By Michael Han, Bivio Yu & Arthur Wong1

On June 17, 2024, China’s State Administration for Market Regulation (“SAMR”) released the Guidelines for the Review of Horizontal Mergers (“Consultation Draft”), seeking feedback from the public. These guidelines represent a significant step forward, as they are the first specialized guidelines for merger review introduced by the Chinese regulatory authorities.

The document consists of 12 chapters and 87 articles, expanding upon the existing Merger Review Provisions. It covers various aspects of horizontal merger reviews, including procedural rules for such things as accepting evidence and conducting market testing. Additionally, it goes into the substantive criteria for evaluating horizontal mergers, including defining the relevant market, assessing market share and concentration, analyzing unilateral and coordinated effects, evaluating potential competition, examining market entry barriers, and considering aspects of buyer power, efficiency, and other relevant factors.

The primary goal of these guidelines is to improve SAMR’s decision-making process by providing a more detailed technical and operational framework. By offering clearer legal norms and expectations, the guidelines aim to enhance transparency and effectiveness in handling horizontal mergers.

In this article, we highlight eight key points from the Consultation Draft and provide recommendations on how businesses can navigate the evolving landscape of heightened antitrust scrutiny.

Highlight 1: Introduces market share and HHI index thresholds for assessing whether a horizontal merger is anti-competitive

Previously, legislation contained no “quantitative presumption,” which presumes a transaction to have anti-competitive effects if the transaction surpasses a specific market share or concentration index. However, in practice, the Chinese regulatory authorities used quantitative indicators established from previous cases to evaluate the competitive impact of transactions. The release of quantitative market share and concentration indicators in the Consultation Draft therefore provides businesses with valuable insights for anticipating the potential outcomes of the review process.

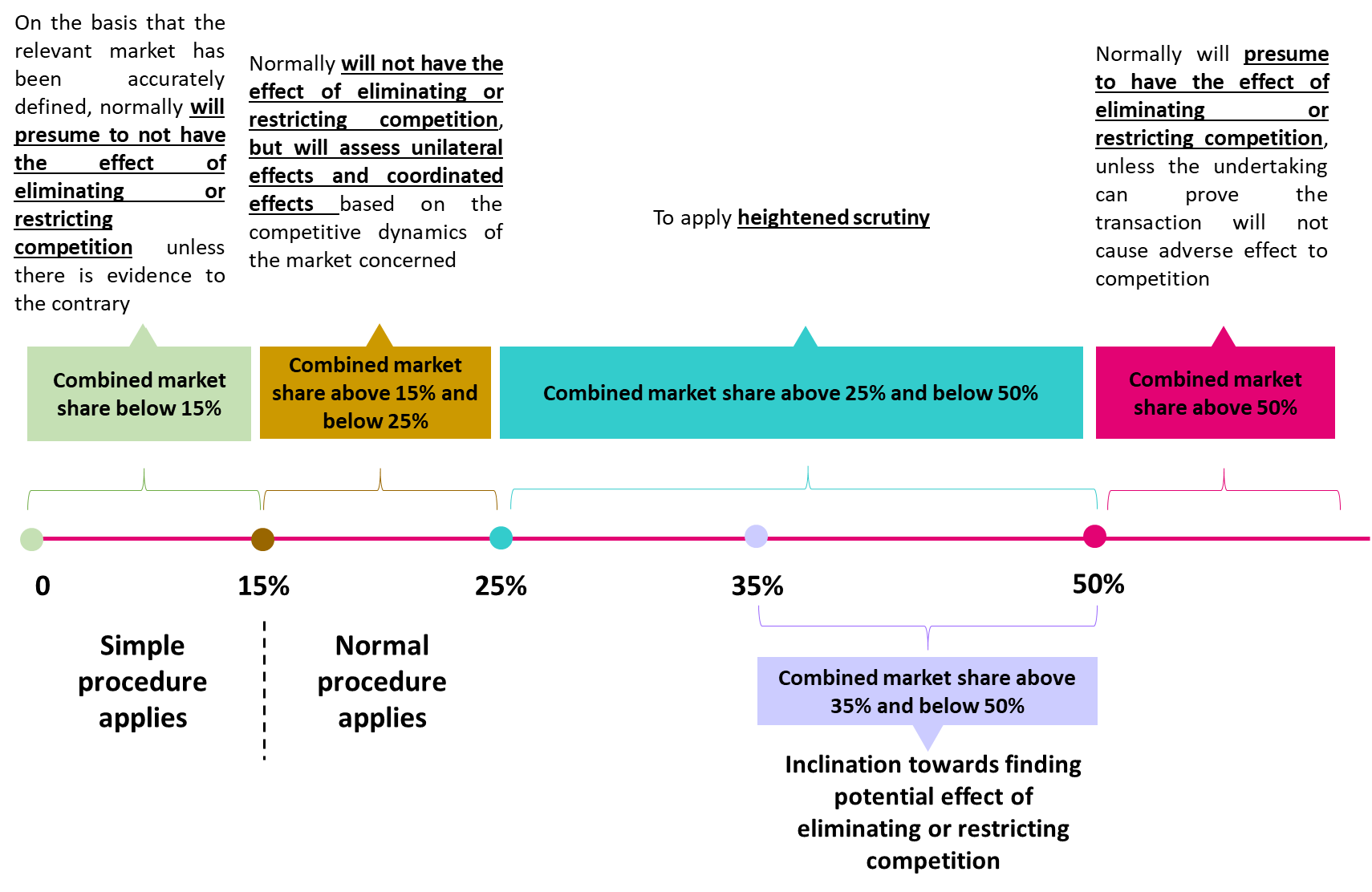

- Market Share Thresholds

The figure below summarizes Article 23 of the Consultation Draft, showing SAMR’s interpretation of each market share threshold:

In addition, the Consultation Draft clarifies how market share is calculated so that transacting parties can assess market share under different scenarios, for example:

- different indicators can be applied to calculate market shares depending on the specific characteristics of the industry concerned;

- sales volume or capacity can be applied as indicators for homogeneous products; and

- Market share over a longer period (e.g. three or five years) may be referred to when the frequency of transactions is irregular and fluctuating.

- HHI Indicator Thresholds

After extensive drafting and closed-door consultations, the current version of the Consultation Draft aligns closely with the HHI thresholds observed in other jurisdictions internationally. The Consultation Draft classifies market structures into three categories based on the HHI Index level:

- Low concentration market: HHI below 1000

- Medium concentration market: HHI between 1000 and 1800

- High concentration market: HHI above 1800

Corresponding to these market classifications, like the categorization by market share, the regulatory authority will implement a tiered review process:

| · HHI level | · Review standard |

| · Low concentration market or ΔHHI (delta) does not exceed 100 | · Normally not considered to have the effect of eliminating or restricting competition; |

| · Medium concentration market and ΔHHI (delta) above 100 | · Likely considered to have or to likely have the effect of eliminating or restricting competition; thus, a comprehensive review is required |

| · High concentration market and ΔHHI (delta) between 100 and 200 | · Further inclined to consider that it has or is likely to have the effect of eliminating or restricting competition; thus, a comprehensive review is required |

| · High concentration market and ΔHHI (delta) above 200 | · Normally presumed to have or to likely have the effect of eliminating or restricting competition, unless there is evidence to the contrary. |

In fact, the idea of a tiered review mechanism according to the HHI index coincides with the practice of other jurisdictions. This mechanism applies different reviewing standards depending on the market structure in order to optimize enforcement resources and offer a more predictable and consistent standard for businesses as a reference point. Additionally, convergence with international standards facilitates the coordination and consistency of cross-border merger transactions on a global scale.

Highlight 2: Fine-tunes the approach to defining relevant markets to enhance review transparency and certainty

The Consultation Draft clarifies how to define the scope of relevant markets in merger reviews. These rules are broadly applicable to vertical and conglomerate mergers as well.

| Transaction type | Relevant market definition |

| Merger | Relevant markets are determined by focusing on horizontal, vertical, neighboring and complementary relationships. |

| Acquisition of control either through acquiring equity or assets or by way of contract | Relevant markets are those markets that have horizontal, vertical, neighboring or complementary relationships between (i) the target company or the target asset and (ii) the acquirer’s business. |

| Establishment of a greenfield joint venture | Relevant markets are those markets that have horizontal, vertical, neighboring or complementary relationships between the proposed business of the joint venture and the undertakings concerned. |

| Target company or joint venture only supplies the undertakings concerned | · If a standalone product market is discernible, then the previous method applies.

· If no standalone relevant product market is discernible, then no separate definition is required. However, the relevant market should still be defined for the business related to and affected by the concentration. |

In addition, the Consultation Draft introduces the following quantification guidelines to ensure comprehensive coverage of all markets relevant to the transaction:

- When the aggregated revenue from the relevant markets, as defined according to the aforementioned criteria, constitutes less than 50 percent of the total turnover of the undertaking concerned, all businesses must be defined as the relevant markets.

- De minimis rule — a detailed market definition is deemed unnecessary when both the portion of the relevant revenue and the portion of the market share are below 5 percent.

These quantification guidelines are valuable for shaping market definition strategies. In previous instances, parties who attempted to define the relevant markets based on minor overlaps in order to divert SAMR’s focus from their main businesses often ended up having to define all their major businesses later in the review process. This can result in significant delays in the review timeline.

Significantly, the Consultation Draft introduces a novel concept, according to which the Chinese regulatory authorities may, if needed, consider the whole situation under different market definition approaches and leave the market definition open if multiple definitions are possible for a relevant market in a transaction. By introducing this novel concept, SAMR has signaled its flexibility in its approach to market definition.

Previously, unlike in other regions such as the EU where the market definition can remain open, the Chinese regulatory authorities typically required filing parties to take a clear stance on the relevant market definition. This requirement sometimes led to inconsistencies in market definitions across different jurisdictions in cross-border transactions.

The new approach under the Consultation Draft will alleviate inconsistencies in market definitions in different jurisdictions and streamline the review process across jurisdictions. It should be noted, however, that even if a definitive position on market definition is not required, the Chinese regulatory authorities will still conduct a comprehensive evaluation under various market definition approaches.

Highlight 3: Clarifies the sources and types of evidence accepted in a review

In normal case procedures and a selective range of simple case filings in China, the review process includes a consultation with relevant stakeholders to gather their perspectives on the transaction. This consultation phase has traditionally been opaque, offering limited visibility to the parties.

The Consultation Draft reveals the evidence types and sources required in the merger review. The primary source of evidence comes from submissions by the notifying parties. Additionally, the regulatory authorities, when considering transactions that may raise competition concerns, may proactively coordinate with third parties to gather supporting evidence to ensure a comprehensive and objective review. .

The Consultation Draft further elaborates on how Chinese regulatory authorities can solicit opinions from third parties:

| Target audience | Evidence sources: upstream suppliers, competitors, downstream customers or end consumers, relevant government departments, and industry associations

Assessment sources: independent experts, scholars, or third-party consultation agencies |

| Mode of communication | Written opinions, questionnaires, symposiums, seminars, commissioned consultations, site visits, etc. |

The Consultation Draft further clarifies the standards for evaluating evidence from various sources. It emphasizes the following principles:

- decision-making documents from daily operations are more credible than documents created for the purpose of a merger filing;

- opinions from downstream customers carry more weight than internal documents from the undertakings concerned and the upstream suppliers; and

- opinions from individual undertakings will not be considered as conclusive evidence but will be carefully considered.

Currently, unlike other jurisdictions such as the EU and the US, Chinese regulatory authorities seldom request parties to submit internal documents during merger reviews. However, with the Consultation Draft emphasizing the heightened significance of internal documents, Chinese authorities are now more likely to request and scrutinize them. Specifically, the Consultation Draft suggests that if evidence indicates that the primary intent of the undertakings concerned is to eliminate or constrain competition, the authority will likely consider that the merger has, or could have, anti-competitive effects, unless compelling counterevidence can be presented.

In the illustrative “Case 1” corresponding to the provision in the Consultation Draft emphasizing internal documents, the case presents the parties’ internal documents as evidence that the transaction’s primary goal was to curb competition. Consequently, for future merger filings in China, transaction parties should prioritize internal documents and ensure their compliance with regulatory standards.

Highlight 4: Establishes potential relevance of supply chain security throughout the review process

Escalating geopolitical tensions have intertwined with regulatory reviews on a global scale. The 2023 Antitrust Enforcement Annual Report by SAMR highlights that “the growing influence of international elements in the Chinese domestic market and Chinese factors in the global market has emerged as a key aspect of both the Chinese and global markets.” The Consultation Draft introduces regulations to adapt to the dynamic regulatory environment at an international level, aiming to address these issues within the framework of merger reviews.

- Market Definition and Competitive Analysis: Foreign Trade Restrictions Considered

It has been reported that SAMR has proposed considering foreign export control restrictions in future merger review guidelines. For example, the forthcoming “Guidelines for the Review of Horizontal Mergers” may aim to mitigate the adverse effects of restrictive trade policies enacted by countries such as the US. [2] The underlying rationale behind this proposal is to respond to substantial changes to the competitive landscape in important industries due to evolving export control regulations and foreign policies. Furthermore, restrictive trade policies may lead to challenges for parties bound by restrictive conditions in China to meet their obligations under a supply guarantee.

Although not explicitly outlined, the Consultation Draft has integrated the impact of restrictive trade policies into provisions concerning market definition and competition analysis.

- The ability to charge differentiated prices for distinct customer segments can significantly impact market definitions, market share calculations, and evaluation of competitive effects. If particular customer segments are vulnerable to anti-competitive effects arising from a horizontal merger, the Chinese regulatory authorities may define the relevant market by focusing on products that cater to these specific customer groups. Significantly, the suppliers’ ability to implement discriminatory pricing strategies for distinct customer segments is a pivotal factor when discerning whether a distinct market can be defined for a particular product.

| Even before the Consultation Draft, the Chinese regulatory authority included price discrimination in the competitive analysis. However, price discrimination had not been expressly laid out as a factor when defining the relevant market for specific products. The Consultation Draft provides clear guidance in this regard.

For example, in ASE Semiconductor’s acquisition of SPIL (2017), the parties could have achieved higher profit margins by implementing price discrimination for different customer types and for customers located in different regions, especially for customers located in China (mainly fabless customers and wafer foundry customers). The Chinese regulatory authority determined that this potential profit margin showed that the transaction parties possessed greater power as sellers compared to the buyers. Consequently, the merged entity would have the ability and the motivation to implement a discriminatory pricing strategy to increase profit margins, which were relatively low before the merger. This discriminatory pricing would have harmed customers and their interests. The Chinese regulatory authority ultimately decided to impose restrictive conditions, such as requiring both parties to maintain independence in pricing and sales, to provide services to customers on a non-discriminatory basis, and to reasonably determine service prices and other trading conditions. |

- Changes in the accessibility of the product will affect the definition of the relevant product or geographic market. Paragraph 2 of Article 18 in the Consultation Draft specifically deals with situations where legal, policy or administrative restrictions, or other factors, obstruct certain customer segments from acquiring particular goods, or lead to modifications or constraints on the geographic area from which customers in certain regions can make purchases. The draft suggests the importance of evaluating whether adjustments to the boundaries of the relevant product or geographic market are warranted based on product accessibility and recommends factoring in these considerations during market share assessments and competitive analyses.

- Impact of Foreign Government Subsidies on Market Competition

In recent years, amidst the global economic slowdown in growth and the escalation in geopolitical tensions, numerous countries have implemented diverse measures to bolster oversight and scrutiny of cross-border investments. These measures aim to safeguard their economic security and national interests.

In the Consultation Draft, China likewise now mandates an evaluation of the influence of foreign government subsidies on market competition. This mandate is designed to address extraterritorial review demands and uphold competition and economic security within China. Notably, the inclusion of government subsidies as an evaluation criterion for merger reviews marks a significant development in China’s regulation.

According to Article 83 of the Consultation Draft, if evidence indicates that government subsidies provided to a transaction party may adversely affect competition, the Chinese regulatory authorities can require the undertaking to provide related information so that the Chinese regulatory authorities can evaluate whether the subsidies adversely impact competition. In contrast to the Foreign Subsidies Regulation in the EU, the Consultation Draft has not established a separate mandatory reporting obligation. It also does not specify detailed evaluation standards, review mechanisms or legal consequences. Further regulatory refinements will be needed to clarify these issues, as well as the precise implementation of the Consultation Draft provisions and the potential impact on restrictive conditions and the possibility of new conditions being introduced.

Highlight 5: Clarifies potential competitive harm from horizontal concentration

The Consultation Draft clarifies that the potential competitive harms caused by a horizontal merger are unilateral effects and coordinated effects.

Regarding unilateral effects, the Consultation Draft provides a detailed framework for assessing whether a horizontal merger is likely to cause unilateral effects. The main factors include the number of competitors in the market before and after the transaction, the market share, the changes in market concentration level, the competitive relationship of the transaction parties, the presence of other competitors that can present effective competitive constraints, the market entry, the buyers’ side power, etc.

Moreover, the Consultation Draft directs the Chinese regulatory authorities to specifically focus on the following factors when assessing whether a horizontal merger is likely to cause unilateral effects:

- The negative impact on technological advancement and innovation: When evaluating the potential unilateral effects of a horizontal merger, the Consultation Draft emphasizes the significance of conventional competitive factors like price and quality, as well as dynamic competition, including technological progress and innovation.

- The competitive impact in two-sided or multi-sided platforms: For horizontal mergers involving two-sided or multi-sided platforms, the Consultation Draft underscores the importance of evaluating the platform’s two-sided or multi-sided business models and analyzing both direct and indirect network effects. In instances where a merger impacts one side of the market, it is essential to conduct a comprehensive assessment of the merger’s impact on the other side of the market and the competition among platforms.

| Before the Consultation Draft, the competitive analysis of the Merger Between Douyu and Huya (2021) took into account the characteristics of the two-sided platform. This merger became one of only three transactions prohibited in China and marked the first prohibition involving digital companies. Huya and DouYu were recognized as two leading game live-streaming platforms in China. The evaluation of the horizontal overlap between them in the game live-streaming markets considered the impact on consumers on one side of the market and game streamers on the other side of the market. Potential negative impacts on both consumers and game streamers, among others, lead to the conclusion that the transaction would exclude and limit competition in the game live-streaming market. |

- The presence of a dominant market player in a horizontal merger: When an entity holds a dominant position before the merger and the transaction leads to the removal of existing or potential competitors, further solidifying its dominant market position, regulatory authorities can determine that the merger results in unilateral effects. However, the Consultation Draft does not explicitly outline whether the criteria used to establish “market dominance” in this context align with the criteria for abuse of dominance as defined in the Anti-Monopoly Law, such as whether the presumption based on market share applies.

| Before the release of the Consultation Draft, it was not uncommon to see a horizontal merger that further consolidated an undertaking’s dominant position. However, unilateral effects were not automatically recognized; rather, all relevant factors were considered holistically.

For example, in United Technologies’ acquisition of Goodrich (2012), the Chinese regulatory authority noted that United Technologies had a 72 percent market share in the market for aircraft AC power systems. This substantial share, in the context of abuse of market dominance, could be presumed to indicate market dominance. However, the authority conducted a thorough assessment, considering factors such as the combined market share post-transaction, historical bidding data and the level of technological development. Subsequently, the authority concluded that the transaction would lead to the elimination and restriction of competition.

It remains unclear how similar transactions will directly be recognized as having unilateral effects under the Consultation Draft. |

Regarding coordinated effects, the Consultation Draft provides a clear assessment framework and stresses that the key factor is whether the merger facilitates coordinated behavior or strengthens existing coordinated behavior. Notably, Article 50 of the Consultation Draft refers to the standard for identifying “joint dominance” in the context of abuse of market dominance. It seems to adopt the market share thresholds from that standard to establish a rebuttable presumption of coordinated effects in a horizontal merger. The market share thresholds provide guidance for undertakings in self-assessing the possibility of coordinated effects being recognized. The market share thresholds are:

- The combined market shares of the entity and another undertaking in the relevant market after the merger reaches two-thirds, and each has a market share of more than one-tenth;

- The combined market shares of the entity and two other undertakings in the relevant market after the merger reach three-quarters, and each has a market share of more than one-tenth;

- The merger eliminates an undertaking that might obstruct market coordination.

The Consultation Draft does not provide additional details on how to challenge the presumption of coordinated effects after meeting the market share thresholds. The recent Judicial Interpretation on Monopolistic Civil Cases, which addresses the rebuttal of “joint dominance,” can serve as a valuable reference in this context. Specifically, the evidence required to challenge “joint dominance” includes: (1) demonstrating actual competition between the relevant competitors and inconsistencies in their market behavior; and (2) showing that the competitors are subject to competitive constraints from other market players.

In addition, one factor that has been historically considered by Chinese regulatory authorities in assessing coordinated effects but is not included in the Consultation Draft is that common interests may increase coordinated behavior among undertakings and competitors. Despite not being explicitly set out in the Consultation Draft, common interests among major competitors have been an important consideration in assessing coordinated effects in previous cases.

For example, in Shanghai Airport Group and Eastern Air Logistics (2022), Chinese regulatory authorities noted that there were common interests between the parties, and the merger would increase the likelihood of price coordination.

Similarly, in Corun/Toyota China/PEVE/New Zhongyuan/Toyota Tsusho, the Chinese regulatory authority pointed out that the market concentration level (CR4) of PEVE, Panasonic, Corun, and Johnson Controls reached 97 percent, which nearly monopolized the global supply of automotive nickel-metal hydride batteries. Among them, Panasonic was a shareholder of PEVE with 19.5 percent equity interest. Hence, the joint venture of PEVE and Corun reduced competition among the three major global manufacturers of automotive nickel-metal hydride batteries, resulting in anti-competitive effects.

Even more significantly, the Consultation Draft does include a model case that partially reflects common interests as a factor for consideration. In “Case 19,” the OEM relationship between the participants in the merger and their main competitors increased information transparency, which facilitated coordination and restricted competition. The merger increased the likelihood of mutual coordination among the major players; hence, it increased the likelihood that competition would be restricted. Therefore, according to this model case, if there are common interests between the transaction parties and other major competitors, including but not limited to OEM, agency, partial shareholding, technology licensing, etc., the likelihood of coordinated behavior would increase.

Highlight 6: Clarifies competitive harm resulting from acquiring a potential competitor

In recent years, “potential competition” has increasingly garnered attention from the Chinese regulatory authorities and the judiciary in China. Consistent with this increased attention, the Consultation Draft emphasizes the importance of evaluating the impact of a horizontal concentration on potential competition. If a potential competitor is eliminated and the transaction involves a party that already holds a dominant position, the transaction will likely be viewed as eliminating or restricting competition. Notably, the detrimental effects on potential competition are not limited to cases where the entity being eliminated is the target company; they also encompass situations where the acquirer itself is a potential competitor. Furthermore, according to Article 45 of the Consultation Draft, if the target company being eliminated is a potential competitor and the acquirer holds a dominant position in the market, the transaction will automatically be deemed to have unilateral effects.

| Before the publication of the Consultation Draft, the authority had already recognized the possibility of strengthening unilateral or coordinated effects by eliminating potential competitors in horizontal mergers.

For example, in Danaher’s acquisition of General Electric’s Life Sciences Biopharma Business (2020), SAMR’s conditional approval decision pointed out that although Danaher did not at that time produce hollow fibre filters, it was developing related products with significant innovative features compared to products available in the market. After the transaction, Danaher would acquire the target’s hollow fibre tangential flow filter product, which could have potentially reduced its R&D investment and its motivation to commercialize similar products with innovative significance currently under development, thereby delaying the speed at which new products were introduced to the market. These delays could potentially have had adverse effects on market competition and technological progress. |

Article 59 of the Consultation Draft further details the two-pronged analytical framework for assessing the elimination of potential competitive constraints through horizontal mergers. Under that framework, the Chinese regulatory authorities will:

- Determine whether a party in the horizontal merger is a potential competitor: The main factors considered in determining whether a party is a potential competitor include the costs, the time and the entry barriers. For example, the Chinese regulatory authorities will look at whether the party possesses the production equipment, intellectual property, raw materials and investments to become a competitor of the other party. To determine whether a party could compete with the other party, the Chinese regulatory authorities will focus on whether the party:

- could enter the relevant market without incurring significant sunk costs;

- is very likely or already has plans to make related investments (including sunk costs) and will enter the market in the near term.

- Analyze whether the horizontal merger eliminates potential competitive constraints: This analysis primarily involves evaluating the expected market conditions after the potential competitor has entered the market. A merger may be recognized as having or likely to have the effect of eliminating or restricting competition if:

- The potential competitor already has or will constitute a significant competitive constraint on the transaction parties who will operate in the relevant market; and

- Other existing competitors and potential entrants do not exert sufficient competitive pressure on the undertakings concerned.

Highlight 7: Identifies key evidence for rebutting the determination that competition eliminated or restricted: market entry, countervailing buyer power, and efficiency.

The Consultation Draft specifies that the determination of a transaction will result in the elimination or restriction of competition can be rebutted with three types of evidence: market entry, countervailing buyer power, and efficiency. This evidence provides transaction parties with powerful tools to aid their defense.

- Market Entry: The Consultation Draft stresses that market entry is not limited to new entrants entering the market but also includes: (1) vertical expansion by upstream or downstream firms entering the market; and (2) business expansion by incumbents (such as increasing production capacity). Effective market entry must satisfy three conditions: likelihood, timeliness, and sufficiency. When evaluating market entry, one should not rely solely on previous cases of market entry or on low entry barriers. All factors, including the market’s development prospects, operating conditions, the speed of entry, and the competitive constraints on the post-merger entity should be assessed as a whole. For example, in the conditional approval decision of Panasonic’s acquisition of Sanyo Electric, the Chinese regulatory authority focused on the market’s development prospects. It concluded that the development of the nickel-metal hydride battery market was slowing down, which made it more difficult to attract sufficient market entry to counteract the restrictive and exclusionary effects caused by the acquisition.

- Countervailing Buyer Power: The assessment of countervailing buyer power primarily considers: (1) the concentration level of buyers, determining whether a few customers hold a significant share of the purchase volume; and (2) the ability of buyers to switch suppliers easily, which may involve vertical integration, supporting other upstream suppliers, or new market entrants. Notably, countervailing buyer power must exhibit a substantial “spill-over effect.” This means that the protective impact of countervailing buyer power should not only shield large-scale buyers from competitive risks but also extend to shielding small-scale buyers and end consumers. Moreover, the continuity of countervailing buyer power is essential – it should remain stable both before and after the transaction to mitigate any potential competitive harm arising from the deal. For instance, in the conditional approval decision of Panasonic’s acquisition of Sanyo Electric, the Chinese regulatory authority concluded that although some large downstream users had enough buyer power to counteract the combined entity, this buyer power could not extend to other medium and small users who did not have the same bargaining power. Further, the continuity of buyer power is also crucial – the buyer power must remain stable before and after the transaction to counteract the potential competitive harm caused.

- Efficiency: Increased market efficiency is a common defense cited by transaction parties. The Consultation Draft outlines specific efficiencies, encompassing economies of scale, economies of scope, technological progress, and improvements in product quality. A qualifying efficiency gain must: (1) enhance consumer welfare; (2) directly result from the merger and be unachievable through less anti-competitive alternatives; and (3) be objectively demonstrable. In practice, although efficiency gains have been a common defense raised by transaction parties, they are often speculative and difficult to verify or quantify – which explains why they are rarely accepted by Chinese regulatory authorities. The criteria laid out by the Consultation Draft will help transaction parties to formulate more effective defense strategies based on efficiency and to present more compelling arguments.

The Consultation Draft elaborates on when these three types of rebuttal evidence can be provided. Market entry evidence and buyer power evidence can be provided when the regulatory authority anticipates that the merger “may” lead to competitive harm. In contrast, as the efficiency defense has broader applicability, efficiency evidence can be provided to support mergers that “have” or “may” result in the elimination or restriction of competition.

As previously mentioned, according to Article 45 of the Consultation Draft, horizontal mergers involving entities that are already dominant will be deemed to have unilateral effects. In such instances, if the merger is definitively determined to eliminate or restrict competition rather than merely being “likely” to have such effect, then only the efficiency defense can be raised.

Highlight 8: Clarifies the criteria to argue the “failing firm defense”

For the first time, the Consultation Draft clarifies the criteria to argue the failing firm defense. Historically, in the absence of explicit guidance in the Anti-Monopoly Law, the failing firm defense was interpreted to apply broadly, suggesting it was widely available to firms facing operational challenges. The Consultation Draft seeks to rectify this ambiguity by establishing clear and precise criteria for when the failing firm defense can be argued.

As outlined in the Draft, to argue the failing firm defense, the following three conditions must be satisfied:

- the target is suffering business difficulties and will exit the market in the short term;

- no other viable solution is available that could avert the target’s market exit while causing less harm to competition;

- the anticipated competitive harm from the merger is deemed less detrimental compared with the target’s departure from the market.

By adopting these conditions, the Consultation Draft has provided a clear legal framework for the failing firm defense. Nevertheless, it will be challenging in practice to assess and prove these conditions in individual cases. For example, whether a company is indeed suffering from business difficulties requires a comprehensive assessment of its financial status, market position, potential for restructuring and the existence of other potential buyers.

Conclusion

The publication of the Consultation Draft marks a new phase in rigorous and comprehensive merger review. It imposes higher standards and poses greater challenges for businesses in mergers and acquisitions.

Businesses should look to adapt to these standards and challenges by conducting pre-transaction antitrust risk assessments, considering risk assessments and transaction timetables, and emphasizing internal document compliance.

Conduct pre-transaction antitrust risk assessment. In the initial stages of planning and negotiating any merger or acquisition, a business must conduct an in-depth analysis of the potential competitive impact of the contemplated transaction.

For horizontal mergers that may have a significant impact, a dedicated antitrust risk assessment team should be established. With the recent elevation of notification thresholds and the decentralization of simple case reviews to local authorities, SAMR possesses enhanced resources and flexibility to conduct meticulous evaluations. Given this evolving landscape, businesses should prioritize pre-transaction assessments. In particular, a business should pay close attention to evaluating market share and HHI thresholds:

- If a preliminary assessment shows a market share exceeding 25 percent, the business needs to evaluate potential competition issues as early as possible. The evaluation may involve conducting economic analyses and considering stakeholder feedback that could arise during the Chinese regulatory authorities’ consultation process.

- Even when the combined market share or the HHI indices approach but do not surpass the thresholds, the business should still adopt a conservative strategy because the Chinese regulatory authorities tend to be cautious in approving transactions when the combined market share or the HHI indices are close to thresholds.

Consider risk allocation and transaction timetables. Based on the results of their antitrust risk assessment, the business should establish a framework for distributing antitrust risks and create a realistic schedule for the transaction. If potential competition issues are flagged, the parties should anticipate possible delays stemming from the merger review process and set a reasonable completion timeline. Implementing risk mitigation strategies such as break-up fees and reverse break-up fees can effectively address uncertainties during the review phase. Additionally, the seller may want to ensure that the rights and responsibilities of both parties throughout the merger review are clearly outlined. These rights and responsibilities should include the buyer providing timely and comprehensive disclosure of the review progress and the seller being entitled to actively participate in the review process.

Emphasize internal document compliance. Chinese regulatory authorities are expected to increase scrutiny of internal documents, as demonstrated by the recent incorporation of compliance management incentive systems in the “Antitrust Compliance Guidelines for Undertakings.” Therefore, businesses must make sure their internal documentation complies, to prevent unfavourable outcomes during merger reviews. When drafting documents, it is essential to provide inclusive yet precise depictions of competitors, competition, and markets. To facilitate internal document compliance, businesses should establish explicit protocols for document creation and management, augment employee training programs, and verify the accuracy and compliance of all pertinent documents. Furthermore, routine internal evaluations should be undertaken to assess document compliance and promptly rectify any identified issues.

Click here for the full article.

1 Michael Han and Bivio Yu are Partners at Fangda Partners. Arthur Wong is Associate at Fangda Partners.

2 PaRR, “China’s SAMR explores solutions to geopolitics-linked trade policies in upcoming guidelines, official says – CIIAIWebinar,” December 7, 2023.

Featured News

Belgian Authorities Detain Multiple Individuals Over Alleged Huawei Bribery in EU Parliament

Mar 13, 2025 by

CPI

Grubhub’s Antitrust Case to Proceed in Federal Court, Second Circuit Rules

Mar 13, 2025 by

CPI

Pharma Giants Mallinckrodt and Endo to Merge in Multi-Billion-Dollar Deal

Mar 13, 2025 by

CPI

FTC Targets Meta’s Market Power, Calls Zuckerberg to Testify

Mar 13, 2025 by

CPI

French Watchdog Approves Carrefour’s Expansion, Orders Store Sell-Off

Mar 13, 2025 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – Self-Preferencing

Feb 26, 2025 by

CPI

Platform Self-Preferencing: Focusing the Policy Debate

Feb 26, 2025 by

Michael Katz

Weaponized Opacity: Self-Preferencing in Digital Audience Measurement

Feb 26, 2025 by

Thomas Hoppner & Philipp Westerhoff

Self-Preferencing: An Economic Literature-Based Assessment Advocating a Case-By-Case Approach and Compliance Requirements

Feb 26, 2025 by

Patrice Bougette & Frederic Marty

Self-Preferencing in Adjacent Markets

Feb 26, 2025 by

Muxin Li