger a product review or ratings, offer directions to the fitting room, or suggestions for other things that might go with it.

iBeacons can also be used to close the loop and initiate payment. And, there’s absolutely nothing to keep consumers with their brand new NFC –enabled iPhones from accessing other apps that enable mobile payments at their favorite iBeacon-ized retailer via another payment method. In fact, it’s happening today.

iBeacons can deliver the single most important merchant requirement for payments innovation: bringing them shoppers and getting them to buy. iBeacons can also close the loop by embedding payment in the experience so that merchants can eliminate the friction associated with checkout.

So, maybe the better question to ask in light of Apple’s impending announcement is whether, in the end, the new iPhone is about Apple pushing NFC or pushing iBeacons and their own commerce ecosystem?

I think the answer lies in whether you believe that the prospect of 10 percent or even 20 percent of the 25 million consumers running around with NFC-enabled phones is enough to tip 9 million merchants in the US to conclude that NFC is the de facto payments technology standard that they should invest in.

Or whether the prospect of that outcome is enough to accelerate the actions of others to use iBeacons to enable payment and commerce for all iPhone toting consumers in the U.S. – and around the world.

The way that it sounds, NFC is obviously a part of the commerce equation for Apple and is its opening act. But I’d be stunned if there wasn’t a second and third act and even a grand finale here that included lots of other opportunities for consumers and merchants to use its phones, its apps, and its iBeacons to create a commerce platform that also enable payments via QR code, BLE, Siri, online and who knows what else. That consumers and merchants all pledge their loyalty to the Apple platform and use its devices and apps consistently is Apple’s ambition. I don’t think that Apple actually cares whether it’s NFC or XYZ that powers payments, just that it all happens inside its ecosystem and that its platform is that which can both reinvent and monetize the commerce experience in a way that it can also control.

Any way you cut it, Apple stands to be a winner, and mobile payments could be a winner, too.

Finally, mobile payments is getting very serious and very exciting. It’s going to be a very interesting Fall.