By the numbers, saying the travel industry had a terrible year is a massive understatement. In the wake of a global pandemic, the year was so bad that apocalyptic only barely covers it. The travel industry closed the books on 2020 with $1.1 trillion (with a “t”) in losses, a 42 percent contraction from the previous year, plunging to $1.5 trillion from $2.6 trillion, according to the U.S. Travel Association, citing data prepared by the research firm Tourism Economics. Employment in the industry dropped from 5.6 million employed to 16.7 million in 2019. Jobs lost in and around the travel industry accounted for 65 percent of all U.S. job losses during the pandemic.

“While the gradual progress of vaccinations has provided hope that a turnaround may be on the horizon, it is still unclear when travel demand will be able to fully rebound on its own,” said U.S. Travel Association President and CEO Roger Dow.

And yet, since those figures came out about a month ago, outlooks on the market have consistently risen. Booking.com CEO Glenn Fogel, following the release of new data from the site, indicated that 71 percent of American adults are feeling more hopeful about traveling in the next year since vaccines began rolling out, and noted that the rising tide of consumer optimism is “encouraging” when it comes to “reviving travel.”

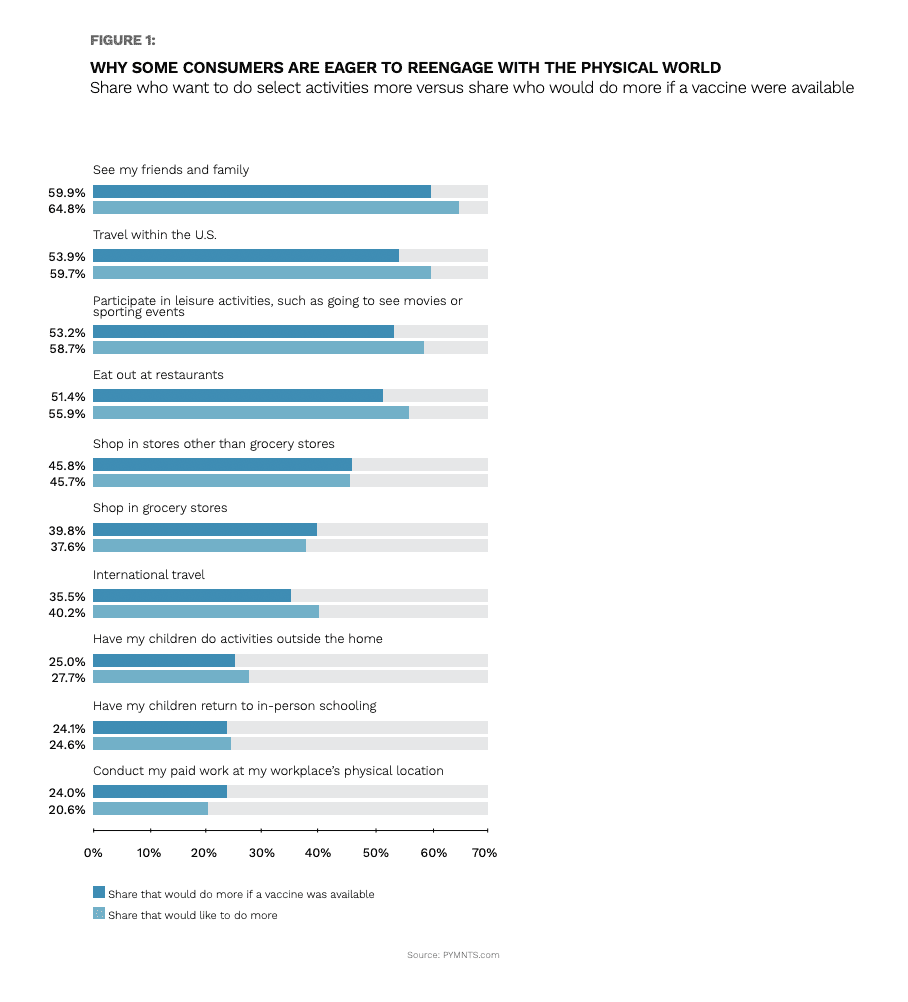

Booking’s consumer data matches with PYMNTS’ data — both in terms of growing consumer enthusiasm for travel and how vaccine and case count depend on that enthusiasm. Getting out to travel domestically was second only to seeing friends and family again on the list of things consumers are eager to get back to doing more post-pandemic, beating out both eating at restaurants and going to events.

And that optimism for recovery is being backed up with actions from some firms like United Airlines, which as of last week announced plans to hire hundreds of pilots, a process that had been delayed by the COVID-19 pandemic. United is the first U.S. carrier to announce such a move. The effort will be modest at first, starting with around 300 pilots who had conditional job offers or training scheduled before the pandemic.

And that optimism for recovery is being backed up with actions from some firms like United Airlines, which as of last week announced plans to hire hundreds of pilots, a process that had been delayed by the COVID-19 pandemic. United is the first U.S. carrier to announce such a move. The effort will be modest at first, starting with around 300 pilots who had conditional job offers or training scheduled before the pandemic.

Last week also saw Frontier Airlines, a budget carrier based in Denver, become the second airline this year to hazard an IPO, anticipated to bring in more than $570 million — another sign of growing faith in the airline industry as bookings continue to increases and vaccinations are more widely distributed.

But for all the sunny dispositions, there is still a lot of trepidation in the industry. “We’ve said since the beginning of the pandemic that vaccines will be critical to a full travel recovery,” Fogel told Fortune. “It’s encouraging to see vaccine distribution ramping up, but we still have a long road ahead to a full recovery.”

And the prediction of a long road ahead is also echoed within the industry, particularly as vaccines and new variants of the virus are racing for dominance all over the world. Among the particularly pessimistic, it’s expected that it could be years before the travel industry truly recovers from the bludgeoning it has taken over the last year or so.

“We do not expect a quick recovery in travel demand, even if the pandemic seems to wind down. The two main factors that are weighing on any real recovery in the tourism industry are the effectiveness of vaccines in preventing the transmission of the virus and the absence of a common approach by countries around the world,” economist Marc Livinec told The Street.

And no matter how far away that return to normal might be, the growing consensus is that the travel industry that emerges will be different than the one that was forced to press pause in 2020. By way of example, Flywire’s Vice President and General Manager of Travel Colin Smyth noted in a conversation with PYMNTS’ Karen Webster that the industry will likely have to rethink its interest in things like offering payments alternatives like installments going forward. Buy now, pay later (BNPL) has historically been a bit slow to catch on in travel, he noted, for the simple reason that operators across the board didn’t feel they needed it, as they were scoring massive profits with consumers paying for their travel costs upfront, all at once.

“Some of the companies that we work with, I think they’ll be very open to it to get more cash flow in, to get paid faster,” Smyth noted. “And I don’t think you’ll get as much pushback as there has been. If it can help the supply chain get paid faster, and therefore be in business longer, it sounds like something that our clients would be more interested in today than they probably would’ve been 18 months ago.”

Travel is far from the state it was in 18 months ago — and though it has clearly started walking its road to recovery, there is deep uncertainty about when it will arrive.