Why Europe Must End Its 30-Year Digital Winter to Ensure Its Long-Run Future

In the last 30 years, Europe — defined here as the EU plus the U.K., Norway and Switzerland — has created few leading digital businesses compared to the U.S. and China. This long digital winter is symptomatic of underlying problems that are behind persistent gaps between the U.S. and Europe in GDP per capita, output per worker and various measures of innovation. It is also a bellwether for other cutting-edge technologies. The European Commission has documented these problems periodically, since at least 2000, and called for reforms. None has narrowed much less closed the gaps.

The lack of digital innovation during an epoch in which most industries will be driven by digital, along with other cutting-edge technologies with similar trajectories, places European industries at risk of falling even further behind the U.S., China, and other surging economies. Viewed over the coming decades the situation is dire for Europe as the region faces other serious economic challenges including the steep decline in the working age population.

There is no airtight recipe for turning this around or even for proving the root causes of the malaise. The common rationales for Europe’s giving birth to so few digital and other startups often mistake cause for effect, such as the lack of venture capital funding. After all, one of Alibaba’s early investors was from Sweden. Other rationales cannot explain why Europe does so much worse than other parts of the world where, for example, successful startups such as Grab emerge — from Malaysia, which has fewer people than Spain — to serve highly fragmented regions.

The European Commission’s past initiatives to reverse this situation, most recently with artificial intelligence (AI) in 2018, provide insights into what has not worked for 30 years now. It would be a profound mistake to repeat them and stick to the same path, including flirting with industrial policy. Globally, digital innovations, and economic growth, have largely come from private investment, entrepreneurship, and market forces, even in China. To reverse its long losing streak in digital innovation, which may extend to other critical technologies as well, Europe would have to move to a greater reliance on markets, a stronger culture of risk taking and a smaller appetite for regulation.

Creating digital leaders, and successes based on other disruptive technologies, must be part of the solution if Europe wants to improve, let alone preserve, its economic position in the global economy. Or to remain a global beacon for high standards of living with job security, universal healthcare and robust social welfare programs.

Europe’s Long Digital Winter

In the 30 years since the start of the digital economy, the United States, China and other parts of the world have given birth to major global or regional internet-based businesses in diverse areas. They range from giants such as Apple in the U.S. and Tencent in China, to regional successes such as Mercado Libre in Latin America, to important domestic innovators like M-Pesa in Kenya.

Advertisement: Scroll to Continue

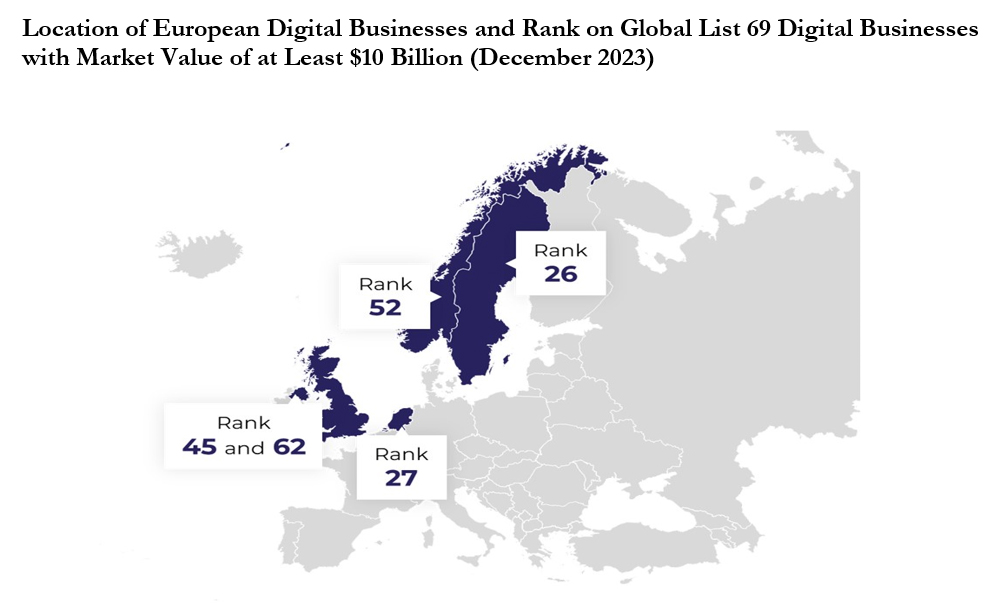

Europe has given birth to few leading digital businesses over those three decades. Of the 69 digital businesses worth $10 billion or more as of December 2023, Europe, which accounts for 21% of global GDP, had spawned just five: Spotify, Adyen, Revolut, Adevinta and Checkout.com. Together they account for less than 1% of the total value of the 69 businesses. None is based in Germany, France, Spain or Italy, the four largest EU economies.

This failure has persisted through three major disruptions where Europe had substantial advantages. The World Wide Web was invented at CERN, in Switzerland, in 1990 by Tim Berners-Lee, a Brit. The EU was instrumental in creating the standard-setting process behind the mobile revolution. By 2006 the largest mobile phone company and the leading smartphone operating system were from Europe. European-based scientists now account for 28 percent of the citations to academic articles on AI. More generally, Europe is a highly developed part of the world, with exceptional universities, a highly educated population, leading global industries and the birthplace of some of the most important innovations of modern times. Germany, alone, is the third-largest economy in the world, having recently overtaken Japan.

Europe’s failure to create digital leaders has ripple effects. More successful digital startups result in more employees who learn how to innovate in this area, more staff trained to work for these companies and more people who have built up enough wealth at successful startups to try things on their own. An increased supply of entrepreneurs with the right skills attracts venture capital funding. Profitable VC investments attract more capital into VC funds. There are externalities across the participants in the ecosystem.

Europe probably cannot make up for lost time. Even the seeds of the unknown challenges a decade from now may have been planted already. Europe can, however, try to break the vicious cycle so that it can limit the long-term threats to its growth.

Europe’s Economies and Living Standards Are in Jeopardy

If digital was just a sector, such as airplane manufacturing, Europe’s three-decade-long digital winter wouldn’t matter much. It could just pick up the slack elsewhere. Digital, however, involves general-purpose technologies, with artificial intelligence an increasingly important one, that are transforming the physical economy and reinventing the maturing digital economy. Over time, some firms that create or apply these general-purpose digital technologies will lead more industries, while many more will deploy these technologies to increase productivity and drive innovation.

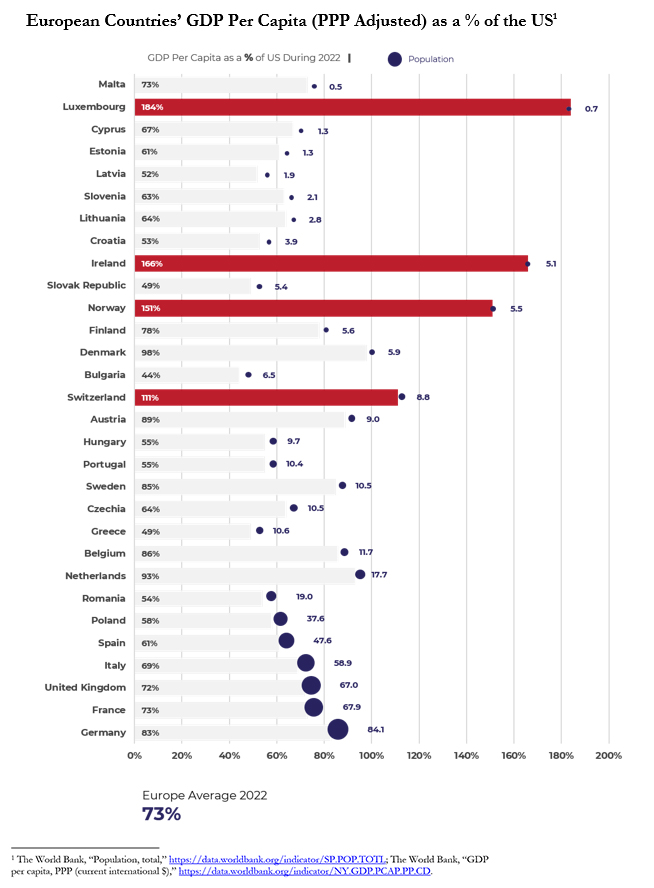

Europe’s digital winter reflects fundamental problems that have put it far behind the U.S. according to key metrics of economic success. GDP per capita has remained about 20% to 30% below the U.S. for three decades, after adjusting for purchasing power parity. As of 2022, GDP per capita was greater than the U.S. in just four small European countries.

The levels and trends in personal consumption are more troubling. The situation is worse in 2020-2022 but given the differing government responses to COVID-19 let us put those years aside. Private consumption inclusive of government social benefits in 2019 was substantially lower than the U.S.: 72% for Europe and 78% for the five largest economies (Germany, U.K., France, Italy and Spain) as a percentage of the comparable metric for the U.S. Between 1995 and 2019, private consumption inclusive of government social benefits declined, relative to the U.S., from 86% to 78% for the five largest economies and from 85% to 72% for the 15 members of the EU in 1995. (The ratio declined less for Europe overall, from 74% to 72%, because of rapid improvements in the economies of the accession countries.)

The path that Europe is now on is not viable. Declining population will eventually drag Europe’s growth down. The World Bank projects that the working-age population will decline by 16% between 2022 and 2050 compared to a 3% increase in the U.S. As the number of workers declines and the share of the older population increases, Europe will find it difficult to sustain social welfare programs. It will need to counter these hard-to-reverse trends by increasing labor productivity, speeding adoption of information and other technologies and having strong industries that can drive growth on a global stage.

The European Commission and its expert committees have made similar observations over the last 30 years, as have other European institutions. In 2010, for example, the European Commission announced its plan to turn Europe into an “Innovation Union” based on a “comprehensive innovation strategy from research to retail.” It noted that, “Boosting our research and innovation performance is the only way for Europe to support sustainable growth and create good and well-paid jobs that will withstand the pressures of globalization.” The Commission asked a group of experts to consider possible pathways which they summarized in the Global Europe 2050 issued in 2012. The report’s authors noted that, “According to the latest Innovation Union scorecard, indicators of innovation in Japan and the United States continue to grow faster than Europe. …”

The experts considered three scenarios. In the middling one (nobody cares), “economic growth will remain stubbornly lower than in the US and China, and [Europe] will fail to exploit our potential for innovation and will, in consequence, lose our position in terms of global competitiveness to other regions in the world.” Unfortunately, “nobody cares” is where Europe ended up more than a decade later.

Since 2010, the situation, however, has become more serious. It is clear that digital technologies, including AI, as well as other cutting-edge technologies, will drive long-term economic growth globally. Europe can use these technologies and the products and services they support. Being aggressive in doing so and limiting regulations that stand in the way will help productivity and growth. Unless things change, though, Europe will play a relatively small role in the key businesses and industries behind this long wave of disruptive innovation.

The Usual Rationales Can’t Explain the Depths and Length of the Digital Winter

Commentators have offered various explanations for why Europe is so far behind in creating digital leaders. Some rationales could account for part of the gap, while others are less cause than effect. Individually and collectively, they are not persuasive excuses for Europe’s record over the last 30 years.

Fragmentation Europe’s fragmentation is a plausible reason for it having relatively fewer digital startups than the U.S. or China. But not for explaining Europe’s dismal track record in spawning digital leaders. Other parts of the world have created successful regional digital startups despite facing many of the same problems and having fewer of the advantages.

Grab, for example, started as a ride-hailing company in Malaysia in 2012, relocated to Singapore in 2014, and became the leading “super-app” offering deliveries, mobility and payments in Southeast Asia. It operates in Cambodia, Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam. These countries are at least as diverse and fragmented as the European ones.

Mercado Libre, to take another example, is a Latin American eCommerce platform that is large relative to the income of the market it serves. It started in Argentina but then launched in 16 other Spanish-speaking countries as well as Portuguese-speaking Brazil. It accounted for 68% of eCommerce sales in Argentina, 27% in Brazil and 14% in Mexico as of 2023.

Venture Capital The lack of investment, and interest, in European startups is not a plausible cause of the lack of digital success stories in Europe. VCs chase returns and money is liquid. If there was a supply of entrepreneurs, with great ideas, who had a chance of building successful businesses, VC funding likely would have flowed to Europe. VCs would have set up offices in Europe earlier to tap into the pool of entrepreneurs and occasional hits.

Other parts of the world have given birth to successful digital firms despite initially lacking domestic VC firms. Alibaba received its early investments from Investor AB, the investment arm of Swedish Wallenberg family, N.Y.-based Goldman Sachs and Tokyo-based SoftBank. Grab’s initial investors included Booking Holdings, SoftBank and Microsoft.

The lack of VC capital is mainly an effect, not a cause, of Europe’s long failure to create digital leaders.

Tech Hubs Europe also lacks tech hubs that rival Silicon Valley. Silicon Valley arose over time from agglomeration effects in which venture capital firms, entrepreneurs, successful tech firms and academics at Stanford University fed on each other. The U.S., with Silicon Valley, has a substantial edge which can help explain the U.S.’s success.

The absence of Silicon Valley cannot, however, explain the poor performance of Europe compared to other parts of the world. China has a substantial tech hub in Shenzhen largely because tech firms, such as Tencent, are located there and have become highly successful. Other parts of the world have spawned leading digital businesses without having their own Silicon Valley.

Shenzhen

Europe has a heavy concentration of scientists in disciplines that can spawn tech firms around London, Paris and Berlin. That has not been enough to create a virtuous cycle because there have been few major tech successes from those areas and few VCs to provide funding. Europe’s modest success in creating tech hubs is partly a symptom of the problems that have limited successful tech innovation historically.

Regulation Many European countries are more highly regulated than the U.S. Labor law in the EU countries, for example, often provides employees with greater protections relative to the U.S. Moreover, the EU has more restrictions on employees’ work hours and more generous laws regarding minimum wage, paid leave and maternity/paternity leave rights.

Greater regulation can explain why Europe has had a lower rate of formation of digital businesses, and, therefore, why relatively fewer home-grown businesses become digital leaders in Europe than the U.S. It is a less plausible excuse for Europe having created so few digital successes over three decades. Digital businesses, started elsewhere, come to Europe, often soon after they have started, and build up substantial European operations.

European entrepreneurs also have comparative advantages in starting digital businesses in Europe that foreigners lack. They are more attuned to the culture, languages, and regulations.

Europe Hasn’t Powered the Virtuous Circle A homogeneous market, a superstar tech hub, venture capital funding, favorable regulation and the rise of domestic Big Tech have, no doubt, given the U.S. a substantial advantage in creating the businesses that drive digital transformation as well as other disruptions based on other cutting-edge technologies. These advantages feed on each other. They have not, however, prevented other countries from creating digital leaders for their countries or regions.

Europe could reduce the gap with the U.S. by getting some success, attracting venture capital, building up pools of talent that could launch new firms, and forging tech hubs. This could take a decade or more. If Europe does not, though, the region will fall further behind the U.S., China and other parts of the world that have already gotten the virtuous cycle going. The sooner the seeds for success are planted the better, for a prosperous future.

The EU Focuses on Digital Regulation, Not Digital Innovation

The European Union appears far more focused on devising regulations for the digital economy than developing practical plans for creating digital industries. In the last 10 years, the EU has adopted six major pieces of legislation for regulating the digital economy compared to one initiative for addressing digital innovation. Regardless of whether the regulations are a hindrance themselves, the focus on regulation reflects a mindset that appears unhelpful in thawing Europe’s digital winter.

The EU has been described as a “digital empire” because it develops regulations that lead digital businesses to comply with European standards globally and that other countries emulate in devising their own regulations. It is hard to imagine that anyone would say that Europe had an “automobile empire” if it had mainly developed regulations for selling automobiles but never had any major companies that manufactured them, generated jobs or contributed to economic growth. Europe does not have a “digital empire” in any economic or business sense of that phrase.

The digital world is ultimately shaped by the companies that create products and services. Digital companies determine what products and services customers use, how those customers interact with each other on digital platforms, and private regulations concerning behavior by participants. Thus, even when EU regulations are widely adopted, Europe does not influence the digital world much because it has not been successful at creating the digital leaders and industries that people, and businesses, regularly engage with.

The Wake-Up Call

On April 25, 2018, the European Commission presented “a series of measures to put [AI] at the service of Europeans and boost Europe’s competitiveness in this field.” It proposed a three-pronged approach based on investing in AI, preparing for socio-economic changes and ensuring an ethical framework.

Later that year, the Commission announced that the Member States and the Commission would “work together to boost artificial intelligence ‘made in Europe.’” Mariya Gabriel, the commissioner for Digital Economy and Society, said, “The coordinated action plan will ensure that Europe reaps the benefits of AI for citizens and businesses and competes globally while safeguarding trust and respecting ethical values.”

More than five years later, the EU had little to show for its efforts or its money. There was not much in the way of AI products being “made in Europe” and Europe does not “compete globally.” In fact, the EU was far behind the U.S. and China on several key metrics for competing globally in AI technologies.

This was Europe’s wake-up call. Its Sputnik moment. Or should have been.

The Path Forward

The path that Europe is now on cannot lead to a happy place. Declining population will eventually drag Europe’s growth down. As the number of workers declines and the share of the older population increases, Europe will find it difficult to sustain social welfare programs. Europe will need to counter these built-in trends by increasing labor productivity, speeding adoption of information technologies and having strong industries that can drive growth on a global stage.

Without action, however, there is no obvious reason why Europe will be in a better situation in 2040, 2050 or beyond. Europe and its countries will be absent as a leader of the industries that will arise, or be transformed, from future disruptions. Continuing on the current path will not enable Europe to generate the positive feedback loop between innovation, venture capital, success, and human capital seen elsewhere. Repeating variants of what has not worked will not yield different outcomes.

More Enthusiasm for Markets, Less for Regulation There is no airtight recipe for turning this around or even for proving the root causes of the malaise. It appears likely, however, that the EU would need to move to greater reliance on markets, lighter regulation and more risk taking. It is well known that is the environment in which U.S. digital leaders have emerged and is now driving the rapid growth of AI. It is less well appreciated that it is also the one in which digital businesses started and grew in China. The early histories of companies such as Alibaba, Baidu and Tencent were like those of U.S. startups.

The U.S. and China relied on the dynamic market process to get to where they are today. Startups and investors took risks. Most failed. The few who succeeded reaped enormous rewards. Government involvement and regulations were minimal for these businesses. The European model, reflected in the Commission’s 2018 AI initiative, has not worked for Europe, and there is no evidence that a similar approach has worked elsewhere. Government-led industrial policy would just be more of the same.

Embracing Risks and Rewards A root cause of the paucity of digital businesses in Europe is likely a deep-seated aversion to risk.

Innovation is a numbers game where most efforts fail and only a few succeed. Greater risk aversion by entrepreneurs and investors reduces the number who try. Risk aversion by consumers and businesses makes it harder to ignite a business and reduces the size of the market. Risk-averse policymakers can devise regulations that increase costs and delay which further reduces rewards. The cumulative effects of risk aversion in a society chill innovation.

This is the case in Europe. McKinsey’s 2022 report on competitiveness in Europe documented that “EU firms and individuals are more risk averse in business than their counterparts in the United States. A 2021 McKinsey executive survey on the future of growth found that European firms were more risk averse than their U.S. counterparts on 4 out of 5 aspects of risk aversion.” It summarized evidence “that European firms underperform their US counterparts on embracing disruptive ideas and that they have a weaker appetite for entrepreneurial risk than in either the United States or China.” A Gallup Survey from 2009 “found that US respondents were more likely to prefer competition and taking risks than their European or Chinese counterparts.” There is no reason to believe this would be different 15 years later.

We can trace out the consequences of this aversion to risk as a matter of economics. Fewer Europeans want to become entrepreneurs and more entrepreneurs may prefer starting less risky businesses. Domestic investors want safer opportunities and avoid funding riskier startups. Risk aversion also limits the number of early adopters, for consumer or business uses of innovative products or services. Citizens want to avoid risk and therefore encourage politicians to devise regulations that protect them. Foreign venture capital funding does not flow to Europe because there are fewer high-return opportunities to fund. Tech hubs do not form because there are so few successes to create a population of startup veterans. Risk aversion may therefore make it difficult for Europe to secure the positive feedbacks that have propelled digital tech startups in the U.S. and China.

Creating a culture of risk taking is no easy task. But it is a necessary long-term investment for the long-term economic health of Europe. In the meantime, Europe would have to consider measures that counter higher risk aversion with greater rewards and would need to limit policies that reflect or encourage risk aversion in the innovative process.

The Time Is Now for Drastic Action Europe learned in early 2023 that it had been left behind, again, as a leader in latest major technological revolution. Earlier, it lost the Web despite having invented it. It lost mobile despite having the leading mobile handset maker, operating system, and standards setting body. And it might lose artificial intelligence despite having one of the world’s largest concentrations of academic researchers.

Whenever the next major technological disruption takes place, say 2040, Europe will find itself in the same situation unless it takes actions that induce a high degree of entrepreneurship, investment, and risk-taking, which could lead to success by then. Figuring out specifically what those actions are is not an easy task. But that’s where the focus now needs to be. Not just repeating what has not worked for so long.

Dr. David S. Evans is an economist who has published more than 10 books and 200 articles, many related to entrepreneurship, platforms, and the digital economy. He is chairman of Market Platform Dynamics and managing director of Berkeley Research Group. He has taught at the University College London and the University of Chicago Law School. For more details, see davidsevans.org. This paper is based on his study, Why Can’t Europe Create Digital Businesses?, the research for which was partly funded by Google.