Banks Risk Missing Out on Millennials' Wealth-Building Needs

Personalization Beyond Traditional Banking To Build Financial Wealth

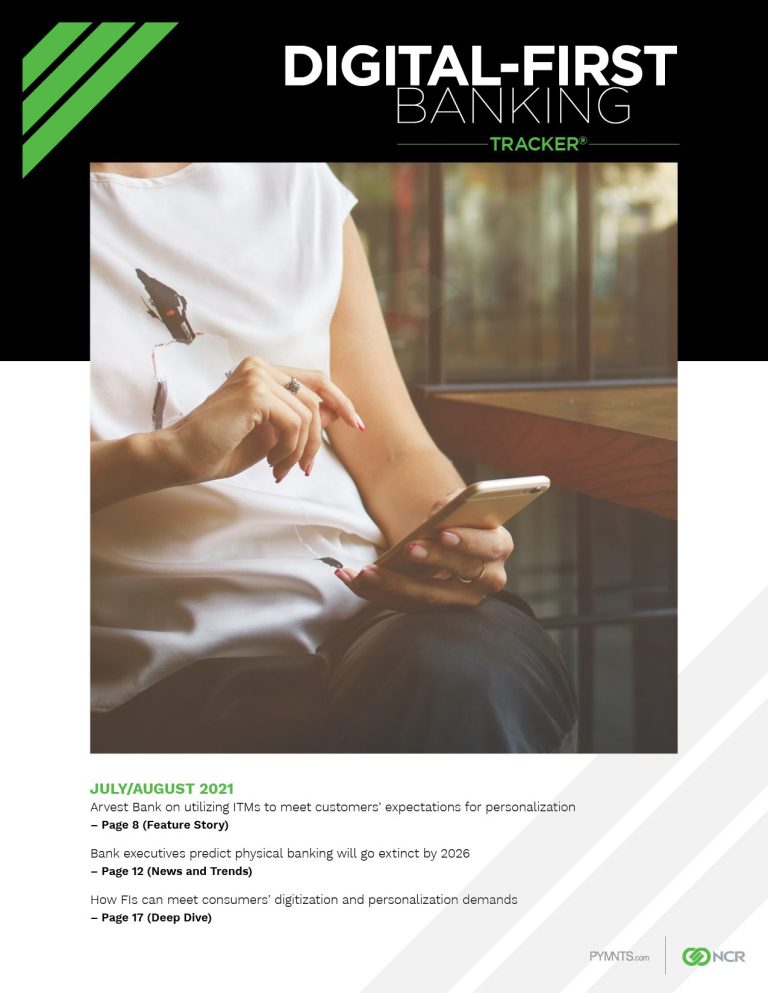

In this month’s “Digital-First Banking Tracker®,” a collaboration with NCR, TD Bank’s Rejeesh Ramachandran tells PYMNTS that an enormous opportunity exists for banks to meet the particular planning needs of this demographic where over 80% say they want personalized advice, tools and service to build wealth.

Inside the January Tracker

- Retail banks prioritizing a digital-first approach and strong data framework are well-positioned to compete and deliver personalized, wealth-building offerings

- Gen Z and millennials are increasingly taking advantage of digital tools to build wealth, while accessing in-person services is difficult for some

- Personalizing offerings can be challenging for any financial institution but considering how quickly consumer trends have shifted toward digital, gaining customer cooperation and trust with data is a must