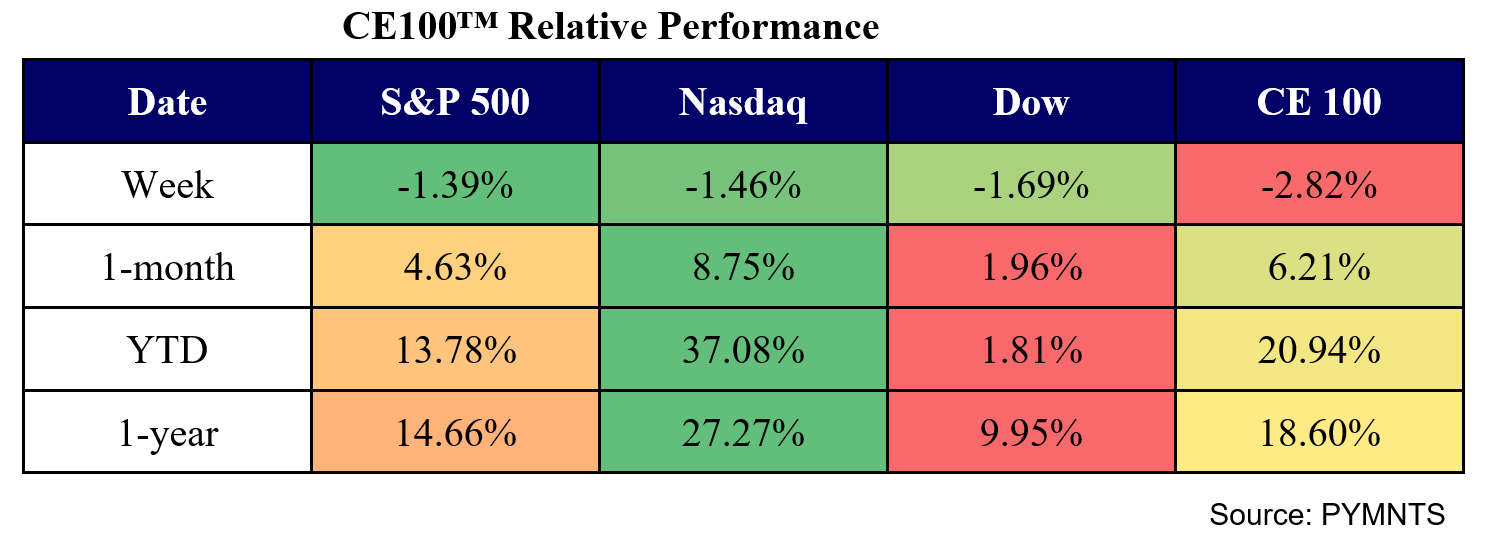

As a result, The CE 100 Index lost 2.82% last week, and only a single pillar gained ground, marked by the Shopping group’s 0.4% muted positive performance.

Ocado in the Crosshairs?

Within that segment, shares of Ocado were up 15.4%. The shares were buoyed by reports that the firm has garnered interest from several would-be suitors — Amazon among them.

As we noted, Ocado’s latest fiscal year earnings results show that revenues were up 0.6% year on year to 2.5 billion pounds (about $3.2 billion), while its pre-tax loss grew to 500 million pounds (about $637 million) from 177 million pounds (about $225 million) in the previous year.

But drilling down a bit, the revenues tied to its technology solutions were up 59%. As for the digital shift in groceries: PYMNTS’ own research has found that only 7.2% of consumers buy all their groceries online. But that’s a huge jump from the 0.2% pre-pandemic percentage.

The impact of Ocado’s surge was blunted and overwhelmed by declines in the Work segment, which was off 4.9%. In that designation, shares of WeWork retraced some recent gains and gave up 13.8%.

Advertisement: Scroll to Continue

In the Enablers segment, which was off 3.5%, C3.ai plunged 25% through the week. As reported by Investor’s Business Daily at the company’s investor day attendees, it has seen strong pipelines of activity. But as the publication noted, Deutsche Bank reiterated a “sell” rating on the stock in the wake of investor day and said there had been a “lack of details” about company-wide financials.

Peloton shares were off 15.3%. And in another example of how negative sell-side sentiment can hit shares, as Bloomberg reported, Wolfe Research LLC downgraded the company to what has been termed a “sell-equivalent” rating, saying its “path to growth doesn’t seem to exist.” The analyst who penned the note, Zach Morrissey, said that at-home fitness product demand is likely to be “muted” after the pandemic, which pulled demand for those offerings forward.

The analyst also wrote that there’s “limited confidence” in growth initiatives that are in place.

As detailed last month, the fitness firm is amid a rebrand, where the company has “re-introduced” the Peloton app with a tiered membership structure. During the company’s most recent earnings call, Chief Financial Officer Liz Coddington told analysts that going forward, Peloton is focusing on “growing our subscribers efficiently. And we expect to target a lower [lifetime value (LTV)] to [customer acquisition cost (CAC)] ratio in Q4 than we did in Q3.”

Regarding the rental of Peloton Certified Refurbished (PCR) bikes under its Fitness-As-A-Service (FAAS) offering launched last year, management said in a letter that accompanied results that the program grew to 47,000 subscribers in Q3 with an average monthly churn rate of 5% and with an average payback of 18-19 months.