Amid the volatility of last week — the soaring prices at the pump and everywhere else, the double-digit percentage point plunges (and gains) as companies reported earnings — the Connected Economy 100 Index barely budged.

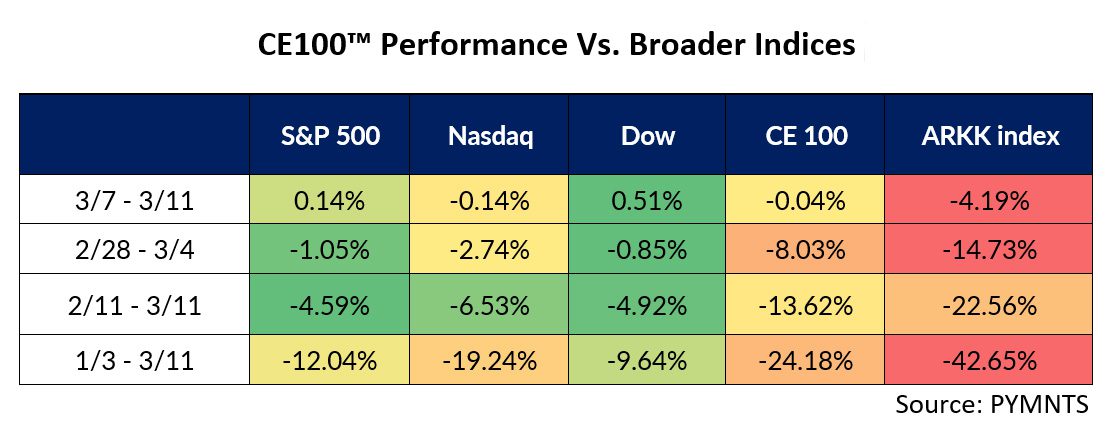

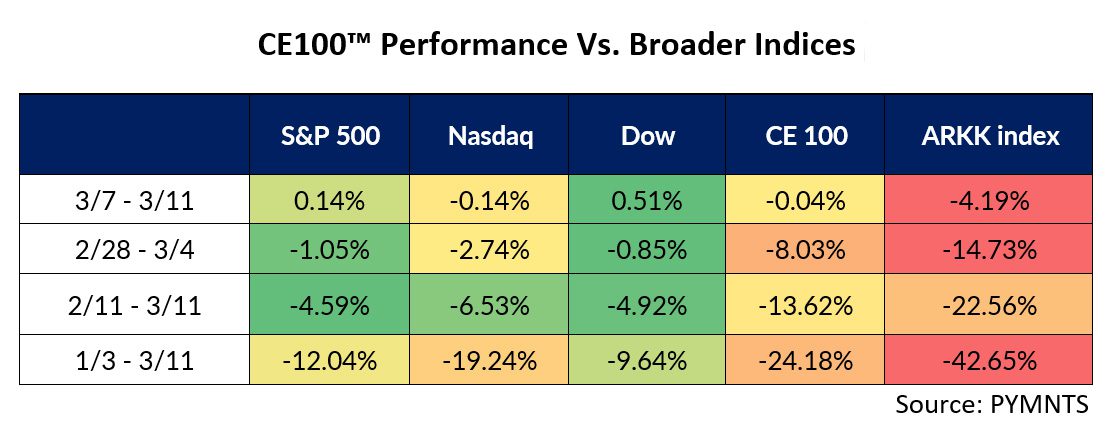

For those of us keeping score, the index slipped a muted four basis points. The tech-heavy Nasdaq was off 14 basis points, and the broader Standard & Poor’s 500 index was up 14 basis points in the same period.

Go back a bit, though, through the past month (trailing four weeks) and the CE100™ has significantly trailed behind other benchmarks, slipping more than 8%, while the Nasdaq was down less than 3% and the S&P 500 was down a bit more than 1%.

The muted performance this past week comes as three pillars showed low- to mid-single-digit percentage point gains, offset by three pillars that showed similar movement to the downside. The best performing indices were the Move Index (+7%), Eat Index (+2%) and the Live Index (1.4%). The biggest drops were recorded in the Shop Index (-4.3%), Be Well Index (-3.3%) and Stay Connected Index (-2.1%).

As for individual stock performance, Porch, housed within the Live pillar, saw gains of nearly 13% during the week, rebounding off recent lows set earlier in the month after it reported earnings that showed revenue growth of about 172% in the most recent quarter. Flutter Entertainment, which saw one of the biggest losses last week, rebounded a bit, too, rising 9.6%.

Some Significant Declines

Advertisement: Scroll to Continue

Those gains were muted, though, by significant declines tied to firms like DocuSign. Shares in that firm slipped by more than 25% this past week. DocuSign said after the close of trading, in its own quarterly report, that it expects revenue growth of 24% at the midpoint for the current quarter, as measured year over year, and between 17% to 18% for its fiscal 2023. That’s a slowdown, indeed, from the 35% revenue growth that was seen in the most recent quarter and the 45% for the year.

But “as people begin to return to the office, they are not returning to paper,” CEO Dan Springer said during remarks on the conference call. “eSignature and the broader Agreement Cloud will only continue to gain prominence in the evolving Anywhere Economy.”

Tencent shares were down nearly 25% through the week, after the company reported that it would reduce transaction fees for small- to medium-sized businesses (SMBs) using the WeChat payments network. The 10% price drop is expected to be retroactive from Sept. 1 of last year through Sept. 30, 2024, the company said.

Tencent added that it also will lower fees on cash withdrawals from customers’ bank accounts.

Read also: Tencent to Trim WeChat Transaction Fees for SMBs