If you can figure out a way to save people time, so they can use it for something better or devise a way to give people more time by preventing death or extending life, you have the makings of a fortune.

Instacart Makes Profits From Time

In May 2020, a couple of months into the pandemic, I went to my local Whole Foods, where we did most of our grocery shopping, masked up. By then, Whole Foods had a policy of limiting the number of shoppers in the store to reduce risk. Sadly, they had already lost one employee to COVID-19. Shoppers queued up to get into the store as others left. That day, the line was long, and it was clear this was going to be a time suck.

Like many of you, I decided to try Instacart despite having had bad experiences with other grocery shopping apps over the years.

This saved me a lot of time. It helped me avoid the risk of getting COVID-19 and losing the rest of my time.

Instacart is one of many innovators that have built valuable businesses off of time.

Advertisement: Scroll to Continue

Time Is Money, but How Much?

Economists have developed clever ways of estimating the value that people place on their time. These estimates provide insights into the value of innovations that save or preserve time and the profit potential from these innovations.

Economists value time by looking at how much people have to be paid to give up time, say, for work. Or by how much people will pay to save time, say for a faster commute. These aren’t ivory-tower exercises. They now drive federal cost-benefit analyses of new programs, regulations and spending.

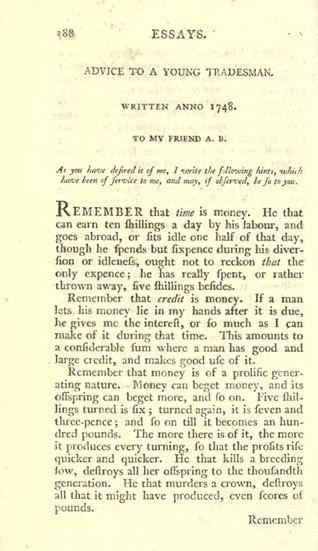

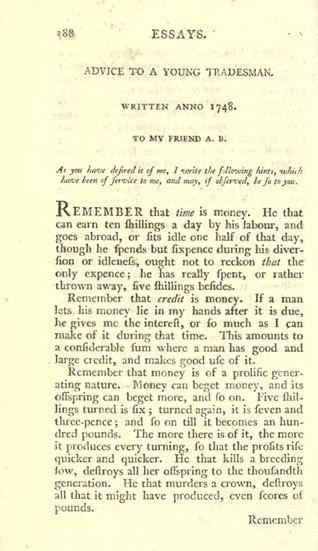

The simplest approach is based on looking at how much people have to be paid to work. The basic idea goes back to, at least, Benjamin Franklin.

“Remember that Time is Money. He that can earn Ten Shillings a Day by his Labour, and goes abroad, or sits idle one half of that day, tho’ he spends but Sixpence during his Diversion or Idleness, ought not to reckon That the only Expence; he has really spent or rather thrown away Five Shillings besides.”

A person could go to the beach or do some chores around the house instead of working another hour.

If they are willing to take $20 to work an extra hour, say for a gig job, then that must be more than the value of the hour doing something else. That wage-hour tradeoff is hard to identify in practice because many people have salaries or must work a fixed number of hours. Economists have found that the after-tax average wage rate is a good proxy for the value of time for the average person. Zip Recruiter says that was $26 in 2022. (Sounds about right. I did a careful calculation for my work on attention markets and found that it was about $19.65 in 2018).

The most extensive estimates of the value of time come from studies that look at the choice of different transportation methods. The U.S. Department of Transportation did a survey of these studies. Based on them, USDOT recommended using $13.60 for local personal travel and $19 for intercity personal travel based on 2015 earnings for the average person.

The value of time depends a lot on the situation, so it isn’t possible to come up with a “single” estimate even for an individual. An hour of work may be more or less pleasant. I can listen to the radio in the car or on my smartphone on the subway, so the time isn’t all wasted. I think most people hate standing in line at checkout, so that wasted time is really costly.

As imprecise as they are, these estimates are much better than nothing. Take a typical case where they are being used. The federal government is considering investing your tax dollars in faster trains. They should factor in the value of time that citizens will be saving as a result. Maybe the investment is worth it, or maybe not, but it is hard to know without valuing the time.

Economists estimate the value of time for particular activities using surveys and other data, and these can inform business decisions on pricing and the ROI of time-saving products and services.

The Time of Your Life

Part of my decision to pay for using Instacart was based on avoiding risky physical contact during the height of the pandemic. I didn’t want to lose the rest of my precious time. Like all of us, that meant that I needed to make a tradeoff between the value of life and money. Economists have used that insight to estimate how much people value their lives in the sense of not wanting to risk losing the rest of their time.

People make many decisions, just like the one I made, that result in small changes in the probability they may die. Often, these involve making tradeoffs between money and risk. They can, for example, pay extra for a safer car with lower fatality rates in crashes or take a job that pays more but poses a great risk to their lives. Economists have conducted scores of studies that estimate the implicit prices for the risk of dying.

Many of the studies, and the most robust, are based on looking at job decisions. The government collects and reports data on the risk of job-related fatalities across occupations and industries. It turns out that there is wide variation. A person is much more likely to die from working in construction than in an office. Economists would expect employers to pay people more to take on riskier jobs.

People would sort themselves into jobs based on their personal tradeoffs between money and risk. You may scoff that people behave so rationally, but it turns out massive amounts of data, collected over many years, based on several different methods, and in many countries confirm that people really do.

Economists have used data on occupational wages and fatality risks to estimate how much more people are paid for taking on greater risks of dying. The estimates vary over time as a result of inflation and increases in income. A review, based on 2017 data found that an employer would have to pay a typical worker another $100 a year to take a job where 1 in 100,000 workers die as a result of that job in a year. To summarize these results, economists calculate the “value of a statistical life” as the total amount of money that a group of people would pay to avoid one death among them. The answer is around $10 million. The U.S. Department of Transportation used $12.5 million for the value of statistical life in 2022.

These estimates are for the average person. A young person can expect to have a lot more time remaining than an older person. Another study found that, with an average value of statistical life of $11.5 million, twenty-somethings valued their remaining time at $16.1 million, those in their 50s at $10.3, and ones in their 70s at $3.7 million.

Don’t be offended by these numbers. Yes, life is priceless, especially yours. The reality, however, is that people take their chances at the right price and pay money to increase their odds. And it all comes back to how people value their most precious asset — their time.

The Business and Profits of Time

I recently wrote about how friction fighters can make a fortune by identifying frictions in exchange and building businesses that solve them. Many frictions involve people or businesses having to invest their time in everything that goes into buying and selling.

Entrepreneurs and corporates can identify potential innovation opportunities by identifying these frictions and assessing the value of time they could save. With the right innovation and execution, big-time savings lead to big profits.

Instacart was hardly the first in the online grocery ordering business, but it became a winner by doing a better job of eliminating frictions and making the best use of time — and getting lucky from our misfortune.

Instacart’s success depended on whether it could get households to order their groceries online and have them delivered rather than going on a shopping trip. To reach critical mass, it had to convince enough people to spend extra to save the time and hassle or going to the store for some of their shopping trips. Simultaneously, it had to persuade enough people to spend their time using its gig delivery app to shop and deliver those groceries.

It arbitraged the value of time between households and gig workers. It did well enough to sell more than $7 billion of groceries in 2019. Investors valued the company at almost $8 billion at the start of 2020.

However, that $7 billion of grocery sales was just slightly more than 1% of all grocery sales, and sales weren’t growing rapidly. A big problem was inertia. People were just used to going to the supermarket and hadn’t had much incentive to try online ordering.

That’s where luck, misfortune, and the value of life came in.

Shopping at the supermarket or doing other things where people came into contact with others was like taking a risky job. People in their 40s had a 12 in 100,000 chance of dying from COVID-19, while those in their 50s had a 29 in 100,000 chance, and that risk rose exponentially from there, as many of us with aging relatives sadly know.

Consumers had new incentives to check out Instacart. COVID solved the inertia problem (watch for my upcoming post on inertia) for this multisided platform and helped spur its rapid growth. Of course, when the risks of COVID diminished, the value of using Instacart for life-preserving declined, which not surprisingly resulted in some people switching back to physical stores.

Instacart sold $29 billion of groceries in 2022. It fulfilled 263 million orders for households. If we take Instacart’s estimate that they save an average of 1.4 hours and assume that the average consumer values their time at $20 an hour, then Instacart saved its customers $7.4 billion in 2022. It would be more if we accounted for couples who shop together.

Almost everything that Instacart does — from its back-end computer systems for supermarkets to its delivery gig business — is ultimately done to save households time.

They wouldn’t get many orders if they didn’t save time.

At one level, Instacart is a successful online grocery ordering business. Still, at another level, it is a successful time-saving business that got a kick-start from its opportunistic time-preserving business.

Look carefully, and you’ll see lots of other businesses whose valuations and value to customers are based on saving or preserving time.

To find those opportunities, entrepreneurs and corporates should prospect for frictions that suck up a lot of time. And look at the increasing opportunities for innovations that preserve or extend our time.

David S. Evans is an economist who has published several books and many articles on the technology businesses, including digital and multisided platforms, including the award-winning Matchmakers: The New Economics of Multisided Platforms. He is currently the Global Leader for Digital Economy and Platform Markets at Berkeley Research Group. For more details on him, go to davidsevans.org.