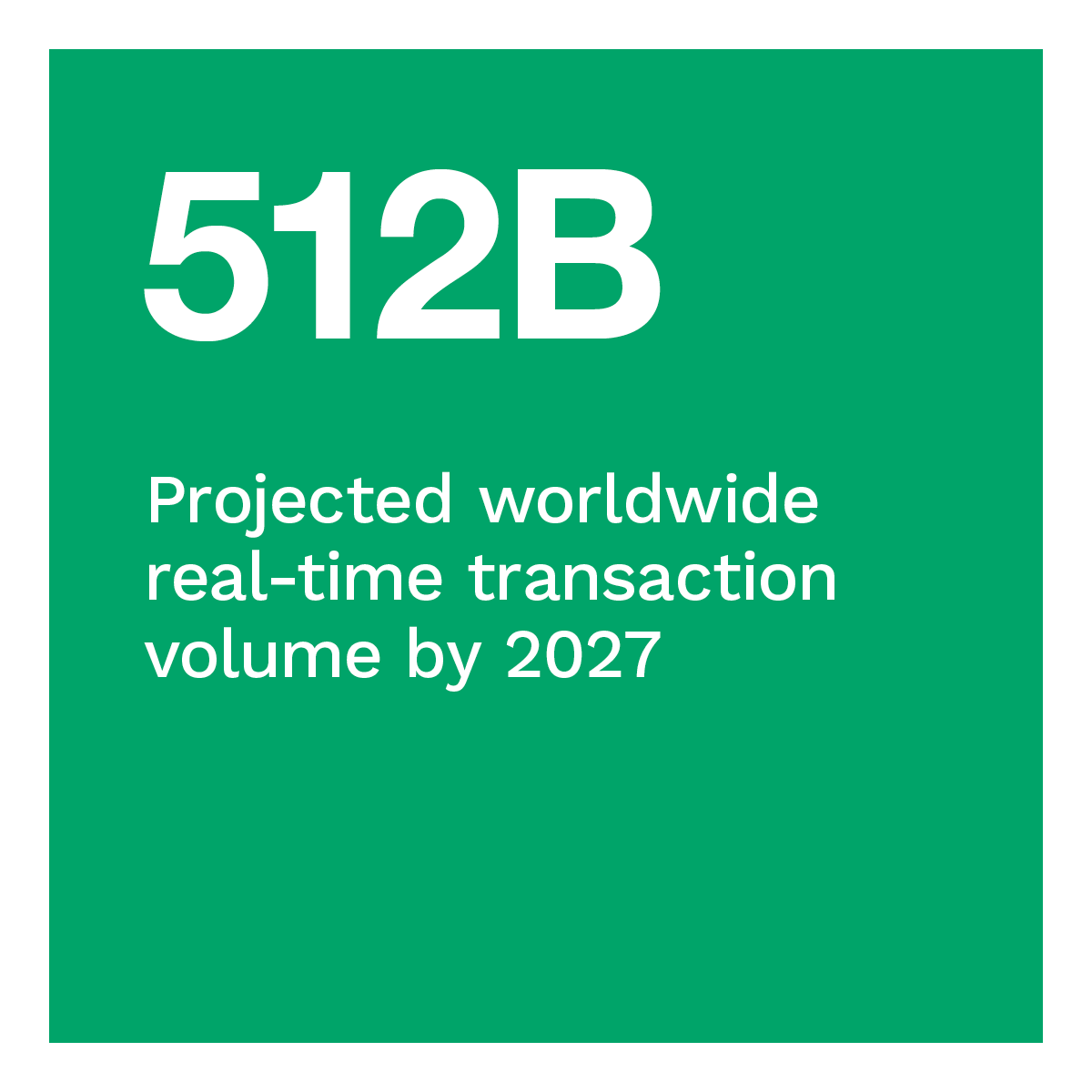

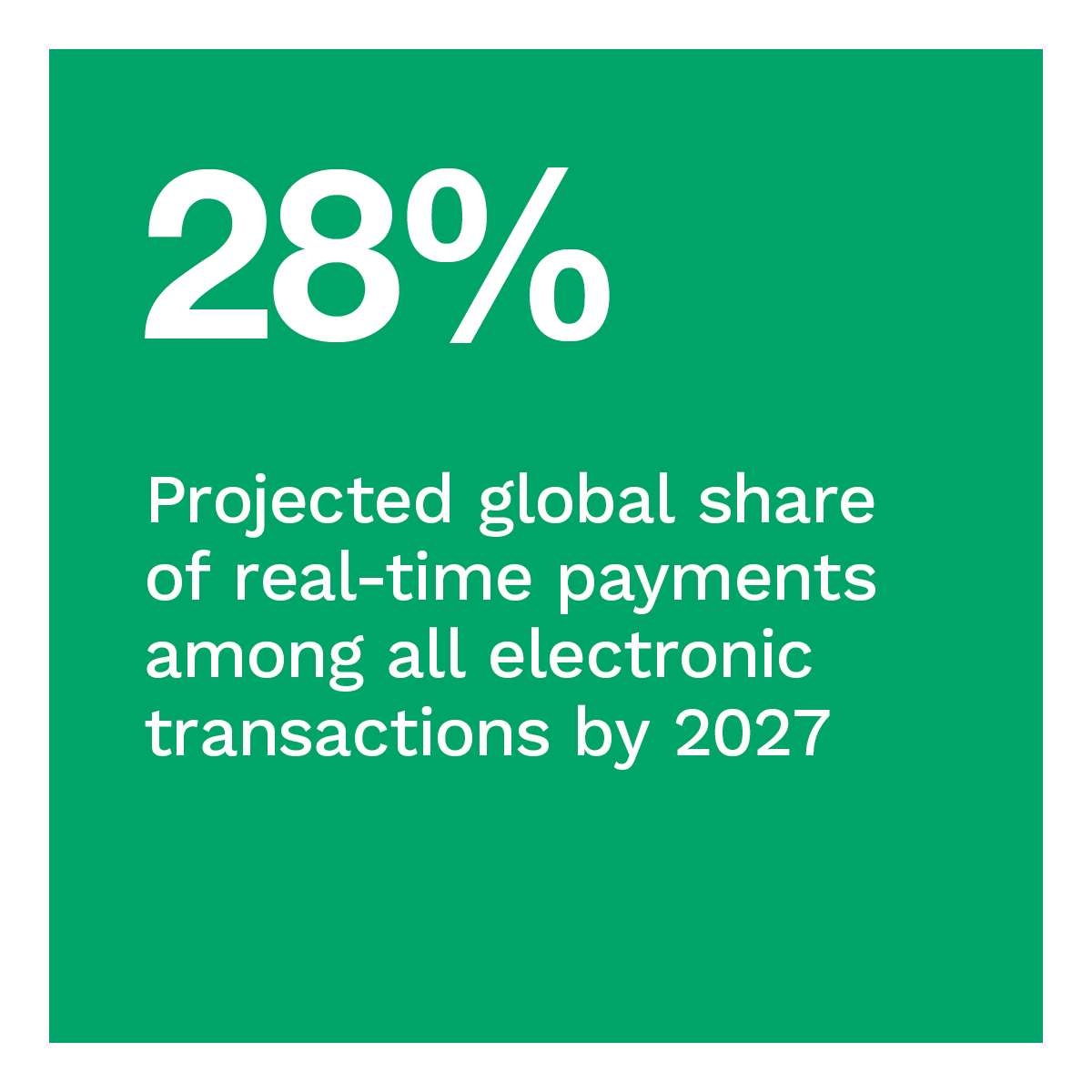

Real-time payment systems continue to see strong usage worldwide.

One of the most significant developments is the European Council’s new rule to enable instant payments across the European Union and European Economic Area. Under this regulation, instant credit transfers must arrive in recipients’ accounts within 10 seconds, regardless of the date or time of day. In addition, all payments must arrive in euros irrespective of the currency posted by the sender, although the permitted transfer time will be extended to allow for currency conversion. The date for the rule to take effect is still to be determined.

One of the most significant developments is the European Council’s new rule to enable instant payments across the European Union and European Economic Area. Under this regulation, instant credit transfers must arrive in recipients’ accounts within 10 seconds, regardless of the date or time of day. In addition, all payments must arrive in euros irrespective of the currency posted by the sender, although the permitted transfer time will be extended to allow for currency conversion. The date for the rule to take effect is still to be determined.

Meanwhile, in Qatar, the Qatar Central Bank plans to launch the Fawran instant payment service in March. The new application will allow users to send and receive funds in seconds, 24/7, using their mobile phone numbers as identifiers. Existing payment services primarily leverage users’ International Bank Account Numbers (IBANs), which may be inaccessible to unbanked individuals. The Fawran system, produced in accordance with Qatar’s Third Financial Sector Strategy initiative, could be available to a much larger consumer segment due to its accessibility.

Elsewhere in the Middle East, Abu Dhabi Islamic Bank (ADIB) announced the launch of a new real-time payments hub to facilitate and streamline cross-border transactions. The hub is the product of ADIB’s partnership with real-time payment solutions company ProgressSoft, representing a step in enhancing the speed, security and efficiency of international transactions for ADIB’s customers.

Elsewhere in the Middle East, Abu Dhabi Islamic Bank (ADIB) announced the launch of a new real-time payments hub to facilitate and streamline cross-border transactions. The hub is the product of ADIB’s partnership with real-time payment solutions company ProgressSoft, representing a step in enhancing the speed, security and efficiency of international transactions for ADIB’s customers.

In Colombia, Wompi Colombia debuted a merchant-focused mobile payment app using Nequi, the QR code system of Colombia’s largest bank, Bancolombia. The app aims to tokenize users’ savings accounts for enhanced security and streamlined payments. This will enable users to make payments with a single click. Additionally, the company plans to expand the app’s functionality with open banking technology to improve the overall payment experience.

Finally, the National Payments Corporation of India (NPCI) unveiled an initiative to establish a real-time payment link between India and the United States. The new model will coordinate with the U.S.’s FedNow® Service to enable transactions between the countries. Initially, the system will focus on small transactions, such as payments between family members, with the potential to expand to larger amounts.

The coming weeks and months promise to be an exciting time for instant transactions, driven by the ongoing demand for instant payments fueling their expansion worldwide.

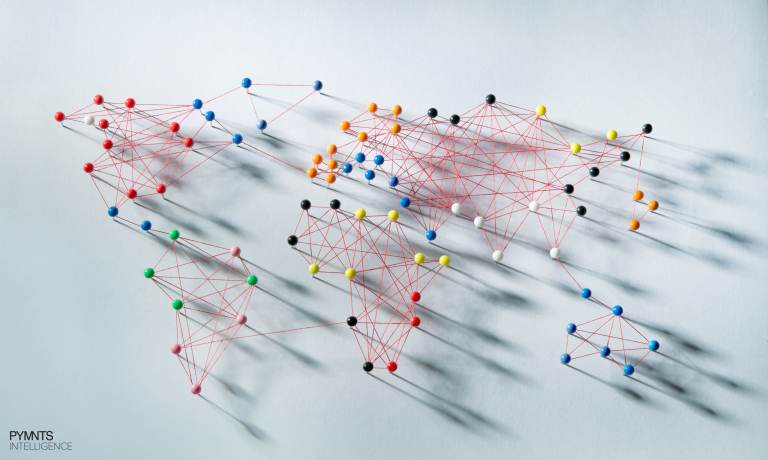

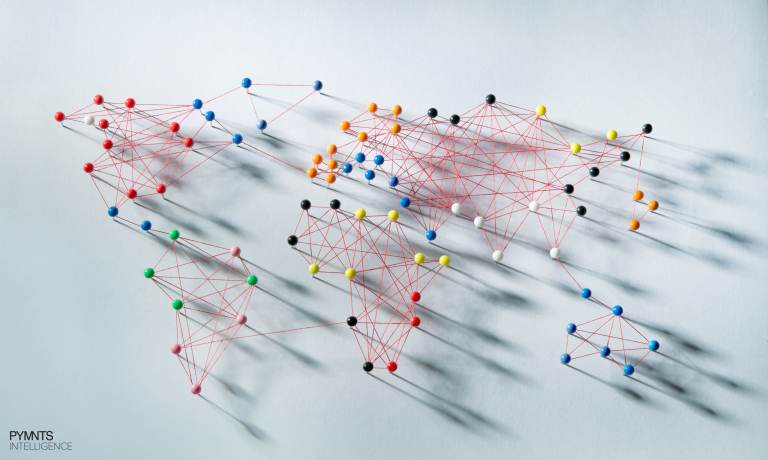

About the Real-Time Payments World Map

The “Real-Time Payments World Map,” a collaboration with The Clearing House, examines the state of real-time payments across countries around the world, how they compare to their counterparts and total payments volume in recent years.