And it may help them pay for at least some “everyday” essentials, too.

The PYMNTS Intelligence and Visa report “The Embedded Lending Opportunity” found that across geographies, about half of consumers are satisfied with the embedded lending options that come their way in the course of everyday commerce. That leaves a significant percentage of individuals who are less than satisfied with their embedded lending experiences, but that dissatisfaction offers an opportunity to forward-thinking lenders.

Traditional credit avenues are seeing some pressure. As recently as this week, the Federal Reserve noted in a survey of senior loan officers that standards are tightening when considering extending credit via cards — and card limits themselves are also being tightened.

Limited Experience

As for the greenfield opportunity, the data showed that across more than 8,200 consumers, a bit fewer than 23% of those surveyed said they had “never” used this type of financing — implying, by extension, that more than three-quarters of consumers would at least consider it. The real-world experience is limited thus far, as a mid-teens percentage-point tally of consumers has used embedded lending — 15% in the United States, for example, 13% in Australia and 15% in India.

Part of the reason why there is some reticence or outright dissatisfaction lies with the fact that 37% of customers said embedded lending credit limits are too low. The emergence of platform models such as Versatile Credit’s, and the use of a broad range of data points to help multiple lenders extend offers at the point of transaction, can help personalize those offers.

Advertisement: Scroll to Continue

In other examples, LendingClub said it is rolling out “turnkey” embedded finance options to extend pre-screened offers. The continued rise of open banking, especially in the U.S., with consumer-permissioned data, may do much to help merchants and their lending partners fine-tune their efforts on a case-by-case, customer-by-customer basis.

The PYMNTS Intelligence/Visa data showed that embedded lending holds the most immediate appeal in meeting unplanned, emergency expenses, at 29% of the overall sample. That use case rises among consumers who use embedded options when necessity demands it, at 40.3%.

However, embedded financing may find some use in meeting the continued demands of everyday spending, especially among the consumers who tap into embedded financing when it is needed.

Groceries represent a prime example.

Although the report found that only 6.6% of consumers have used embedded financing to put food on the table, 13.4% would use it for everyday expenses, and 12% said they would use it at their favorite stores.

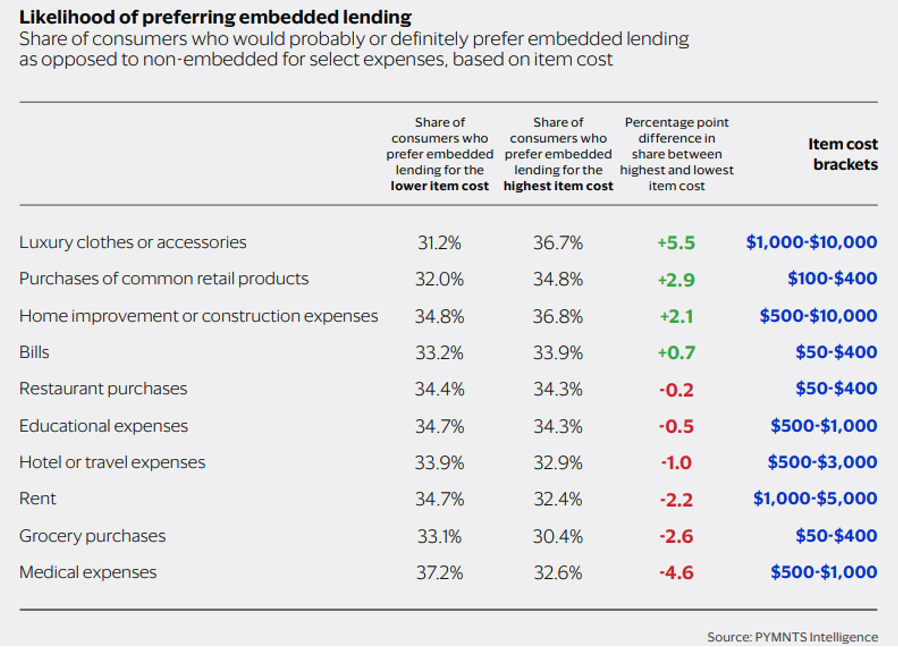

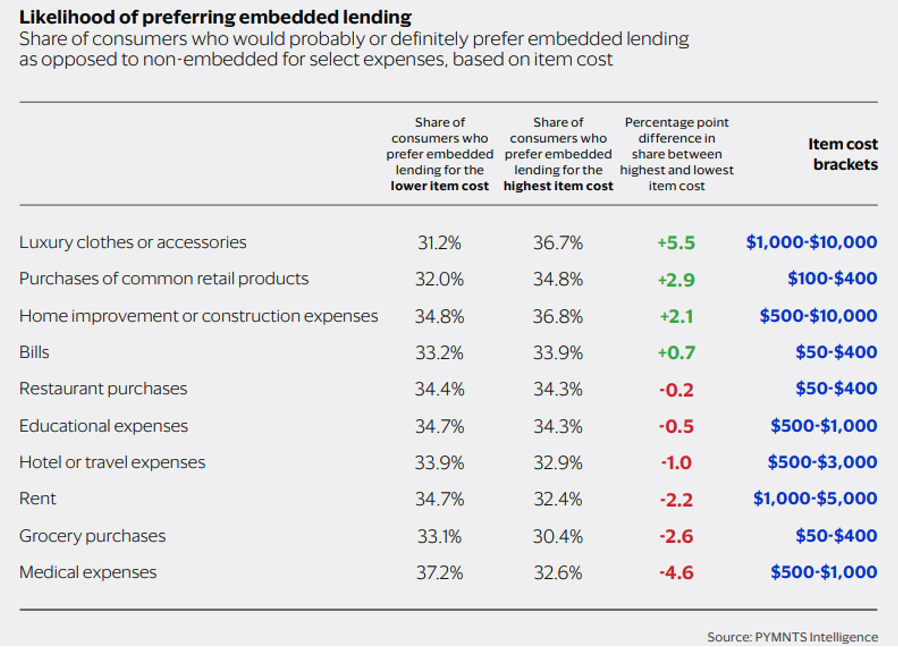

Within the grocery purchases segment, roughly 30% of those who said they would use embedded lending over non-embedded options would opt for those offers across a range of cost brackets spanning $50 to $400. The percentages are roughly the same across other types of bills — the type that recur and are part of everyday life.