By Paulo Burnier da Silveira[1]

I. Introduction

In 2024, the Brazilian Competition Authority (CADE) received 712 merger notifications including several transactions with a transnational dimension (e.g. IAG/AirEuropa, Bunge/Viterra and Minerva/Marfrig). Some of these cases involved close international cooperation with other competition authorities around the world such as those from Argentina, Chile, Saudi Arabia, South Africa, Uruguay, US, and the European Commission. The sum of their transaction values is estimated at around USD 200 million.[2]

Nowadays, merger control regimes exist in over 20 countries in Latin America and the Caribbean, adding to the nearly 100 merger control regimes worldwide.[3] According to the OECD, more than 10,000 mergers have been notified every year to competition authorities, leading to dozens of prohibitions and hundreds of conditional approvals every year.[4] These numbers reveal the prominence merger control has taken in recent years. Indeed, companies today must comply simultaneously with several merger control regimes around the world, each with their own procedures, timelines, and notification fees.

As seen in the recently revised OECD Merger Recommendation (2025)[5], merger control is an area of competition policy that invites competition authorities to converge in both substance and procedural matters. Despite these efforts, merging parties are subject to challenges related to the large number of jurisdictions enforcing merger control provisions and the risk of divergent or inconsistent decisions issued by competition authorities.

Indeed, a recent study based on the Brazilian experience indicates that the costs incurred by notification fees can be significant, with an international merger requiring, on average, 103 days for review, 8 notifications to competition authorities around the globe, and €175,794 in expenses related to notification fees.[6] Considering this context, the following paper first examines the duration of international merger review, then the issue of costs related to the notification fees, before concluding with final remarks.

II. Counting the Days: How Long Does It Take?

The Brazilian experience indicates that, on average, an international merger requires 103 days for review, 8 notifications to competition authorities around the globe, and €175,794.00 in expenses related to notification fees. The study relies on a dataset of 192 cases reviewed by CADE between 2013 and 2022, covering a total of 1,562 merger notifications involving 73 jurisdictions worldwide.[7] The figure below indicates the average time it took CADE to review an international merger in Brazil over a 10-year period:

Figure 1. Duration of review of international mergers by CADE in Brazil (2013-2022)

Source: created by author based on information available on CADE’s public database.

The average duration of 103 days for the review of international mergers is more than 10 days longer than the average duration for the review of domestic mergers, given that the average duration of all merger reviews is 93 days (considering only the “ordinary” merger control proceedings, which excludes “fast-track” proceedings).

One key factor that may affect the duration of merger reviews is the number of jurisdictions notified of the international transaction. Using the Brazilian dataset as a proxy for global transactions, the figure below shows the top 10 jurisdictions notified of an international merger (in addition to CADE in Brazil).

Figure 2. Top 10 jurisdictions notified of international mergers in Brazil (2013-2022)

Source: created by author based on information available on CADE’s public database.

In total, they count for 624 notifications, which corresponds to 39% of the total notifications of the dataset.[8]

The European Union, the United States and China were the jurisdictions most frequently notified, which seems natural considering their economic importance for Brazil. It is curious that both Turkey and Ukraine appear in this top 10 list, which may be related to the level of their notification thresholds or driven by certain sectors that may have high turnovers (i.e. energy sector). It is also curious that Argentina does not figure in this list despite having strong commercial ties with Brazil.

The number of jurisdictions notified is a factor that may affect duration because they usually point to the complexity of the transaction. Indeed, analysis of Brazilian merger case law points to an increasing average in the length of reviews as the number of jurisdictions notified expands. Although the causality nexus is unclear, namely whether the longer duration is caused by the higher number of jurisdictions involved, intuition points in this direction, at least as a partial explanation, since these cases often require coordination efforts by merging parties with legal counsels around the world, as well as competition authorities who must consider on the competition concerns raised by their counterparts and resulting from the transaction.

In addition, several other factors can influence the duration of international merger reviews. These can include the complexity of the transaction (such as the number of notifications around the world) and the resources available to the competition authority (such as the number and quality of the staff in charge of merger review).

The recent study mentioned reveals that factors related to the complexity of the transaction – namely, the geographic scope of the merger (i.e. regional or global), the number of jurisdictions notified, the existence of international cooperation between competition authorities, the number of relevant markets, and the type of decisions (i.e. approval without conditions, approval with conditions, and prohibition) – do indeed increase the duration period of reviews. As expected, more complexity leads to longer duration, which is consistent with the need of more in-depth analysis and/or coordination efforts by merging parties with legal counsels around the world, as well as competition authorities depending on the competition concerns resulting from the transaction.

In regard to the effects of resources, such as the size of staff and notification fees, these may also have an impact in the duration of reviews, although the empirical work done with Brazilian case law was unable to draw any meaningful conclusions in this matter, probably due to dataset limitations. For the size of staff, this might be due to the quality of the data, which includes all CADE’s staff and is not limited to those working on merger control. Similarly, the notification fees, when applicable, do not necessarily go directly to fund competition authorities, which makes it difficult to infer a possible link between resources and review duration.[9]

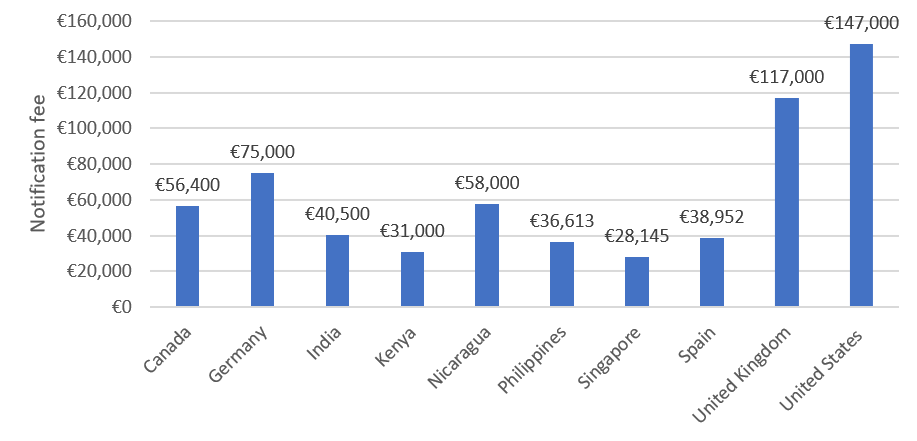

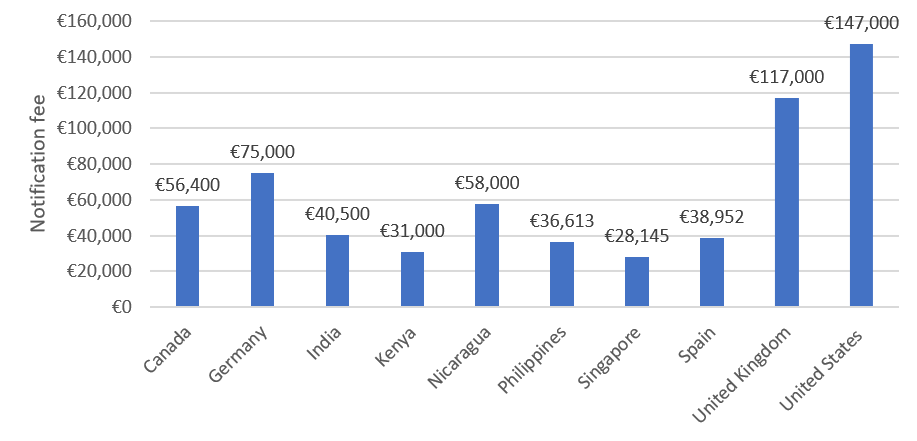

III. Paying the Bill: How Much Does It Cost?

Filing fees can vary significantly from one jurisdiction to another. For instance, the filing fee can reach USD 280,000 in the US (when the transaction value is above USD 843 million) and GBP 160,000 in the UK (when turnover exceeds GBP 120 million), while France and the European Union do not charge any filing fees. The figure below shows the most expensive jurisdictions in terms of notification fees for merger transactions:

Figure 3. Top 10 jurisdictions with most expensive merger notification fees

Source: created by author based on public information[10]

A report from the International Competition Network (ICN) provides a comprehensive description of different types of filing fee systems and their rationales. The study covered 73 jurisdictions with pre-merger notification regimes, in which 42 of them do not charge filling fees, as they view merger review as a public service that should be funded by general tax revenues.[11] Another ICN policy study proposes a set of policy recommendations that aim at reducing or eliminating the costs and burdens of multijurisdictional merger review without compromising competition agencies’ effectiveness in enforcing their jurisdiction’s competition laws.[12]

More recently, the International Chamber of Commerce (ICC) published a policy statement that advocates for greater convergence between pre-merger notification regimes. It also stressed that multiple merger control regimes increase transaction costs for companies and may delay the closing of global transactions, which could affect negatively the global economy. For this reason, the ICC recommends that policymakers carefully take into account these costs and delays when considering future improvements of merger control regimes.[13]

There is also a debate on whether merger fees should be charged to cover the costs of merger analysis. Whereas certain jurisdictions consider that notification fees should cover entirely or at least partially these costs, others think that merger review should be funded by general taxation since it is an instrument that protects market structures and consumers. The UK government has published an impact assessment report that discusses the policy options to address this specific issue.[14]

This is an important finding of this research: while there is no evidence of correlation between duration and merger notification fees, the later can potentially be used to increase the budget of competition authorities and thus allocated, at least partially, to merger control tasks. The OECD has explicitly recommended the adoption of merger notification fees in recent in-country studies, namely the Peer Review of Competition Law and Policy of Tunisia in 2022 and the Peer Review of Competition Law and Policy of the Dominican Republic in 2023.

IV. Final Remarks

This paper provides useful insights to understand the duration of international merger reviews. It explores previous work based on Brazilian merger case law and focuses on the duration of the review process and the costs incurred by merging companies through notification fees. It also helps fill a gap in the economic literature given the low number of empirical studies dedicated to the topic of duration and cost of international merger review.[15]

The Brazilian experience has key features that may allow us to expand its findings to a wider global community.

First, it concerns a major jurisdiction, which is often affected by global mergers that are also notified in other major jurisdictions worldwide, including the US and the European Union. Indeed, Brazil is the largest economy in Latin America and the ninth largest in the world by GDP. This relevant economic activity adds to a large population of more than 210 million people resulting in a wide consumer base and, consequently, a great interest from multinational companies. In this context, Brazil emerges as a key country for research on global mergers, providing insights that are pertinent to the understanding of broader trends and impacts in the global market.

Second, the Brazilian legal framework is favorable to the proposed research since most information related to merger control is publicly available, allowing open access to data and cross-checking by other researchers. The availability and reliability of data is crucial for this research, and they include the name of the companies, the economic sectors involved, the jurisdictions that have been notified alongside Brazil, and the reasoning of the competition analysis.

Third, CADE is a well-established and respected competition authority around the world. It has been ranked at the top of competition authorities by the Global Competition Review (GCR) during the past years, including 4,5 stars in GCR’s Rating in 2025, providing a good proxy for a competition authority that works efficiently and effectively when compared to international standards. It has also been recognized twice by the GCR as the best competition agency of the year in the Americas within the past decade, which confirms the sound enforcement of competition laws by CADE in Brazil.

Finally, notification fees is an area that could be further explored by competition authorities and researchers, particularly in light of recent recommendations made by the OECD to adopt merger notification fees as a way to fund the work of competition authorities. Indeed, this study revealed that notification fees vary significantly across jurisdictions ranging from zero to USD 280,000 per transaction (i.e. in the US when transaction value is above USD 843 million). Nearly one third of the competition authorities examined do not charge any notification fee for merger filings (i.e. 25 out of 73 jurisdictions). This is a potential source of funding that could provide relevant support for competition authorities if allocated (entirely or partially) to competition enforcement work, for instance to increase or train staff, accelerating case handling and improving the quality of competition analysis.

Click here for a PDF version of the article

[1] Senior Competition Expert at OECD, Professor at University of Brasilia and Visiting-Professor at Sciences-Po Paris. The opinions are personal and do not necessarily reflect the views of the OECD or its Members.

[2] CADE’s Annual Report (2024). Available at: www.gov.br/cade/pt-br/acesso-a-informacao/transparencia-e-prestacao-de-contas/relatorios-de-gestao.

[3] Paulo Burnier da Silveira and Pamela Sittenfeld (2025), “Merger Control in Latin America: Overview, Particularities and Recent Developments”, Concurrences. Available at: www.concurrences.com/en/bulletin/special-issues/mergers-in-latin-america/merger-control-in-latin-america-overview-particularities-and-recent.

[4] OECD (2025), OECD Competition Trends, Paris. Available at: www.oecd.org/en/publications/2025/02/oecd-competition-trends-2025_435ed241.html.

[5] OECD (2025), Recommendation of the Council on Merger Review. Available at: https://legalinstruments.oecd.org/en/instruments/OECD-LEGAL-0333.

[6] This paper is an updated, revised and shorter version of the paper “International Merger Control: How Long Does it Take and How Much Does it Cost? An Empirical Study Based on the Brazilian Case Law” (2025), published by Paulo Burnier da Silveira and Isabela Maiolino at Journal of Competition Law & Economics, vol. 21, available at https://doi.org/10.1093/joclec/nhae020.

[7] Paulo Burnier da Silveira and Isabela Maiolino (2025), “International Merger Control: How Long Does it Take and How Much Does it Cost? An Empirical Study Based on the Brazilian Case Law”, Journal of Competition Law & Economics, vol. 21, available at https://doi.org/10.1093/joclec/nhae020. The study focuses on the determinants of international merger control including econometric analysis to capture the intensity of the correlation between key factors (e.g. geographic scope, number of notifications and type of decisions) and the duration of international merger reviews.

[8] The 73 jurisdictions concerned in the dataset are: Albania, Angola, Argentina, Australia, Austria, Botswana, Brazil, Canada, Chile, China, Colombia, Costa Rica, Cyprus, Ecuador, Egypt, European Union, Finland, France, Germany, Honduras, Hungary, Italy, India, Indonesia, Ireland, Israel, Japan, Kazakhstan, Kenya, Macedonia, Malaysia, Morocco, Mauritius, Mexico, Montenegro, Morocco, Netherlands, New Zealand, Nicaragua, Nigeria, North Macedonia, Pakistan, Paraguay, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Switzerland, Taiwan, Tanzania, Thailand, Trinidad and Tobago, Tunisia, Turkey, Ukraine, United Kingdom, United Arab Emirates, United States, Uruguay, Vietnam, as well as the Common Market for Eastern and Southern Africa (COMESA) and Economic and Monetary Community of Central Africa (CEMAC).

[9] For a complete view of the economic analysis, see: Paulo Burnier da Silveira and Isabela Maiolino (2025), “International Merger Control: How Long Does it Take and How Much Does it Cost? An Empirical Study Based on the Brazilian Case Law”, Journal of Competition Law & Economics, vol. 21, available at https://doi.org/10.1093/joclec/nhae020.

[10] In certain jurisdictions, the notification fee depends on the transaction value. In those cases, and for comparison purposes, the notification fee indicated in the figure corresponds to the average or mid-term in the range of possible notification fees.

[11] ICN (2005), “Merger Notification Filing Fees: a Report of the International Competition Network”.

[12] ICN (2004), “Report on the Costs and Burdens of Multijurisdictional Merger Review”.

[13] ICC (2015), “ICC Recommendations on Pre-Merger Notification Regimes”.

[14] UK (2012), “Merger Fees”, Impact Assessment from Department for Business Innovation and Skills (BIS).

[15] Before 2025, there are only two studies that indirectly addressed this topic were a paper by Yang and Pickford (2016) limited to domestic mergers in New Zealand, and a study by PwC (2003) limited to 28 international mergers which is interesting but outdated (and may have issues related to selection bias of the dataset). For further references, see: Yang, Qing Gong; and Pickford, Michael (2016), “Modelling the Duration of Merger Reviews in New Zealand”. Journal of Competition Law & Economics, vol. 12, n. 1; and PriceWaterhouseCoopers (2003), “A tax on mergers? Surveying the time and costs to business of multijurisdictional merger reviews”, published by the American Bar Association (ABA) and International Bar Association (IBA). In 2025, see: Paulo Burnier da Silveira and Isabela Maiolino (2025), “International Merger Control: How Long Does it Take and How Much Does it Cost? An Empirical Study Based on the Brazilian Case Law”, Journal of Competition Law & Economics, vol. 21, available at https://doi.org/10.1093/joclec/nhae020.