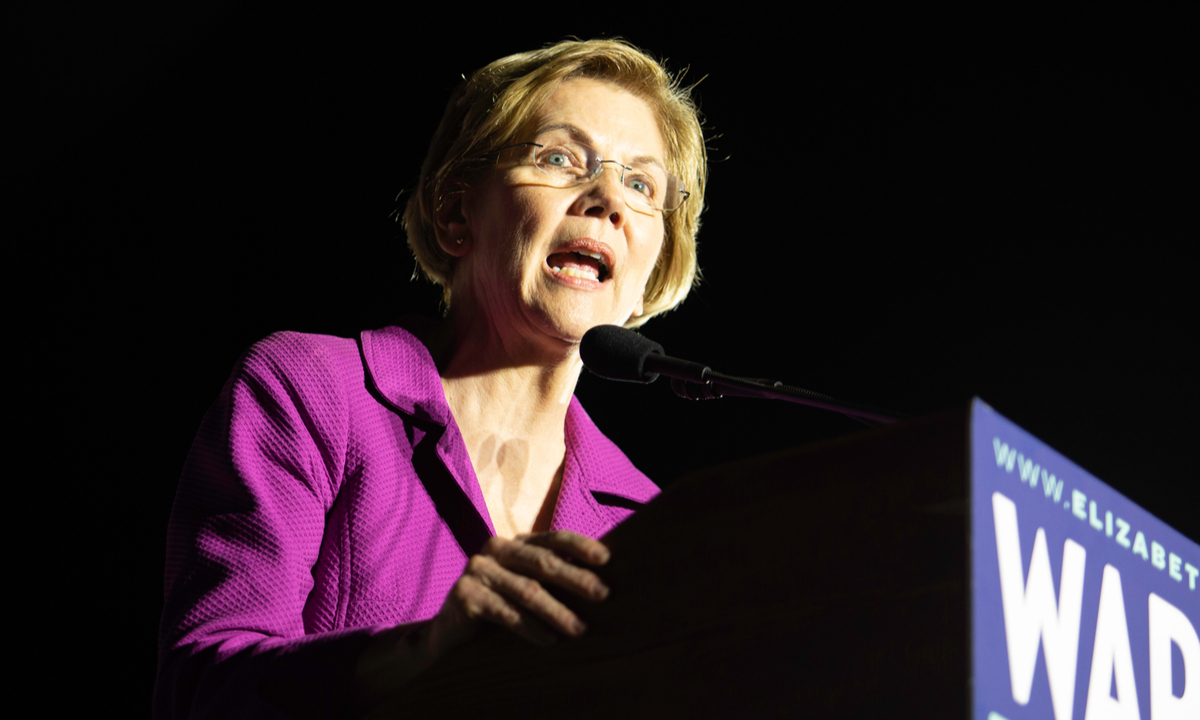

U.S. Senator Elizabeth Warren has called upon the Department of Justice (DOJ), the Department of Health and Human Services (HHS), and the Federal Trade Commission (FTC) to address the escalating healthcare costs resulting from the practices of vertically-integrated insurers, private equity companies and pharmaceutical firms. Warren’s letter to these agencies follows a March 2024 cross-government inquiry into the impact of corporate greed on the healthcare system.

Vertical Integration and Conflicts of Interest

In her letter, Senator Warren highlighted the significant role of vertical integration in the U.S. healthcare system, where major insurers control various aspects of healthcare delivery and payment. These giant corporations, which dominate 70 percent of a taxpayer-funded system, own pharmacies, pharmacy benefit managers (PBMs) and physician groups. This structure allows them to operate on both sides of healthcare transactions, creating a conflict of interest. By shifting profits among subsidiaries, these corporations can sidestep federal requirements that cap insurer profits and administrative expenses, leading to higher prices and reduced competition.

Private Equity and Market Consolidation

Warren also criticized the consolidation tactics of private equity firms and insurers, which acquire healthcare provider groups through a series of smaller transactions to avoid antitrust scrutiny. These “serial roll-ups” increase market share and diminish competition, harming patients and raising costs. She urged the agencies to scrutinize these widespread trends to protect competition and patient interests.

Abuse of Capitation-Based Financing

The letter pointed out how rapidly consolidating companies exploit capitation-based financing, a system where insurers and providers receive monthly lump-sum payments. Companies manipulate patient records and billing practices to secure higher payments from the government, deny care to increase profits, and control providers’ decisions. This manipulation leads to increased costs and reduced care quality for patients.

Patent Listing Abuse by Pharmaceutical Companies

Warren highlighted how pharmaceutical companies extend their patents to avoid competition from generic drugs, keeping healthcare prices high. These companies have been warned by the FTC for improperly listing patents in the Orange Book, a practice that raises drug costs and insurance premiums. In 2019, antitrust violations in the pharmaceutical industry resulted in U.S. patients and payers spending an additional $40.07 billion on drugs.

Call to Action

Senator Warren urged the DOJ, HHS, and FTC to enforce merger guidelines, analyze ownership data to detect profit-shifting schemes, crack down on overpayments to private insurers in Medicare Advantage, remove fraudulent patent listings, enforce laws that protect independent physicians, and reverse mergers that harm healthcare competition.

Source: Legistorm

Featured News

Big Tech Braces for Potential Changes Under a Second Trump Presidency

Nov 6, 2024 by

CPI

Trump’s Potential Shift in US Antitrust Policy Raises Questions for Big Tech and Mergers

Nov 6, 2024 by

CPI

EU Set to Fine Apple in First Major Enforcement of Digital Markets Act

Nov 5, 2024 by

CPI

Six Indicted in Federal Bid-Rigging Schemes Involving Government IT Contracts

Nov 5, 2024 by

CPI

Ireland Secures First €3 Billion Apple Tax Payment, Boosting Exchequer Funds

Nov 5, 2024 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – Remedies Revisited

Oct 30, 2024 by

CPI

Fixing the Fix: Updating Policy on Merger Remedies

Oct 30, 2024 by

CPI

Methodology Matters: The 2017 FTC Remedies Study

Oct 30, 2024 by

CPI

U.S. v. AT&T: Five Lessons for Vertical Merger Enforcement

Oct 30, 2024 by

CPI

The Search for Antitrust Remedies in Tech Leads Beyond Antitrust

Oct 30, 2024 by

CPI