The launch of Apple Pay has kept everyone in payments pretty busy speculating about its impact to others with digital wallet/account ambitions. What’s been ignored, at least so far, is the impact of Apple getting into payments on every other facet of the payments ecosystem.

Like, let’s say, terminal manufacturers.

Ingenico and VeriFone are the big dogs in that space. ABI has said that those two companies , together, have something like 80 percent of the POS terminal market share. The migration to EMV in the U.S. is fueling the sale of new terminals like crazy in a market of 9 million merchants who all need new stuff to be compliant. That, alone, has caused VeriFone’s stock price to rise by nearly 29 percent this year as investors have become more upbeat about its prospects. Ingenico’s stock is also performing well, for many of the same reasons.

But that’s today.

When Tim Cook took the stage on September 9th and told the world that Apple was getting into payments, he wasn’t only talking about Apple Pay. Apple is in the business of selling hardware on which it makes huge margins. And, clearly, one of the reasons that Cook made Apple Pay such a huge part of his presentation was to create demand for new iPhones.

And, this week, quite possibly for its new iPads that can be turned into POS devices.

Advertisement: Scroll to Continue

A Piper Jaffray analyst who covers Apple says Apple will likely introduce an iPad this week with a 13 inch screen. People have asked why in the world Apple would want to produce larger iPads. Why, the better to display transactions and related content at the physical point of sale, my dear!

Keep in mind that it was Apple products that ignited mPOS in the first place. Intuit may have launched GoPayment first, but it was only available on select Sprint phones. When Square launched about a year later, it was the iPhone that its dongle was compatible with, giving it much more of a micro-merchant/consumer base to leverage at the jump.

iPads as POS systems came about a year later as players like ShopKeep and Revel and Lightspeed identified the opportunity to offer small merchants a more robust alternative to terminals that only processed card transactions. With iPads as POS devices, SMBs got affordable business management systems from a single provider that helped them better manage inventory, provide analytics about their sales and profitability, manage and deliver their CRM systems and create and track offers and promotions. And, of course process card transactions.

Apple was making money in payments long before Apple Pay ever hit the scene.

Mobile POS as a concept has since exploded.

According to analysts, last year mPOS sales (hardware and software) exceeded $2 billion. In North America they say that nearly 30 percent of all retailers have some form of mobile POS. These same analysts also say that by next year, about 3 million tablets a year will be sold to retailers in this geography alone.

That can only mean one thing. Traditional POS terminals will be replaced (or never bought at all) and traditional players, who don’t adjust, will see their market share erode.

Analysts estimate that share loss will amount to about 13 percent of their sales in 2014. In some segments, like SMB specialty retail and food services, entire categories could flip.

It’s not just the little guys who are in love with tablets, although they are its biggest fans so far. Big retailers are scarfing them up, too. But at least so far, not as replacements, but as complements, to the fixed terminals that sit on their counters today. It’s been reported that 85 percent of large retailers are doing or will do that in the next couple of years.

But it doesn’t take an analyst’s report to know that. Just walk into some of the major retailers these days and look at what the sales associates are carrying around. They’re using iPads and tablets to help them deliver a better customer experience. It’s not hard to imagine a scenario that shifts more and more transacting away from fixed points of check out and terminals to these mobile devices that offer consumers and merchants convenience and improved customer experience in the store.

For sure, tablets aren’t all iPads and there are some who question whether iPads are battle tested enough to go the distance in retail. So, many alternatives are springing up, like First Data’s Clover, with enterprise tablets designed to give iPads a run for their money. First Data’s Clover even advertises that it will accept Apple Pay. And, because we don’t know whether new iPads will have NFC (most say they won’t), Clover’s positioning is hoping to sway SMBs to jump onto their tablet bandwagon.

But then there’s iBeacon.

One year before there was Apple Pay there was Apple’s iBeacon. iBeacons enable retailers to do the kinds of the things they’ve always dreamed about: track customers in their stores, serve them targeted offers while there, push loyalty and other information to them in real time, remind them they have gift cards to spend or promotions to use, and enable check-in and payment. Entire ecosystems have grown up around iBeacons and there are dozens of companies now in the business of “beacon-izing” the retail experience.

Apple, of course, is making money on the sale of those devices, and could, if it wanted, on the transactions and volume driven by those devices at retailers. It probably will at some point into the future. And since Apple is better than anyone on the planet at mobilizing (pun intended) an ecosystem, it has seen entire retail ecosystems emerge around the hardware and enabling OS software that is in the market today – iPads, iPhones, and iBeacons – and tomorrow – The Apple Watch and, of course, Apple Pay.

For Apple to fully leverage all of these assets though, Apple Pay will have to move to the cloud to get massive consumer and merchant adoption quickly. It has the same slog ahead of it that every other new payments player has, as I have written about. Until then, there are established players with digital accounts and payments ambitions that will (and will want to) ride those Apple hardware coattails, using their own apps which work on all Apple iPhones and even across mobile operating systems. iBeacon may be Apple’s BLE product, but Gimbal, the Qualcomm spinoff, is a technology that powers all Beacon technology, including iBeacon.

So, here’s something interesting to ponder. Today, of course, Apple Pay is only available to a very limited segment of merchants and consumers. But players like PayPal that are already connected to iPad POS systems and available to anyone with an iPhone and their app can take advantage of retailers who have iBeaconized their storefronts. Square, just last week, launched an online ordering app that works with its iPad POS system, Register and is leveraging Beacon technology. LevelUp uses Beacon technology to enable promotions and offers for its merchants. So, since Apple makes its money and margin selling hardware, it has to be careful to avoid alienating those innovators and merchants who have already leveraged its hardware and software assets to innovate on behalf of the millions of consumers that own their devices and like using the apps they have on them today.

Yep, that’s payments for you. Co-opetition in spades.

Except if you are a terminal manufacturer.

If you’re a traditional player watching all of this, you gotta be a little nervous. EMV may be juicing the numbers today because there are going to be plastic cards around for a while, but the little boxes that just enable the swipe (or dip or tap) of cards just aren’t as valuable as any connected device with software and apps connected to the internet. Nearly all consumers walking into retailers these days have their mobile phone with them. Most of those phones are connected to the internet and have apps. Merchants want their apps or access to others apps so that they connect those consumers to them.

Of course, merchants also want to be paid at the end of the transaction in the store, but there are lots and lots and lots of ways for that to happen now. As online and offline continue to blur and omnichannel becomes more than just a buzzword because consumers have digital accounts that enable them to pay for something they bought standing in a store just as if they were buying it on online, fixed terminals on counters will slowly disappear into the background.

In developing countries where mobile is the infrastructure that exists, terminals won’t ever be relevant. Mobile to mobile, mobile to tablet, some kind of connected device to come kind of connected device will all enable commerce, no fixed terminal required.

Apple, of course, knows this, too.

It has seen how its devices have been used to displace those purpose-built terminals. Apple’s hardware matters because it’s how the ecosystem accesses the apps and the innovation that it has spawned. But the innovation that makes that hardware valuable happens in the cloud.

The software that lives in the cloud and is accessed via apps and devices connected to the internet is tons more valuable than simply processing a card swipe (or dip or tap) in a box that only does that. And the ecosystems that have and will continue to emerge around it have seized that opportunity and recognized that transacting in a store can be just like transacting remotely where the only terminals are the devices that connect to the internet – PCs, iPads, iPhones, tablets, smartphones, wearables, you name it.

So, if you’re a terminal manufacturer, your hardware isn’t really that compelling anymore since it enables nothing other than card processing today. Therefore, the competition isn’t the guys who have the market cornered today of little boxes that enable card transactions. It’s a whole new crop of innovators, including Apple, who saw the power of the cloud and connected devices and jumped on it six or seven years ago.

tTerminals, as we know them today, will in a decade or so as quaint as the antique Smith Corona that I have on my bookshelf in my home office.

Speaking of Smith Corona, they actually still have a website. I guess that there are still people somewhere in the world who need those typewriter ribbons replaced just like there are still merchants that use knuckle busters. Even more amazing is to read their history and see just how blindsided their CEO seemed to the PC and the competition it would mean to their business.

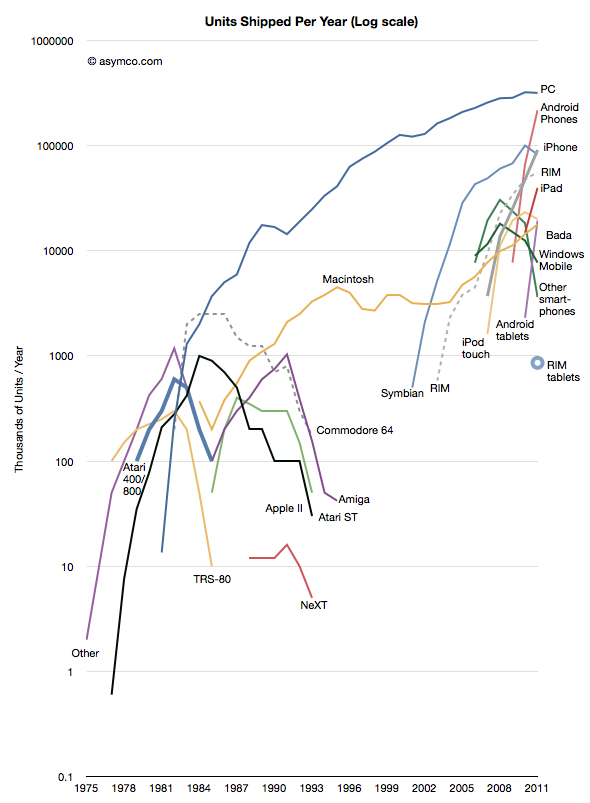

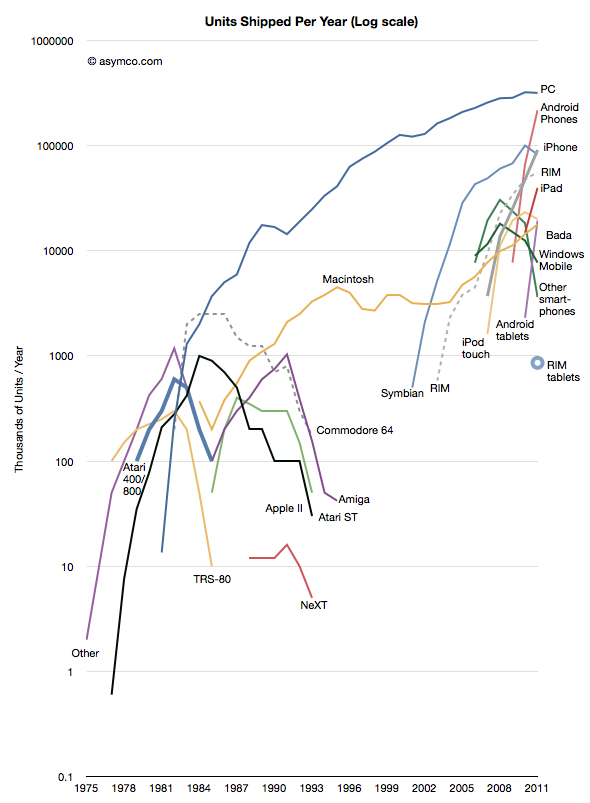

In 1991, its CEO was quoted as saying, that it would never abandon the typewriter, saying that computers would not replace it. He said, “We strongly believe in the continuing need for the typewriter and will maintain our lead position in the market place.” That was the year that Tim Berners Lee “turned on” the World Wide Web in CERN, and when PC sales didn’t hockey stick, they went vertical. Typewriters, he said among other benefits, were a ‘safer’ way to produce documents that could not be easily copied.

In 1991, its CEO was quoted as saying, that it would never abandon the typewriter, saying that computers would not replace it. He said, “We strongly believe in the continuing need for the typewriter and will maintain our lead position in the market place.” That was the year that Tim Berners Lee “turned on” the World Wide Web in CERN, and when PC sales didn’t hockey stick, they went vertical. Typewriters, he said among other benefits, were a ‘safer’ way to produce documents that could not be easily copied.

He got that right.

But that’s okay. Today, Smith Corona, can still say, with pride, that they are the leader. There’s only one problem: The category in which they’re the leader is completely worthless.