Dorsey Tweet Auction Makes Crypto A Household Word

Non-fungible tokens (NFTs).

They’re still exciting people so much that they’ll pay millions of dollars for something that, quite simply, can be enjoyed or experienced for free. It’s the latest bit of evidence that we’re in what might be thought of, charitably, as rarefied territory.

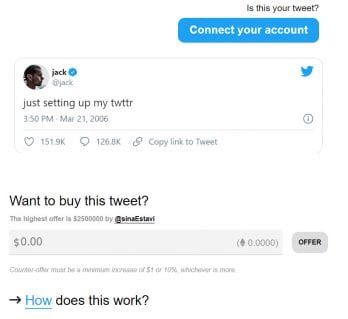

As PYMNTS reported this week, Twitter CEO Jack Dorsey is auctioning off the first-ever tweet. It’s being auctioned as an NFT, which means that the tweet now takes its place as a one-of-a-kind holding — cryptocurrency memorabilia if you will. Call it an immortalization of social media, and now, a direct bridge to the cryptocurrency realm.

As PYMNTS reported this week, Twitter CEO Jack Dorsey is auctioning off the first-ever tweet. It’s being auctioned as an NFT, which means that the tweet now takes its place as a one-of-a-kind holding — cryptocurrency memorabilia if you will. Call it an immortalization of social media, and now, a direct bridge to the cryptocurrency realm.

In one example, a video clip — yes, a video clip — by the digital artist Beeple was initially bought for $67,000 and then was sold for — wait for it — $6.6 million. This time around, for the Dorsey-curious: The post reads “just setting up my twttr” and was sent in March 2006.

Dorsey, you’ll recall, is no stranger to the crypto space. Square has been at the vanguard of crypto in a way, where in the fourth quarter, the company spent $170 million to buy bitcoin, paying roughly $51,000 per coin acquired. Square said that in all of 2020, more than 3 million customers purchased or sold bitcoin via Cash App, and in January of the year, more than 1 million customers bought bitcoin for the first time.

Dorsey himself said on the earnings call that the buying activity has come as “we believe the internet needs a native currency, and we believe bitcoin is it.”

What You Get When You Get The NFT

What do you get when you buy a tweet? An autographed digital certificate signed with crypto, complete with the metadata of the original tweet. And yet, you can continue to see that tweet on, well, Twitter. For free.

In a way, there might be strategy involved in the Dorsey tweet action. If Dorsey’s intent is to bring more “eyeballs” (and money) to cryptos and spotlight how cryptos and the blockchain that underpins it all can be used, it’s safe to say that his name recognition can be a prime mover here. More people know who he is, we would argue, than who have actually dabbled in or embraced buying cryptos or, specifically, bitcoin. We saw some of this knock-on effect with some of the huge embrace of day trading not all that long ago through Reddit and Robinhood, where Elon Musk and others’ social posts spurred individuals to make wholehearted leaps into high-tech, high-risk activities.

In other words: We’re in an age when the excitement of what some big players are doing sparks a “trickle-down” effect. But we note, too, that this is no case of “putting one’s money where their mouth is.” Dorsey is promoting a use case. But we wonder if others also looking to bring crypto in the mainstream would do this. Dan Schulman, CEO of PayPal, comes to mind.

Brave new world we’re in, where the defining characteristic is speculation.