Home Nesting Trend Has Legs Beyond Pandemic Consumer Foot Traffic, Study Shows

Despite concerns the so-called “nesting trend” was cooling down after a year of record results, new data from foot traffic analytics firm Placer.ai shows the home furnishing category may still have further to go as Americans continue to spruce up their homes.

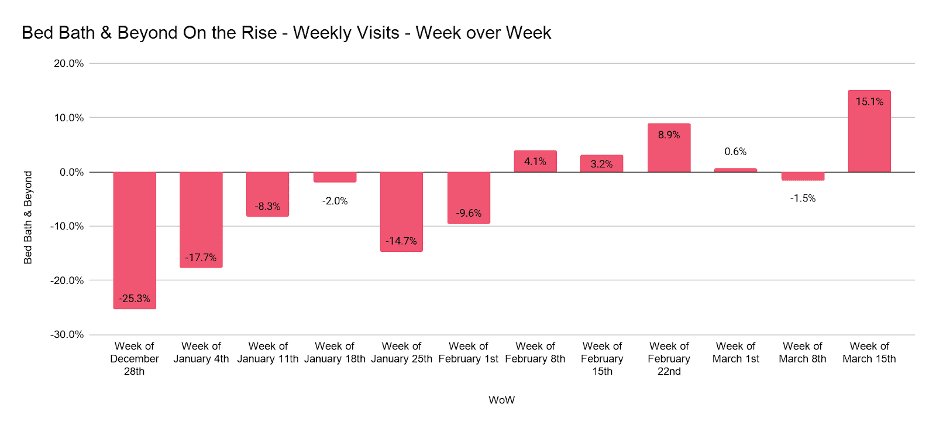

By analyzing weekly shopper movement data at Bed Bath & Beyond and furniture and appliance retailer Conn’s, the California-based tech firm said a recent spike suggests the strength seen last year could continue into 2021.

“After seeing [BB&B] visits decline steadily week over week following a peak in mid-December, visits began to steadily rise again after a wave of inclement weather that hit across the US in late January and early February,” Ethan Chernofsky, Placer’s VP of marketing, said in a recent blog post. “By the week beginning March 15th, visits had risen 15.1 percent week over week.”

While the mid-March rise coincides with the beginning of the third round of federal stimulus checks, it also comes too late to impact the company’s upcoming fourth-quarter and full-year results, which closed in February and will be reported April 14.

That said, if the trend holds, it is likely to impact the retailer’s fiscal first-quarter guidance and its outlook for 2021, at a time when people are returning to work and getting outdoors more due to warmer weather.

Chernofsky said the “significant jump” in Saturday traffic at Bed Bath & Beyond could be an important marker for both the company and the broader sector.

“The result is a brand that could see a bright period in the coming months as home furnishings continues to outperform as a category,” he said, referencing the New Jersey-based retailer that operates 1,000 of its namesake stores, as well as about 100 Buy Buy Baby locations and Christmas Tree shops.

Furniture Findings

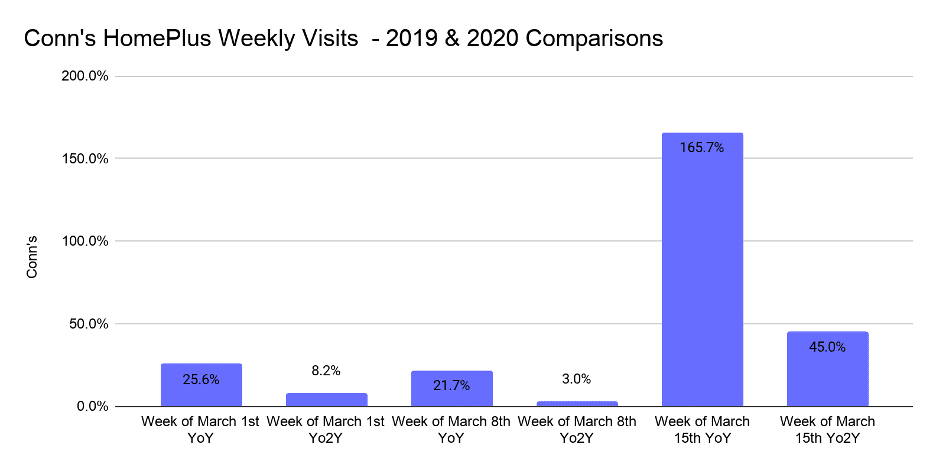

At the same time, Placer said its data showed a similar traffic uptrend at Texas-based furniture, appliance and electronics retailer Conn’s, citing it as another brand that has “benefitted from the home goods wave.”

According to the report, Conn’s has been propelled forward by a brand reset in the new year after a sluggish start in 2020. That said, Conn’s stock has been on a tear, and has risen from a pandemic trough of $5 per share to $22 over the past 12 months.

“We have emerged from the pandemic stronger, more efficient and well positioned to compete in a rapidly changing market, and fiscal year 2022 is off to a strong start,” Conn’s Chairman and Chief Executive Officer Norm Miller told investors last week, citing strong underlying demand for his expectation that positive same-store sales momentum would continue.

From Placer’s purview, the pace of foot traffic seems to be increasing with weekly visits up significantly year over year in early March.

“Even when looking to account for the challenges of 2020, the brand’s visit comparisons with 2019 were also very strong. Visits the weeks beginning March 1st, 8th and 15th were up 8.2 percent, 3.0 percent, and 45.0 percent when compared to the equivalent [normalized, pre-pandemic] weeks in 2019,” Chernofsky said.

Whether the home goods trend fades or continues remains to be seen, as variables such as waning stimulus and resurgent COVID strains play out in the market. At least for now, Placer said, that momentum appears to be building, rather than fading away.