As the world navigates the latest surge in COVID cases attributed to the Delta variant, and medical experts caution that COVID will soon transition from pandemic to endemic disease, the question now asked by many is this:

“When will we get back to normal?”

It’s the wrong question. And we need look no further than Main Street USA and Main Streets all over the world to see why.

See also: Global Digital Shopping Index With Cybersource

Main Street businesses are those that operate a physical storefront up and down the main streets and side streets of cities and towns all over the world. They are the small retail shops, restaurants and coffee shops, dry cleaners, hair and nail salons, doctors, dentists and tax accountants, contractors and remodelers, the specialty food markets, hardware stores, liquor stores and florists.

Collectively, these businesses represent a very significant portion of the U.S. economy, accounting for somewhere between 25 percent and 35 percent of the employment and wages paid to workers in the U.S.

Over the last 18 months, they have come to define and operationalize what’s becoming normal.

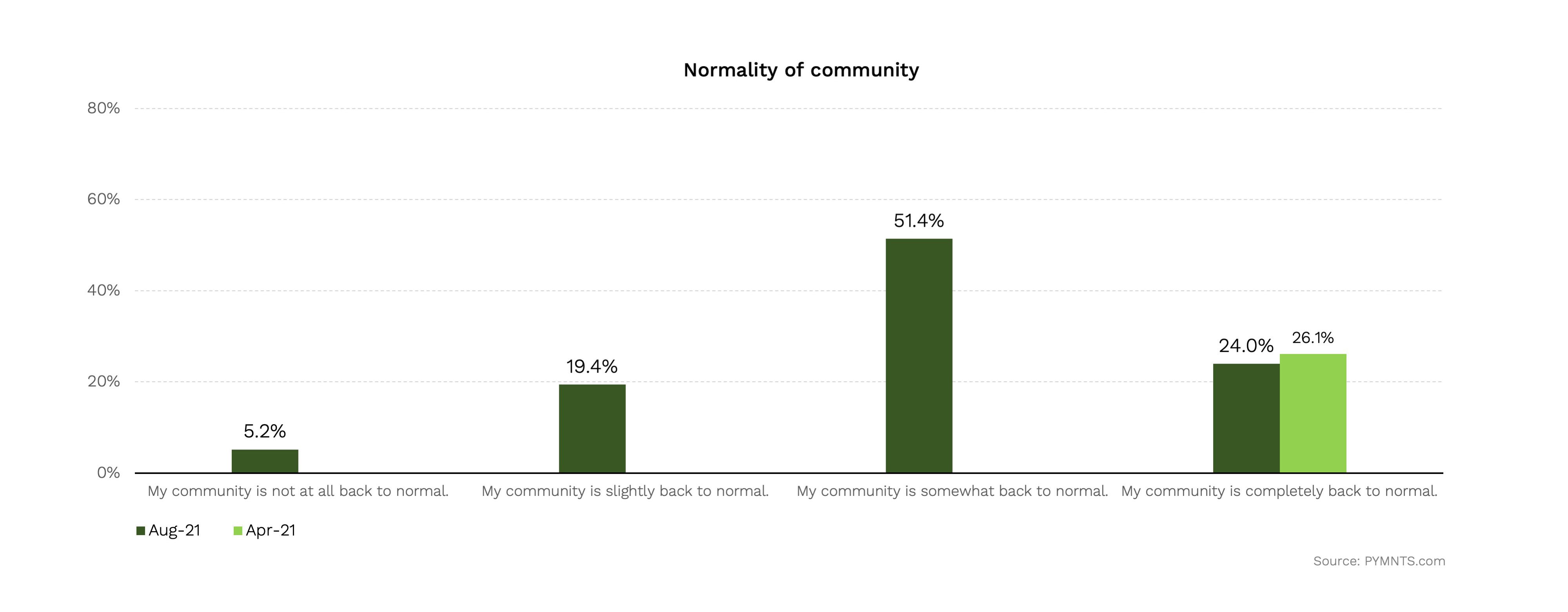

More than three-quarters — 76 percent — of the 2,448 Main Street SMBs in the U.S. that PYMNTS surveyed between July 26 and Aug. 26 say that things aren’t back to “normal” for their businesses — when normal is defined as what their businesses and the world looked like at the end of 2019.

More than three-quarters — 76 percent — of the 2,448 Main Street SMBs in the U.S. that PYMNTS surveyed between July 26 and Aug. 26 say that things aren’t back to “normal” for their businesses — when normal is defined as what their businesses and the world looked like at the end of 2019.

Yet, 75 percent of these Main Street businesses also say they’ve invested in the technology over the last 18 months to adapt to their customers’ expectations of a different, digital-first shopping experience — and they have the sales growth to show it.

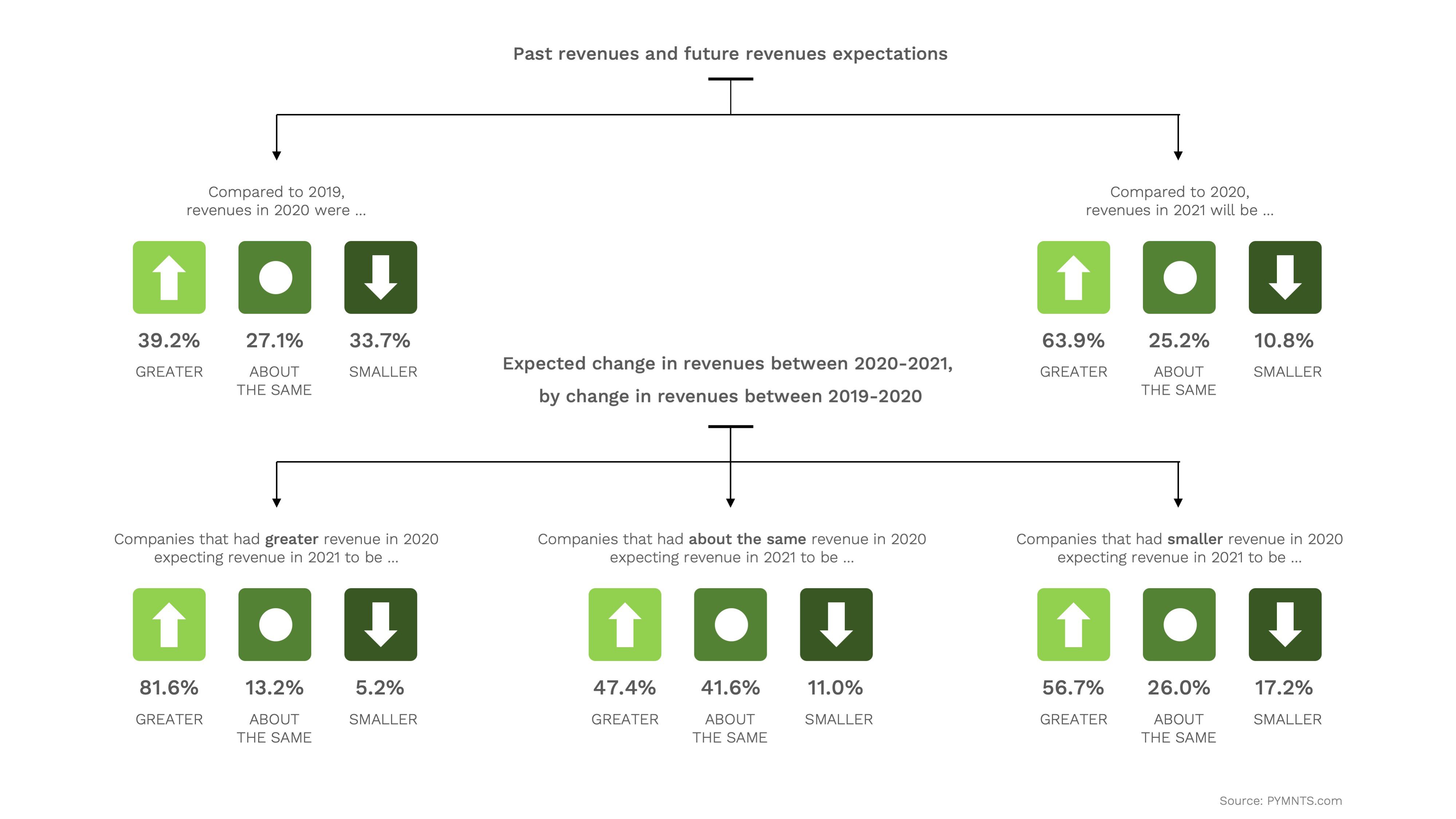

Eight in 10 of those Main Street SMBs say that their revenues in 2021 will be greater than they were in 2019.

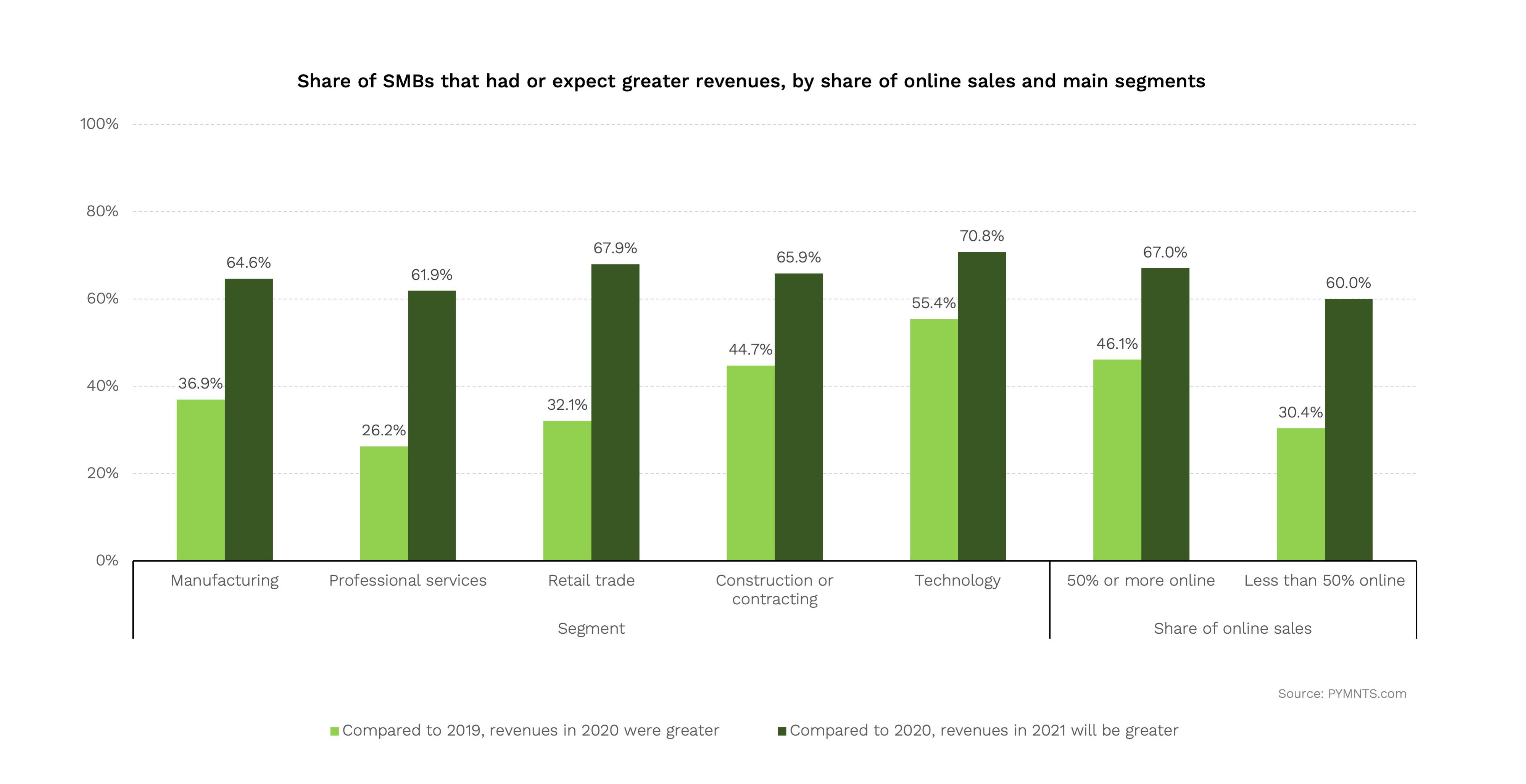

Sixty percent of the shops that reported fewer than 50 percent of their sales online in 2019 say that their sales overall will grow in 2021 over 2019 levels. Those who say that more than 50 percent of their sales were online in 2019 are even more optimistic about their overall sales growth.

Sixty percent of the shops that reported fewer than 50 percent of their sales online in 2019 say that their sales overall will grow in 2021 over 2019 levels. Those who say that more than 50 percent of their sales were online in 2019 are even more optimistic about their overall sales growth.

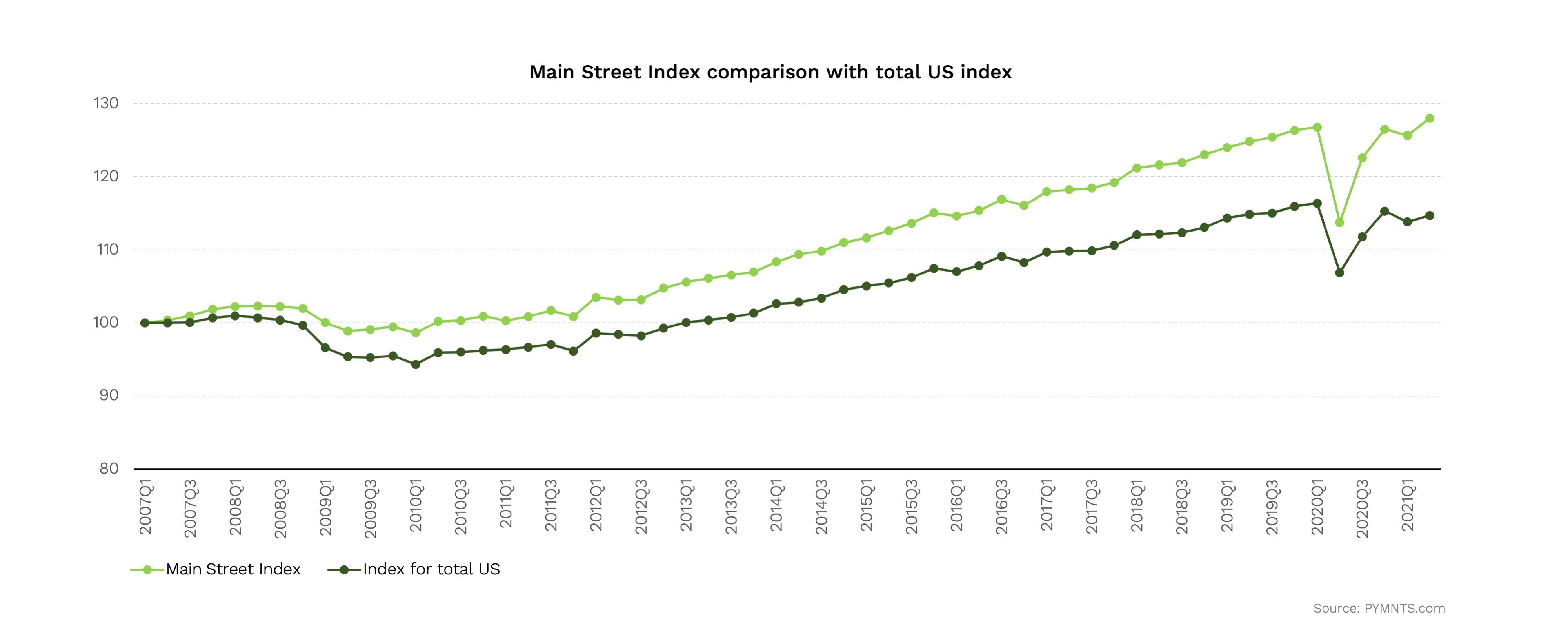

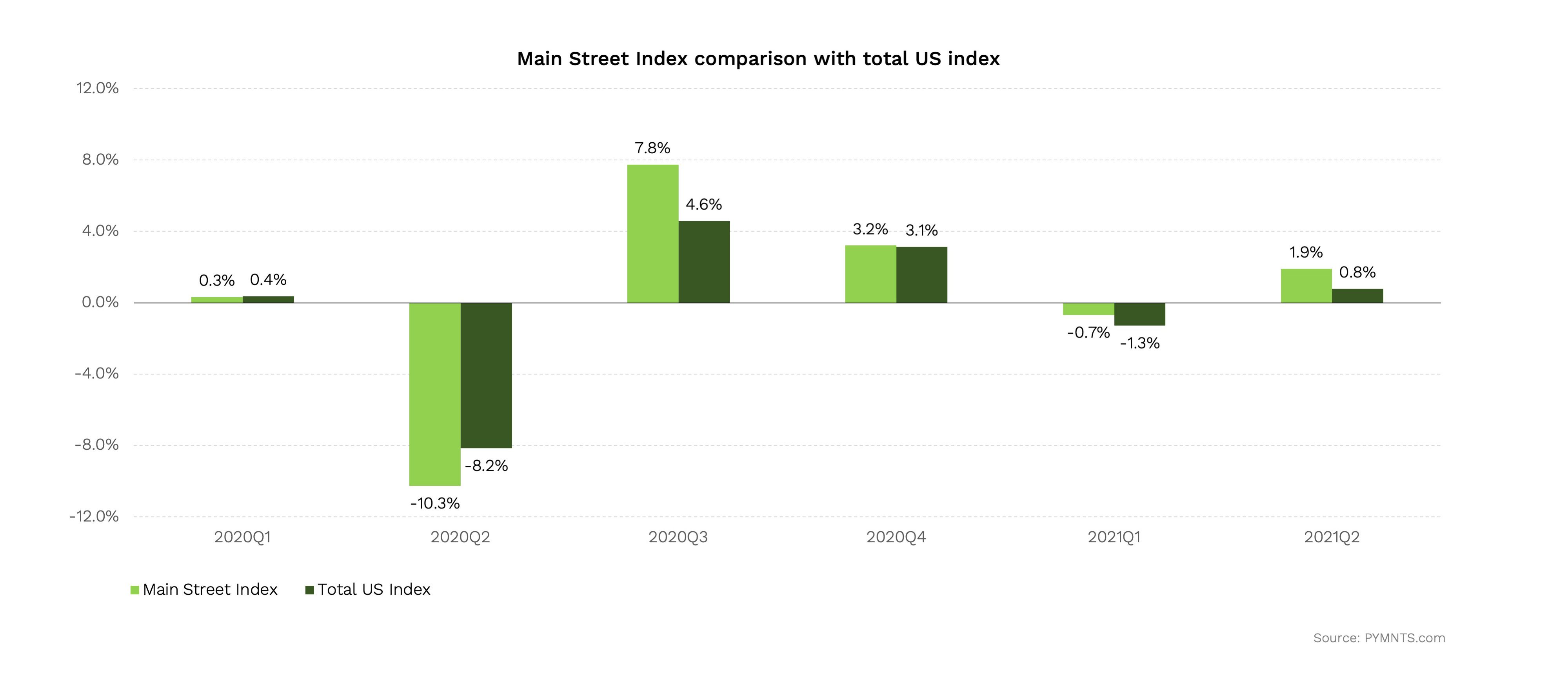

As measured by PYMNTS’ Main Street Business Health Index, a proprietary index of more than 10 million data points on every such business in the U.S. going back to 2008, Main Street small businesses are outpacing the growth of GDP through Q2 2021. Retail and restaurants on Main Street, in particular, have bounced back faster than larger [retail stores and restaurants] as consumers feel an affinity to doing business in their local communities, and those businesses have met them right where they want to do business — increasingly with a digital-first experience.

Read more: PYMNTS Pollinate Study: ‘Local Loyalty’ A Huge Worldwide Opportunity For Shoppers, Merchants

The Wisdom Of Main Street

The Wisdom Of Main Street

Main Street businesses were among the first to internalize the shifting sands of what’s really normal — and to respond.

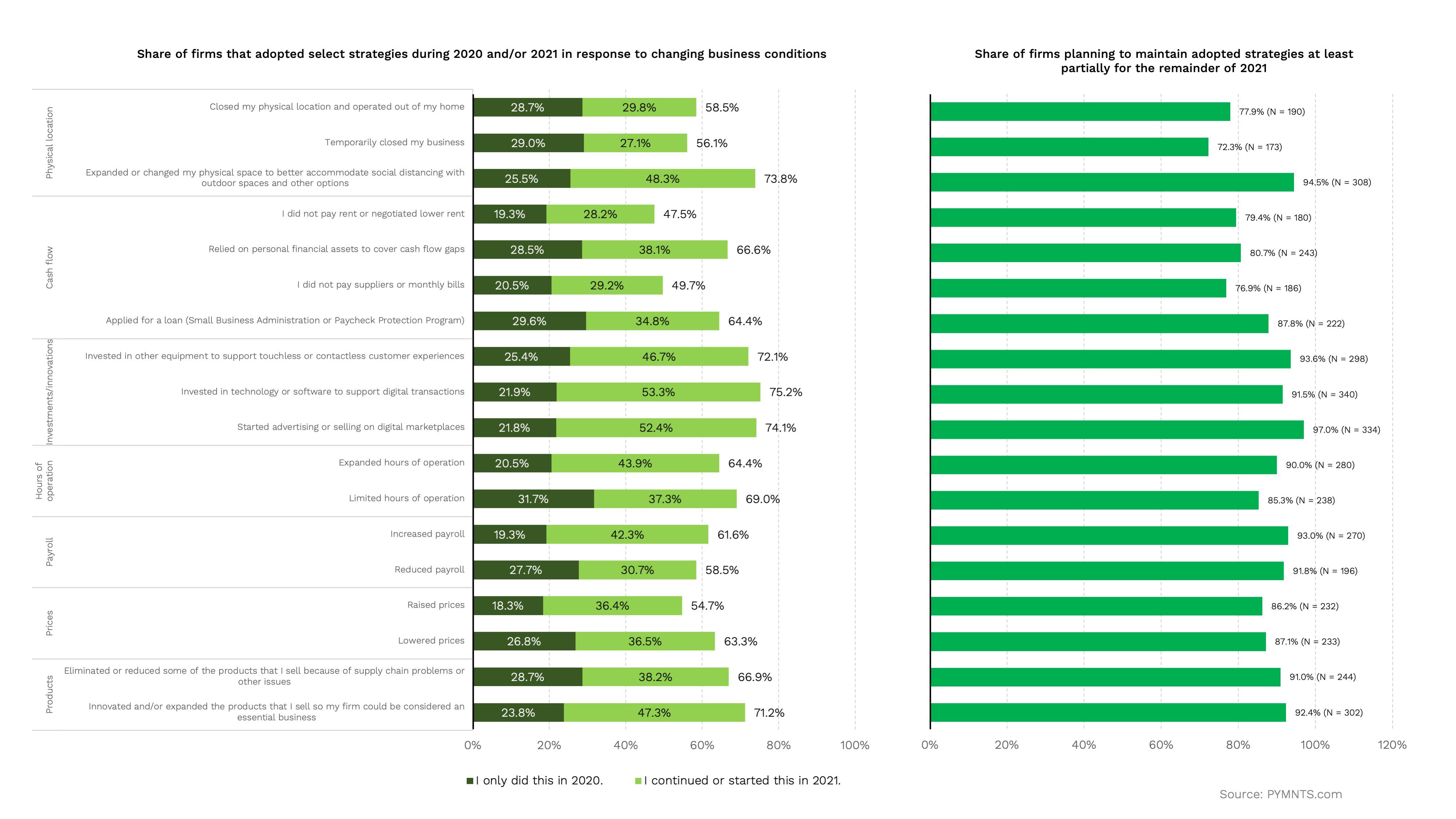

In part, because they had no choice, but largely because they had access to the digital tools and platforms to help them quickly and efficiently pivot away from what used to be business as usual — customers coming into their storefronts and restaurants and coffee shops and hair salons — to how they’d do business going forward. Access to PPP loans gave many of these businesses the financial wherewithal to keep staff employed and to pivot their models.

According to PYMNTS’ latest research, 74 percent of Main Street SMBs in the U.S. now sell on marketplaces, 75 percent have invested in technology to enable online ordering and a digital-first experience and 72 percent have invested in touchless or contactless payment experiences.

More than 90 percent of the businesses that have made those investments say they will continue to support and invest in those digital methods throughout 2021 and going forward.

There’s a good reason for that: It’s worked.

More than 60 percent of the Main Street businesses that also sell online and use third-party aggregators say that their overall sales have increased — including over the last three months when most shops and restaurants had fully reopened their physical establishments.

More than 90 percent of those businesses expect those trends to continue throughout 2021 and beyond.

Main Street businesses now see that digital isn’t cannibalizing physical, but rather expanding sales for existing customers and creating a funnel for new ones — especially for those businesses that only had a physical outlet to see customers and make sales.

It’s also clear that Main Street businesses aren’t waiting for 2019’s version of normal to return — and they’re not investing in resuscitating 2019’s definition of normal, either. Instead, they’re using digital tools that reflect the reality of how consumers live, work and shop today.

Maybe that’s entirely online, maybe that’s online with a curbside or in-store pick-up, maybe that’s in-store with a digital experience. What drives those decisions are convenience, and how consumers want to engage with those businesses. With digital as part of the mix, how consumers choose to interact with these Main Street SMBs matters less than their ability to use digital to make a sale — in their store or away from it.

With digital as their foil to the uncertainty, that is now the norm.

See also: The Optimistic State Of Main Street On The Road To Recovery

What Is Normal, Anyway?

The concept of normal is more than 300 years old — and rooted in math, statistics and probabilities. It was in 1713 that Swiss mathematician Jacob Bernoulli devised a series of random, independent experiments to predict the probabilities of success for different outcomes and to plot the distribution of those outcomes. The concept of statistical significance, which is attributed to Bernoulli’s work, measures the concentration of those outcomes, and is the mathematical test of “normal.”

Most people, though, don’t need Bernoulli’s test to define normal, a concept typically described by what isn’t.

For example, having nearly 12 inches of rain in July in Boston during the summer of 2021 isn’t normal. And as those of us here in New England would attest, not having the New England Patriots win the Super Bowl isn’t normal, either. (Apologies for the double negative.)

Before COVID, ordering groceries online wasn’t normal. Neither was ordering food from restaurants or aggregators for delivery, or wearing masks to shop inside a store. Neither was buying a car online, sight unseen. Seeing the doctor on video wasn’t even readily available, much less normal. And closing a big business deal or doing an IPO road show over Zoom wasn’t how business got done.

All of this is now just what businesses and consumers do as a complement to — or full replacement for — what was their standard operating procedure in 2019.

So, too, is living with the uncertainties of a virus that remains unpredictable.

Until a month ago, most of the world thought the worst of COVID was in the rear view. People booked late summer/early fall vacations, companies pushed forward with fall reopening plans, amusement parks reopened, live concerts were back on the docket, shoppers flooded stores and malls without masks, and consumers flocked to restaurants to dine indoors.

Now, many of those plans have been put on hold, pushed back or outright canceled. Mask mandates are being reimplemented in certain parts of the country — including here in Boston, where 60 percent of the population is fully vaccinated. Breakthrough cases of vaccinated people are raising alarm bells. So are reports of hospitals filling to capacity with new COVID cases attributed to the Delta variant for vaccinated and unvaccinated patients.

Consumers are now making their own decisions based on their level of uncertainty — the risk-reward of going out to eat inside of a restaurant versus just ordering in until the wave crests. Or ordering more items from Amazon or groceries via Instacart instead of going to the store for a while. It’s how consumers have always managed, living with COVID over the course of the last 18 months. Governments didn’t have to shut the economy down: PYMNTS research on March 6, 2020 showed that consumers started retreating weeks before the official order to shut down later in the month.

Also see: New Data: What COVID-19 Is Doing To Main Street SMBs

And just because governments reopened the economy didn’t mean everyone came back, in full force, to do all of what they once did in 2019. As PYMNTS has reported consistently based on national studies of nearly 60,000 consumers, almost 40 percent of consumers are doing more in the digital channel than the physical channel when shopping for retail purchases, and more than 70 percent say they plan to keep those habits. People are traveling for vacations, just not always on an airplane. Business executives aren’t traveling as much, in part because the people they want to see aren’t back in their offices. For some, corporate travel restrictions are still in force.

Even now, consumers we surveyed in July of 2021 forecasted that it won’t be until March of 2022 until things will be back to normal, with “normal” defined as not having to wear a mask in a store, to social distance or to worry about COVID variants.

Learn more: Pandemic Will Linger Into 2022, Say Consumers, Before We’re ‘Back to Normal’

So, it’s entirely possible that “normal” is now a series of cycles — like the one we are in now, where consumers mask up, social distance and remain cautious until they feel confident that they have the information they need to make a more informed decision about how resuming normal activities impacts their personal health and safety.

All the while, moving freely between online and offline channels because they know how, they can and it now just feels normal to do it that way.

Digital has put Main Street SMBs on par with their larger business counterparts.

How Main Street Sees Normal

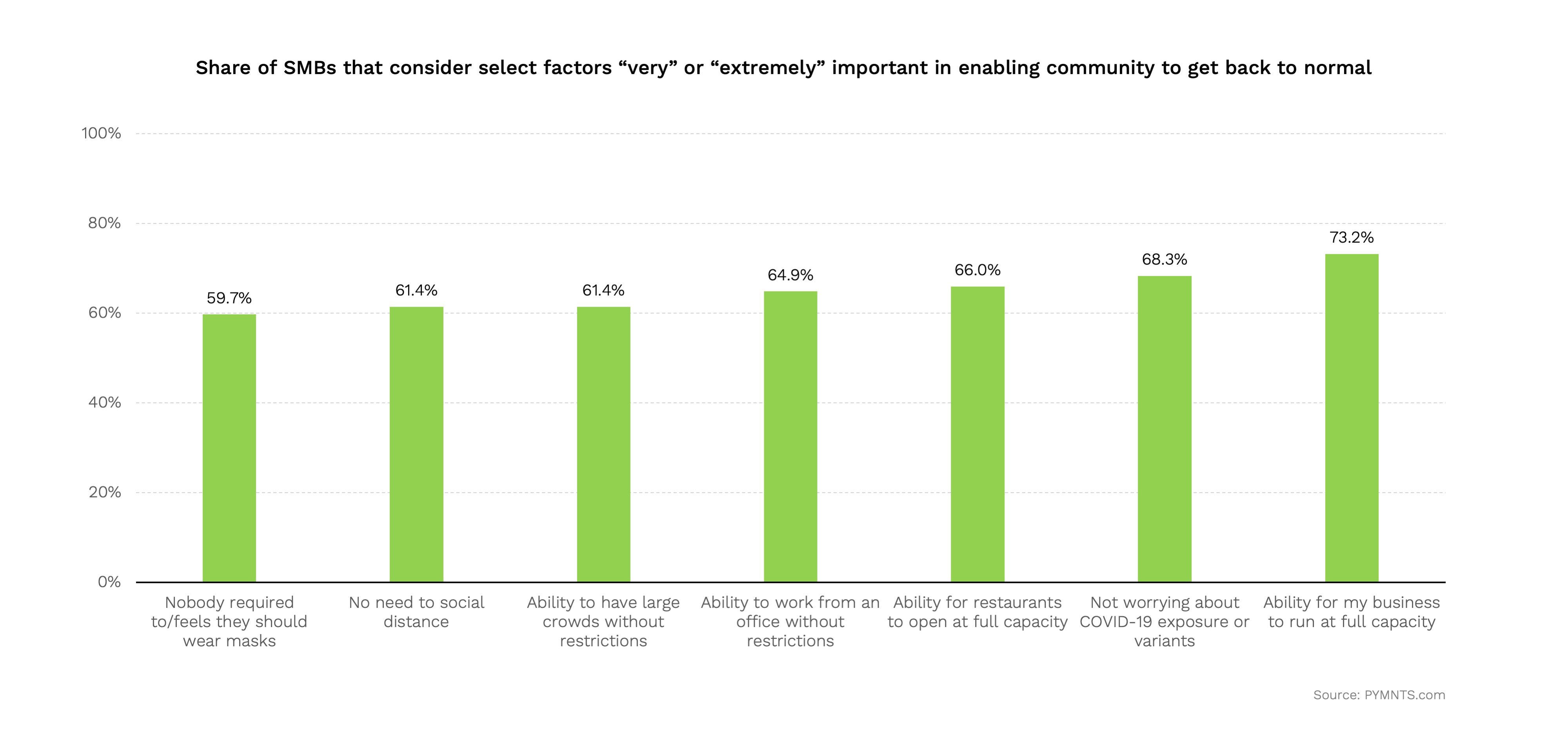

According to PYMNTS research, “normal” for Main Street businesses is being able to open their establishments to full capacity (74 percent) and not worry about COVID or variants (68 percent). Sixty percent say that not requiring and/or having people feel the need to wear a mask is normal.

Opening at full capacity means hiring enough workers. Talk to any Main Street business and they’ll tell you how hard that is in practice, since hiring workers is often related to those employees not having to worry about COVID or its variants. Workers make the same risk/reward tradeoffs as consumers when deciding whether to return to work, many of them in establishments where they are meeting and interacting with the public. Getting a restaurant or retail worker to return to the workplace may be partially related to wage disparity, but also to the uncertainty of knowing whether the diners or customers they are serving — or the co-workers they’re shoulder to shoulder with — are vaccinated or have tested negative for COVID.

Would an Uber driver rather take 25 people a day in their cars, not knowing who may be vaccinated or not, who may have had exposure to COVID or one of its variants or not — or have no passengers and deliver for Uber Eats or Instacart?

It depends.

According to PYMNTS research, only 37 percent of Main Street businesses require their employees to be vaccinated, and only 42 percent of those who currently do not are likely to require vaccinations for employees in the future.

Most likely, they are balancing the desire to keep a safe, vaccinated environment and getting enough employees, including vaccine-hesitant millennials and those even younger, to have a functioning business.

But “normal,” as Main Street businesses have now shown for the last 18 months, means investing in technology and new business models to adapt to the business cycles that reflect the uncertainty of COVID’s endemic health risk, and how consumers — and the workforce — will adjust and adapt.

Just as we’ve seen in the last several months, as the economy has reopened, consumers want to get out and about — to travel and shop and eat at restaurants. Today, “normal” is doing that easily across channels and touchpoints, at the convenience of the consumer, while preserving the culture, personality and economic prosperity of their cities and towns.

Not a new normal. Just how things are now done.