Additionally, shoppers are adapting to high prices rising further, leaving little incentive for manufacturers and retailers to rein in these increases, no matter what factors may be influencing the mark-ups. Inflation’s ebbing influence as a hot-button topic may be because its pace has tempered from last year’s astronomical rise, although it is nowhere near a return to pre-pandemic rates.

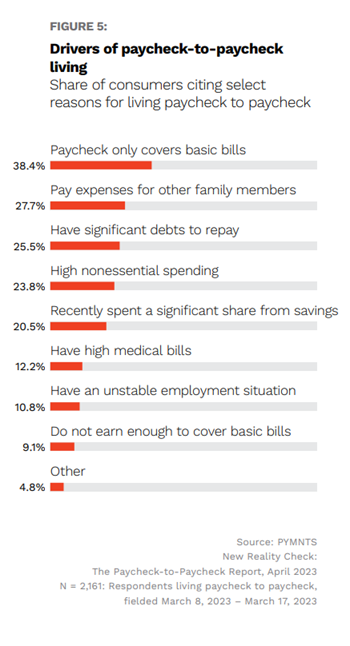

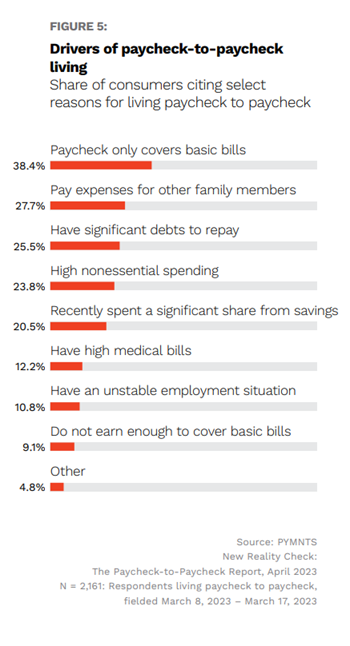

PYMNTS has covered this normalization in the past, even finding that consumers estimate inflation will last until October 2024. As most recently illustrated in the April PYMNTS collaboration with LendingClub, “New Reality Check: The Paycheck-to-Paycheck Report,” the high cost of basic items is driving the paycheck-to-paycheck financial lifestyle for 38% of consumers.

PYMNTS’ data has also found evidence of increased financial stability amid the many living paycheck to paycheck. Is consumers’ resiliency through inflation making businesses more comfortable with higher prices, potentially becoming a self-fulfilling prophecy? It’s hard to say.

However, inflation normalization follows a pattern of consumer sentiment either matching, driving or foretelling near-future economic reality. The predictions right now are of prolonged economic turbulence, with consumer fears echoing along Main Street and inside the Federal Reserve as well. Preparing for these pullbacks, consumers are paring back spending, which, if widespread, could itself partially precipitate a downturn.

Are consumers soothsayers? The Magic 8 Ball says, “Don’t count on it.” Regardless, consumers serve as a vital driver of the economy, and their perceptions may well be indicative of broader economic realities.

Advertisement: Scroll to Continue