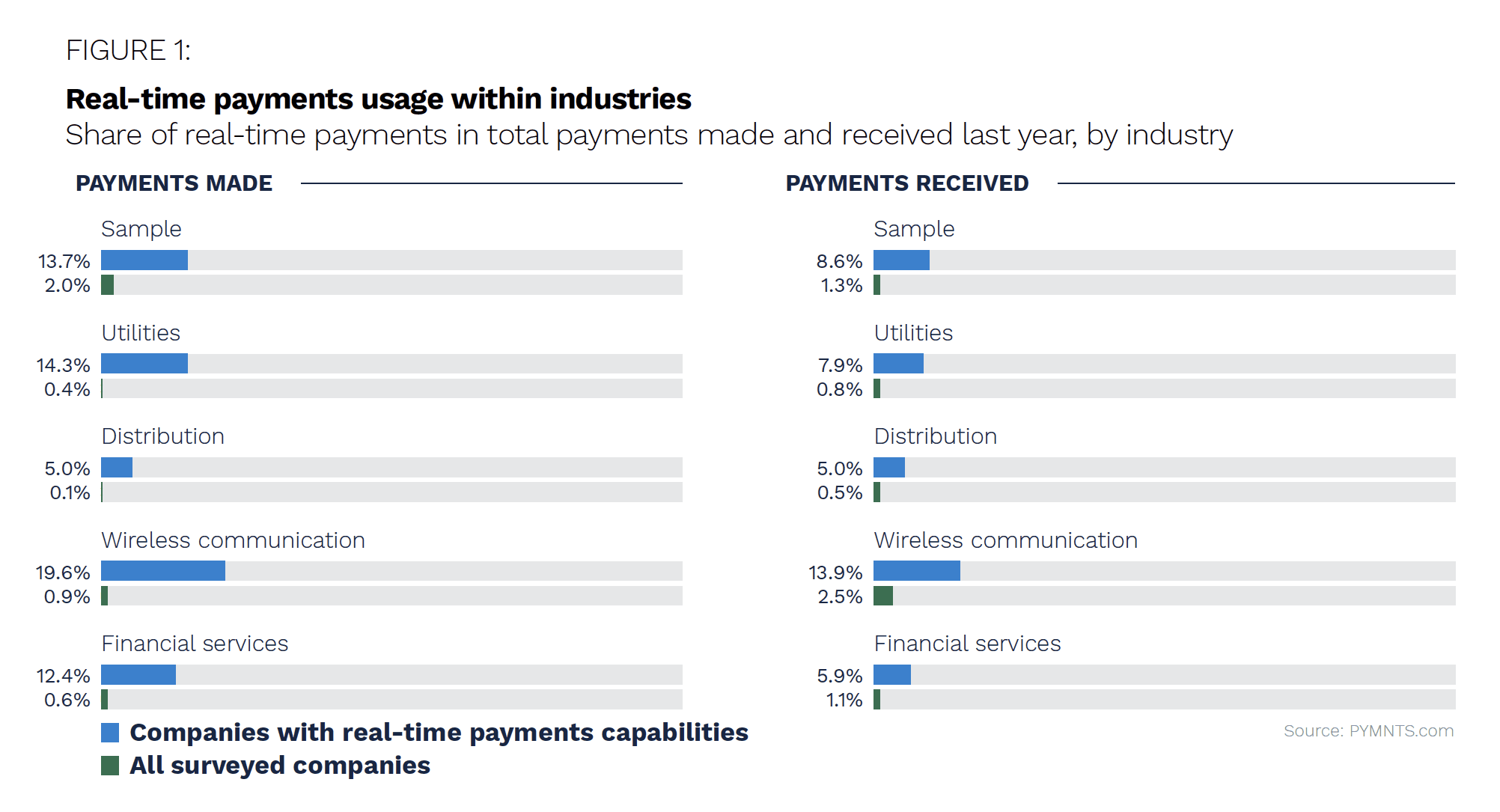

While real-time payments account for just 2% of all corporate payments sent and 1.3% of corporate payments received, the benefits of real-time payments are catching the attention of a growing number of corporate treasurers and billing and payment executives. Among those companies already engaged with real-time payments, nearly 75% expect to increase the payments they receive in real time during the next year, and 69% say they expect to make more real-time payments. Already, 15% of surveyed businesses with annual revenues between $50 million and $1 billion say they either make or receive payments in real time, and this figure is nearly 86% among the largest of these businesses — those with annual revenues between $500 million and $1 billion.

The benefits of real-time payments extend to both consumers and businesses, with merchants able to fulfill customer demands immediately and businesses able to conduct transactions with clarity and finality that is lacking in legacy payment solutions. These faster payments have revolutionized existing payments practices and opened the door to further advancements and new business opportunities that could not exist without real-time payments. The Clearing House’s RTP® network sits at the forefront of this sea of change, providing the means for settlement within two to three seconds at any hour of any day. This has enabled such use cases as enhanced client experience and improved liquidity management.

By September 2021, the RTP network had approximately 150 financial institutions (FIs) connected as participants, accounting for more than 50% of direct deposit accounts (DDAs) in the United States. The most recent information from The Clearing House places that number at 251 FIs able to send and receive real-time payments through the network, reaching 61% of U.S. DDAs. At the same time, just 24 of those FIs are integrated directly into the RTP network. The rest participate through a third party, such as a third-party service provider (TPSP) or credit union service organization (CUSO). In addition, many more FIs can receive real-time payments through such third parties, even though they are not participants in the network. This month, PYMNTS Intelligence takes a closer look at the RTP network ecosystem and the third-party organizations that help more FIs provide their customers with true real-time payments.

The nuts and bolts of the RTP network

Unlike other payment options touted as fast or same day, the RTP network enables transactions that actually happen in real time. With payment information traveling both ways during the transaction, end-to-end messaging prevents fragmented communication that can slow a payment. The RTP network accomplishes this with adherence to the ISO 20022 standard, meaning that all messages comply with a global standard that aids in interoperability and makes it easier for FIs and TPSPs to integrate the messaging into their interfaces. This same standard is planned for the Federal Reserve’s FedNow payment network, making for smoother interoperability for FIs using both networks.

The two-direction nature of RTP payments also enables a request for payment to be sent through the network to a payee, with the payor initiating the transaction and the payee confirming. The data-rich nature of RTP network payment requests also enables easier marrying of payments with accounts receivable (AR) information, saving time and the work involved in reconciliation.

The RTP network is open to any federally insured depository institution, and even FIs that are not full participants can benefit by working with TPSPs to receive real-time payments through the network, as many larger players, such as PayPal, Venmo and Grubhub, have integrated with the RTP network and can send payments.

Choosing how to participate

To make payments through the RTP network, a sending participant must provide funding as determined by The Clearing House and maintain a prefunded balance that covers its transactions on the network. Smaller and mid-sized FIs can accomplish this by working with a third party known as a funding agent, which maintains the prefunded balance on behalf of its client FIs. Some third parties provide the functions of a funding agent while also enabling the connection to the RTP network, or an FI may choose to work with a TPSP to connect to the network while seeking another entity to act as its funding agent.

According to The Clearing House, most RTP network participants connect through a third party. The work of a multitude of technology providers, funding agents and entities that act in both capacities support the network. Working with one of these third parties can provide several benefits, such as offloading the job of creating and maintaining a native interface that connects the FI to the network. Depending on the provider an FI chooses, the FI may be able to act as a full participant or choose a tiered service that provides fewer capabilities at a lower cost. With an overwhelming share of DDAs already connected to the network and new participants constantly being added, even enabling the receipt of payments through the network has clear advantages for any size FI.