WEX, OnDeck Double-Team Against SME Funding Gaps

The alternative finance industry may have emerged as competition to the banks, but today, it’s commonplace for traditional FIs to partner with alt-lenders. That partnership trend appears to be permeating other areas of SME financial services, with the latest tie-up to be between OnDeck Capital and WEX.

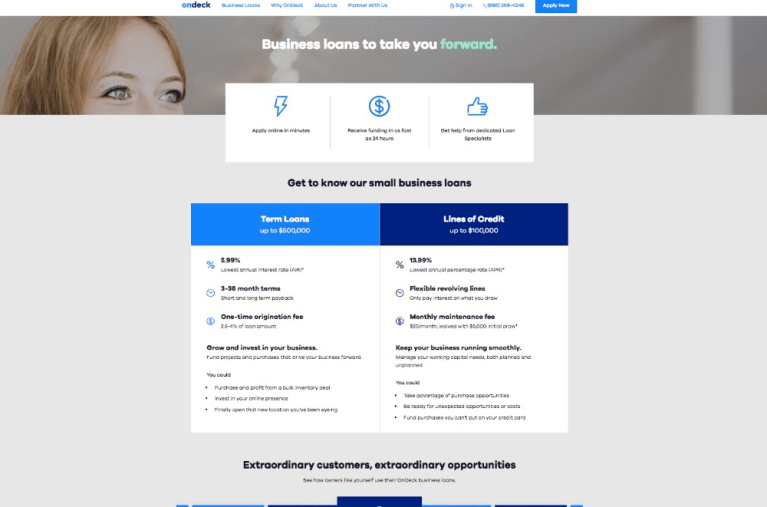

Announced Tuesday (Jan. 17), the collaboration means OnDeck’s SME financing solutions will be integrated into the offerings of B2B payments company WEX; WEX’s business clients, they added, will have access to several loan products offered by OnDeck of up to $500,000, with lines of credit of up to $100,000.

For WEX clients, that not only means money to expand businesses but that means a chance to finance the services they buy from WEX, including fleet card solutions.

“Our partnership with OnDeck will be a huge benefit to our small to mid-sized business customers who will now have access to new sources of financing,” said Brian Fournier, vice president and fleet channel partner of WEX, in a statement.

It’s a tie-up that combines two different methods for small businesses to access financing: commercial cards and alternative finance. But according to OnDeck VP of Business Development Jerome Hershey, that doesn’t mean the two companies are in competition.

“OnDeck loans typically don’t compete with credit cards due to different use cases and size needs,” he explained to PYMNTS. “For instance, a restaurant may want $50,000 to expand its eating space. This is a situation where a credit card line size may not be large enough.”

On the other hand, accessing a line of credit or small business loan may not be the right fit for another type of purchase.

“The flipside is there are instances where a credit card may make more sense than an OnDeck loan — for instance, a smaller-dollar purchase at the point of sale,” the executive continued, adding that most of OnDeck’s existing SME borrowers also have credit cards to use in conjunction with external financing to help expand and support business operations.

To have multiple methods of accessing financing is critical for small businesses. According to EY, the gap in financing available to SMEs in the U.S. remains, despite recent increases in bank lending levels.

“There are a lot of borrowers who are not in the consideration set by the large banks, because they don’t meet the criteria,” explained Rashmi Singh, senior manager at the wealth management practice of EY’s Financial Services Organization, in a recent interview with PYMNTS.

Alternative finance is one way to access funds when a bank rejects a small business, but commercial card products can also offer another source of cash to cover different categories of spend.

“Business owners are solving for a verity of needs throughout their lifecycle,” OnDeck’s Hershey said. “Whether they are looking to finance their growth by investing in more inventory or marketing initiatives or they are looking to cover interim working capital needs, small businesses need the right credit solution for their particular need — a credit offering optimizes for loan size, speed of funding, total payback and APR.”

OnDeck is no stranger to collaborations like the one with WEX. Last year, the company announced a collaboration with JPMorgan Chase, which saw the bank launching its online SME lending platform — with help from OnDeck — in April. But working with traditional finance players isn’t the only avenue alternative lenders have to fill in SMEs’ financing gaps. Increasingly, AltFin companies are working with providers of other types of financial services to SMEs; OnDeck also recently announced a deal with Intuit to provide financing to SMEs using the cloud accounting service.

But a collaboration with another company that offers some form of financing to small businesses is a different type of deal, not only focused on providing loans to SMEs but on ensuring those borrowers have all of their bases covered.

Of course, these collaborations are also good news for the alternative lending companies. And as OnDeck looks to strengthen its footing in a rocky sector — the firm recently secured $200 million in revolving debt from Credit Suisse to fund SME loans and rely less on outside investors — partnerships like the one with WEX will help OnDeck boost visibility among small business borrowers.

“WEX is a fantastic business with a long history and deep customer relationships,” Hershey stated. “Leveraging their brand value is important in helping to validate OnDeck to their customers, some of which may not have heard of us, or the online lending industry.”