Recent PYMNTS research shows that mobile card apps are potential market movers: Nearly 30 percent of consumers would consider switching to banks that offer “better” card apps. Such apps must offer certain key qualities and features, however, and many of those currently on the market are failing to fully deliver. PYMNTS has been examining consumers’ growing expectations for mobile card management services as part of its Building A Better App Playbook series, a collaboration with Ondot. In the new Mobile Card App Features Edition, we dive deep into the specific functions that are most captivating for consumers and could even entice them to switch banks. Our research reveals that mobile-oriented consumers — those most keenly interested in card apps — have appetites for app features that exceed what the market currently offers.

Recent PYMNTS research shows that mobile card apps are potential market movers: Nearly 30 percent of consumers would consider switching to banks that offer “better” card apps. Such apps must offer certain key qualities and features, however, and many of those currently on the market are failing to fully deliver. PYMNTS has been examining consumers’ growing expectations for mobile card management services as part of its Building A Better App Playbook series, a collaboration with Ondot. In the new Mobile Card App Features Edition, we dive deep into the specific functions that are most captivating for consumers and could even entice them to switch banks. Our research reveals that mobile-oriented consumers — those most keenly interested in card apps — have appetites for app features that exceed what the market currently offers.

Only a handful of app features are offered nearly universally, according to our survey. More than 85 percent of consumers that have downloaded card apps report that they can use them to set transaction notifications and alerts and report cards lost or stolen. From here, app feature availability begins to fall off: disputing incorrect or fraudulent charges is the next most commonly reported feature, with about 75 percent identifying it.

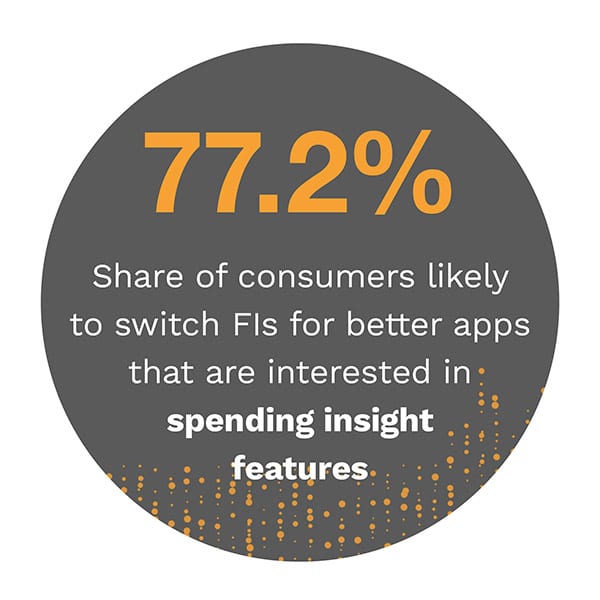

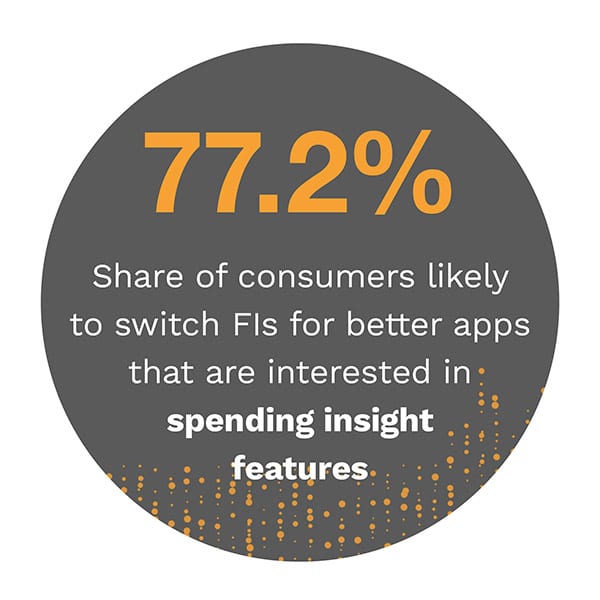

A feature’s lack of availability does not translate into lack of interest, however, especially among those most motivated to switch to financial institutions (FIs) with better apps. For example, 72.5 percent of these would-be switchers are interested in payment plans for large credit purchases, which is 31.2 percentage points higher than the estimated availability of this feature. In addition, 77.2 percent within this group are interested in spending insights, an availability gap of 12 percentage points. There is also substantial unmet demand for location controls on card use, with 77.6 percent interested in this feature, outstripping its reported availability by 24.7 points.

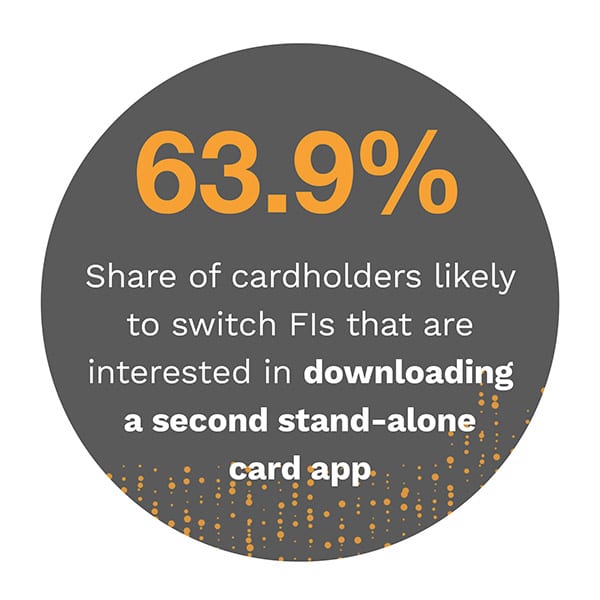

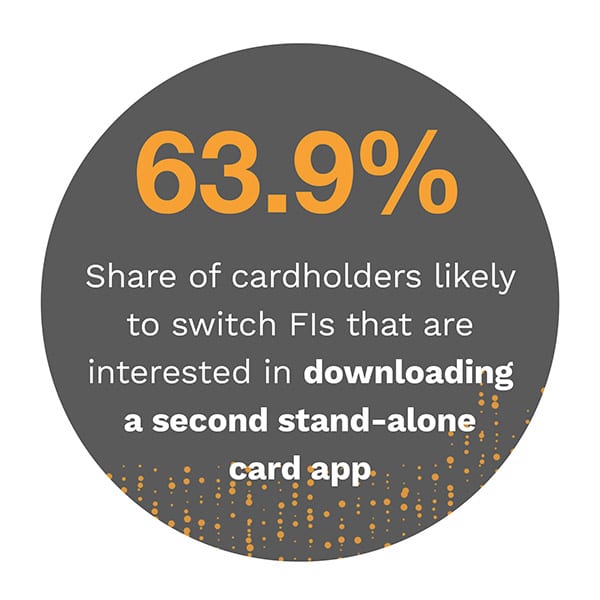

Another component of our research seeks to assess demand for highly functional card apps that are explicitly separate from banking apps but compatible with them. Our findings show that while interest in such “second” apps is slightly more muted among respondents overall, the mobile-oriented consumers remain highly interested: 63.9 percent of them would be “very” or “extremely” interested in downloading the second app. The findings indicate that these cardholders do not just want mobile financial management tools in a general sense, but they want ones they can specifically apply to their credit and debit cards.

Another component of our research seeks to assess demand for highly functional card apps that are explicitly separate from banking apps but compatible with them. Our findings show that while interest in such “second” apps is slightly more muted among respondents overall, the mobile-oriented consumers remain highly interested: 63.9 percent of them would be “very” or “extremely” interested in downloading the second app. The findings indicate that these cardholders do not just want mobile financial management tools in a general sense, but they want ones they can specifically apply to their credit and debit cards.

These data points just scratch the surface of our findings. To learn more, download the Playbook.

Advertisement: Scroll to Continue

About The Playbook

The Building A Better App Playbook: Mobile Card App Features Edition is based on a survey of more than 3,000 consumers and examines the key functions and tools consumers are looking for in card apps.

Banks are well aware that they must do more these days than simply provide their debit and credit card holders with monthly account statements. Just as consumers have come to expect robust mobile banking services, a growing share want mobile tools to help them control and manage their cards, which have become their go-to payment methods, both online and off.

Banks are well aware that they must do more these days than simply provide their debit and credit card holders with monthly account statements. Just as consumers have come to expect robust mobile banking services, a growing share want mobile tools to help them control and manage their cards, which have become their go-to payment methods, both online and off.