Venmo

Venmo is a mobile payment service owned by PayPal. Venmo account holders can transfer funds to others via a mobile phone app; both the sender and receiver have to live in the U.S. Venmo is a type of payment rail. It handled $31 billion in transactions in the first quarter of 2020.

Source: venmo.com

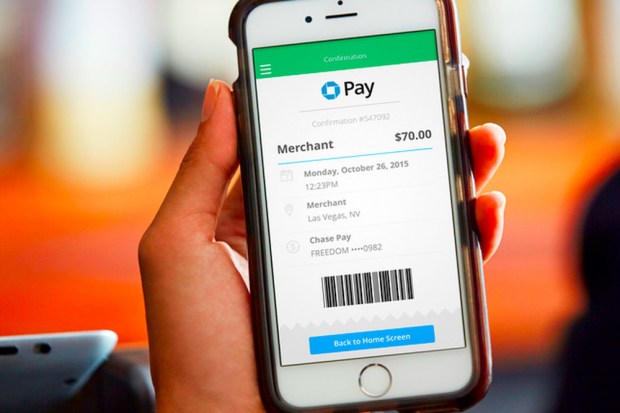

Chase Pay’s Trouble With Traction

November 16, 2017 | Mobile PaymentsAccording to news from The Wall Street Journal, J.P. Morgan Chase (JPMC) is the latest big name with big mobile payments ambitions and bona fides to back...

READ MORE >

ALDI, Venmo Team On Thanksgiving Campaign

November 07, 2017 | Mobile CommerceALDI, the grocery retailer, and Venmo, the peer-to-peer (P2P) mobile payment app company, announced news on Monday (Nov. 6) of a new campaign that lets...

READ MORE >

US Bank Gets Corporates On Board With Zelle

November 02, 2017 | B2B PaymentsZelle, the peer-to-peer (P2P) payments platform deployed by more than a dozen financial institutions to take on competing offerings like Venmo and Square Cash, is...

READ MORE >

With 218M Active Users And 17M Merchants, PayPal Predicts A Strong Finish For 2017

October 20, 2017 | Earnings“PayPal delivered one of its strongest quarters since becoming an independent company,” said Dan Schulman, CEO of PayPal, in a statement. “Putting our customers first...

READ MORE >

Pay With Venmo Launches At 2M Merchants

October 17, 2017 | Payment MethodsGet the Full Story Complete the form to unlock this article and enjoy unlimited free access to all PYMNTS content — no additional logins required....

READ MORE >

Just _______ Me: Venmo Launches New Branding Campaign

October 16, 2017 | Digital PaymentsVenmo has a new creative campaign, but if you like it, don’t rave about it — just _______ them. Get the Full Story Complete the form...

READ MORE >

Transitions Edition: Venmo, Equifax and Nordstrom

September 18, 2017 | Data DiveGet the Full Story Complete the form to unlock this article and enjoy unlimited free access to all PYMNTS content — no additional logins...

READ MORE >

Venmo To Let Users Pay At Williams-Sonoma

September 15, 2017 | NewsVenmo, the peer-to-peer payment company, is enabling its users to pay for purchases at retailer Williams-Sonoma. Get the Full Story Complete the form to unlock...

READ MORE >

Venmo Launches Visa Debit Card Via Shift Financial

September 12, 2017 | VISAVenmo is testing out a free debit card for select users that is linked to their accounts. Get the Full Story Complete the form to...