Since the very start of the concept of digital payments, humans have pursued a dream of simplified transactions between individuals that mix the ease and personal control of cash payments with the speed and interconnectivity of electronic payments. The earliest iterations of eMoney were all third-party products. Even when transactions within a system were instant or nearly instant, the benefits have always been restricted to transactions within a specific platform. Moreover, moving money into or out of that platform could take days.

Blockchain technology emerged with the potential to completely reframe how electronic transactions are completed, removing the need for intermediaries and creating completely new and decentralized currency systems. At the same time, those currencies can be unstable, with significant and unpredictable fluctuations in value. This has led to the birth of stablecoins, cryptocurrencies pegged to physical-world assets such as fiat currencies.

The “Blockchain Payments Tracker®” explores the ongoing evolution of digital payments and how technology is responding to consumer payment desires.

Around the Blockchain Payments Space

The Federal Reserve Board recently surveyed CFOs from some of the largest U.S. banks, and 66% said they do not see blockchain technology and cryptocurrencies as a priority for short-term economic growth and development. Overall, responses indicated a cautious interest in the blockchain space, with CFOs cognizant of the importance of understanding and following developments but not yet seeing cryptocurrencies as a significant focus.

The Federal Reserve Board recently surveyed CFOs from some of the largest U.S. banks, and 66% said they do not see blockchain technology and cryptocurrencies as a priority for short-term economic growth and development. Overall, responses indicated a cautious interest in the blockchain space, with CFOs cognizant of the importance of understanding and following developments but not yet seeing cryptocurrencies as a significant focus.

As lawmakers and regulators in the U.S. explore effective approaches to regulating stablecoins, cryptocurrencies and crypto assets, Coinbase’s chief legal officer, Paul Grewal, says that regulators need to have a more comprehensive understanding of the reserve assets to which stablecoins are pegged. Reserve assets are the most important aspect of stablecoins when it comes to effective regulation, and rules need to encourage transparency, he said.

For more on these and other stories, read the Tracker’s News and Trends section.

Republic on the Future of Blockchain Tokens

The most significant aspect of stablecoins and other cryptocurrencies is the removal of any intermediaries from transactions, meaning that crypto transactions cannot be interfered with by governments or other third parties. Governments still have a role in the crypto space, though, as the regulatory means of ensuring stability and accountability. At the same time, to ensure that the role governments play is positive, lawmakers and regulators will need to be educated on what the technology can and cannot do and what the actual risks are.

In this month’s Feature Story, Jon Knipper, senior director of crypto treasury management at crypto investment firm Republic, talks about the evolution of cryptocurrencies and other crypto assets and how regulators can keep up.

Making Sense of the Digital Currency Space

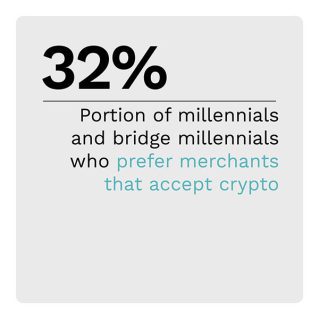

Advocates of eMoney have long envisioned a world in which cash, checks and even cards are replaced with user-friendly digital transactions that eliminate the need to carry anything around and permit instant exchanges of value over any distance and at any time. When blockchain technology first emerged more than a decade ago, it promised a previously unimagined solution that would remove all intermediaries from transactions and create entirely new currencies separate from the control or oversight of any government or outside agency. Since then, cryptocurrencies and crypto assets have gradually gained acceptance among consumers, though they remain a relatively rare means of payment in everyday transactions. Consumer interest in the benefits cryptocurrencies promise has only grown in recent years, and many consumers believe that cryptocurrencies, in some form, are the future.

This month’s PYMNTS Intelligence looks at the roles of eMoney, cryptocurrencies and stablecoins and how consumer interest drives further development.

About the Tracker

The “Blockchain Payments Tracker®,” a collaboration with Algorand, examines the latest trends and developments shaping the blockchain payments space and how blockchain technology is reshaping the face of payments.