PYMNTS’ recent reporting shows that while households continue to spend, sentiment data suggests consumers anticipate higher prices at the register.

Merchants Already Raising Prices

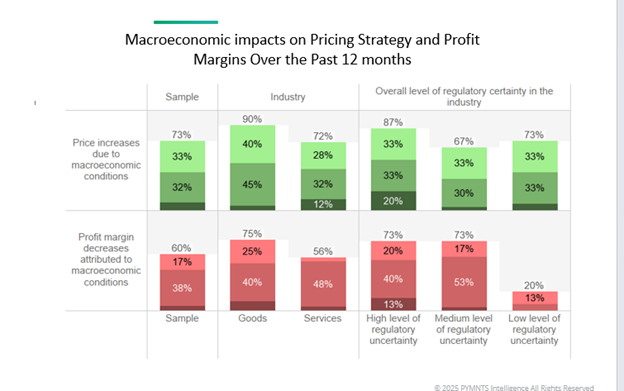

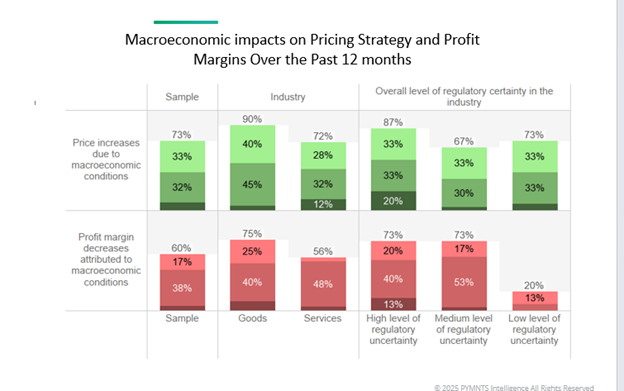

PYMNTS Intelligence’s survey data of 60 executives shows that 90% of goods firms have already raised prices in the past 12 months in response to macroeconomic volatility. Yet, 60% of firms overall — and 75% of goods-focused firms — report declining profit margins even after those increases, with most describing the erosion as moderate.

The first chart underscores the bind facing retailers: 7 in 10 raised prices due to macro conditions, but many still saw profits shrink. Tariffs and other upstream supply chain pressures have compounded the issue, forcing merchants to pass on costs while still absorbing part of the burden themselves.

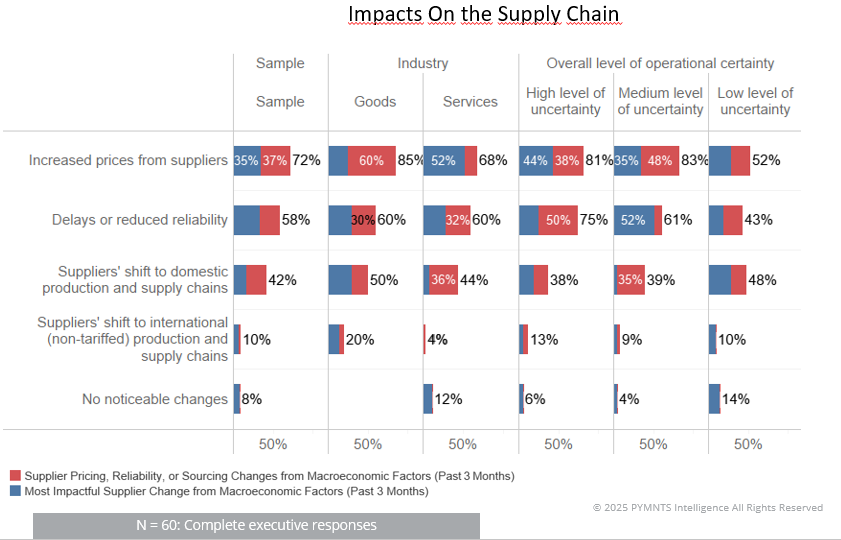

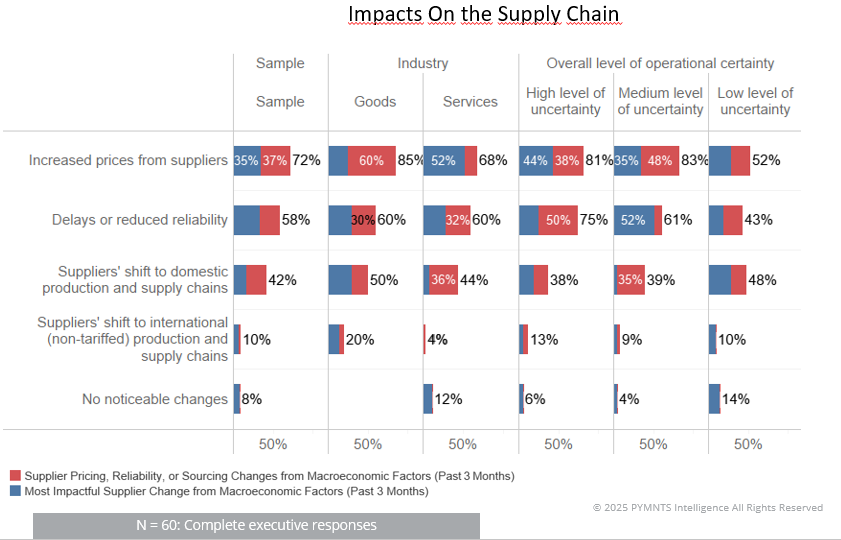

The second chart highlights the scale of those upstream pressures. Eighty-five percent of goods firms (and here we are using them as a proxy for retailers) reported supplier price hikes, and half of those suppliers shifted to domestic production. Tariffs have rippled across the supply chain, making imports more expensive, and reshoring has become a preferred response.

Executives said suppliers were four times as likely to reshore domestically as they were to switch to non-tariffed international alternatives. This is a key trend for retailers: domestic sourcing helps protect margins against tariff-driven cost surges, though it often carries its own transition costs.

Advertisement: Scroll to Continue

Holiday Season Implications

Taken together, the data points to a holiday season in which retailers will likely push through additional rounds of price hikes. The survey shows that merchants anticipate boosting prices even further into year-end, reflecting both ongoing supply chain cost pressures and the expectation that consumers will keep spending despite higher price tags.

For retailers, the calculus is complicated. Consumers’ wallets are stretched, but as PYMNTS coverage has shown, they continue to prioritize spending in categories that matter most. That resilience gives merchants some room to adjust pricing, but they must balance the risk of demand softening if increases overshoot consumer tolerance.

PYMNTS data shows consumers are adapting to higher prices rather than retreating. Even as inflation expectations creep higher, spending intentions remain strong across both essential and discretionary categories. Households continue to budget carefully, but many will still want to make holiday purchases — underscoring the durability of demand even in a higher-cost environment. This resilience provides retailers with a degree of confidence that modest price adjustments will not derail holiday traffic.

BNPL as a Pressure Valve

One factor helping sustain that demand is the continued rise of buy now, pay later (BNPL). As PYMNTS has reported, BNPL adoption has grown rapidly as consumers look for flexible ways to manage holiday budgets. By spreading payments over time, shoppers are able to absorb higher prices without immediately straining their cash flow. For retailers, BNPL not only supports conversion rates but also encourages larger basket sizes, making it an important tool as costs rise along the supply chain.

The reshoring trend provides a partial cushion. By relying more on domestic suppliers, retailers reduce their exposure to tariffs, insulating profits and offering more predictable supply lines. Still, the transition takes time, and for this holiday season, many merchants will be navigating hybrid supply chains — partially reliant on tariffed imports and partially on domestic suppliers still scaling up. But delays and reduced reliability remain a drag: 60% of executives cited late deliveries or reduced reliability in their supply chains. Even if merchants are sourcing domestically, disruptions ripple downstream to inventory management, pricing decisions, and ultimately the holiday shopper’s experience.

The challenge heading into the holidays is not just about setting the right price. It is about managing the tension between consumer expectations, cost absorption, and supply chain resilience. The data suggests the majority of retailers will lean toward passing more costs along. But for those who successfully realign supply chains closer to home, tariff-related pressures may begin to ease into next year.