It was an intriguing but optional layer of functionality that allowed companies to process payments, move money or experiment with banking-grade features without becoming banks themselves.

As 2025 turns toward 2026, that era is over.

According to the PYMNTS Intelligence report “Embedded Finance as a Strategic Initiative,” a Green Dot collaboration, embedded finance has crossed the line from tactical enhancer to strategic centerpiece. It has become, in effect, the connective tissue of modern platforms.

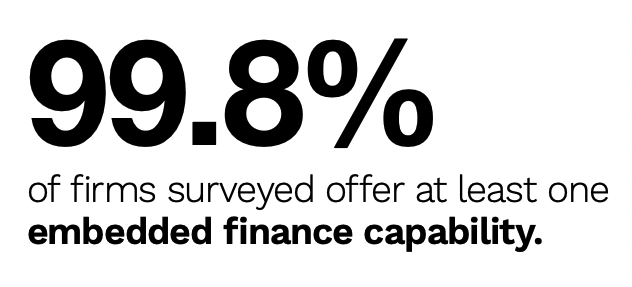

The report found that 99.8% of the 515 companies surveyed now offer at least one embedded finance capability. More than three-quarters of them plan to deepen that footprint over the next year, with 37% planning to do so even more immediately over the next 180 days.

The report found that 99.8% of the 515 companies surveyed now offer at least one embedded finance capability. More than three-quarters of them plan to deepen that footprint over the next year, with 37% planning to do so even more immediately over the next 180 days.

This heightened urgency reflects two interconnected realities. First, embedded finance capabilities are evolving quickly, and platforms must keep pace or risk falling behind competitors with more modern, seamless experiences. Second, the more deeply companies integrate financial functionality, the more it comes to represent not simply a set of transactional utilities but a transformation in how companies think about customer value, operational resilience and strategic identity.

Advertisement: Scroll to Continue

In a business climate defined by rising customer expectations, intensifying competition and unrelenting pressure for seamless digital experiences, firms are no longer asking whether to embed financial tools. They’re asking how fast they can add more.

The Upgrade Arms Race Begins

The industry is experiencing a shift in tempo. The race is no longer about who can process a payment fastest, but about who can build the most frictionless economic relationship with customers inside a single platform. In this new environment, it isn’t enough to simply have embedded finance. Everyone has it. The new question is who can upgrade faster, deploy smarter and extract more value from the financial technology woven into their platforms.

The report revealed that banking and payments are at the center of the coming upgrade wave, with 80% and 72% of firms, respectively, planning enhancements. But the fastest-rising star may be payroll. Among companies not yet offering payroll benefits, 61% plan to roll them out. Earned wage access, faster deposits, pay card options and integrated payroll-banking tools are increasingly seen as high-value features capable of setting platforms apart.

The interest in payroll reflects broader shifts in workforce management and financial technology. Companies appear to recognize that payroll tools offer a consistent point of engagement with users and can strengthen platform reliance.

See the study: Embedded Finance as a Strategic Initiative

Another factor shaping the pace of upgrades is the increasing reliance on third-party embedded finance providers. The report showed that 69% of companies outsource at least some of their embedded finance capabilities. Only 31% of companies handle their embedded finance functions entirely in-house.

Just as cloud computing saw multiple waves of migration and optimization, embedded finance appears poised for ongoing cycles of modernization. Firms are updating their systems not only to remain competitive but also to comply with emerging standards for security, data quality and financial transparency.

As upgrades accelerate, several forces are likely to shape the next phase of development. The demand for real-time payments and instantaneous fund access may place pressure on legacy systems. The expansion of payroll and worker-focused financial tools could require coordination between HR platforms, banks and compliance teams. The reliance on third-party infrastructure may raise questions about concentration risk, vendor lock-in and regulatory oversight.

Ultimately, the growing role of embedded finance in user experience will likely push companies to more tightly integrate financial capabilities into their broader product strategies.