AMZN vs. WMT Weekly: Grocery Strength Likely Won’t Help Walmart Keep Amazon at Bay

One of the most noteworthy aspects of Walmart’s quarterly earnings release earlier this week was the $3.6 billion growth in food sales between July and October, the strongest in six quarters, according to company executives.

Given that it’s the largest grocery retailer in both the U.S. and the world, it’s perhaps not surprising to see food sales lead the way for the Arkansas-based box store giant — but amid high inflation and continuing COVID-19 concerns, competitors have struggled. Kroger, for example, saw sales decrease in the quarter that ended Aug. 14, which Chief Financial Officer Gary Millerchip attributed to inflation that’s “higher than originally contemplated in our 2021 business plan.”

Last week, the U.S Bureau of Labor Statistics reported that the annual inflation rate jumped to 6.2% in October, the highest level since November 1990.

Read more: Walmart Leverages Scale in Grocery to Price Out Competitors

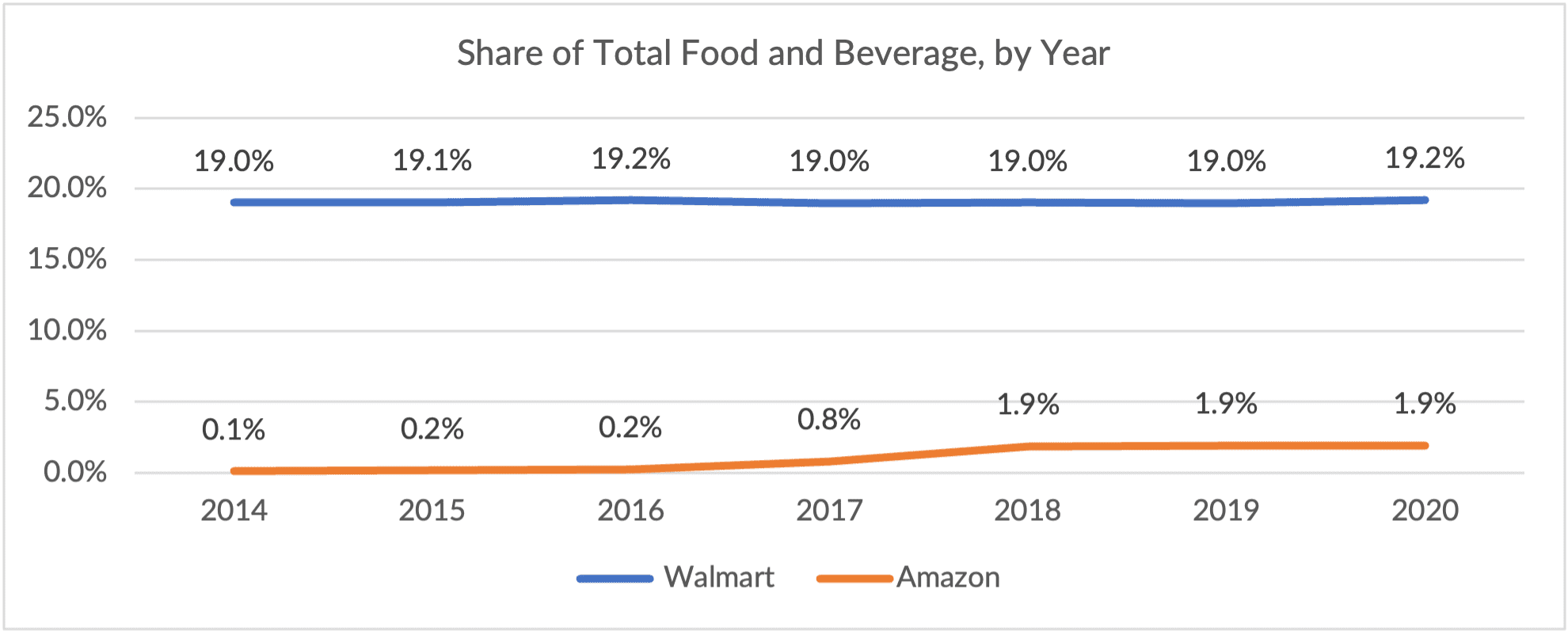

Though Amazon has tried to break into grocery sales through its 2017 acquisition of Whole Foods and the opening of dozens of Amazon Go locations across the U.S., the eCommerce giant has been unable to make very much of a dent. Amazon’s share of the food and beverage category has remained just below 2% since 2018, while Walmart’s share has remained steady at about 19%, according to PYMNTS proprietary data.

Looking just at food and beverage sales made online, though, Amazon has a 33% share, about five percentage points higher than a year ago.

Looking just at food and beverage sales made online, though, Amazon has a 33% share, about five percentage points higher than a year ago.

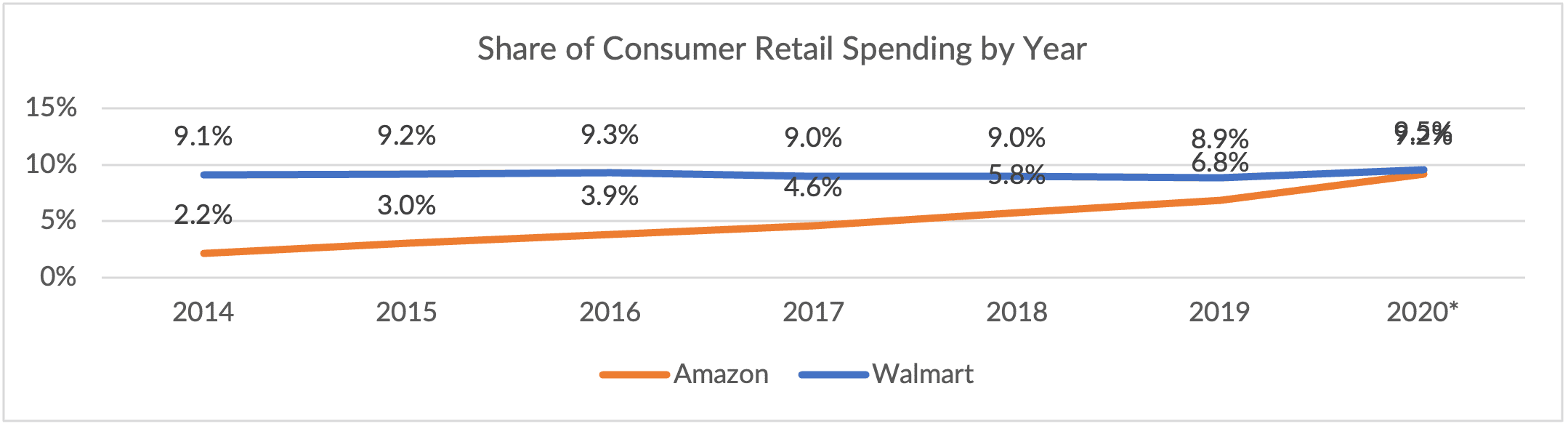

And it’s also worth noting that grocery sales have not helped Walmart maintain its lead over Amazon in the battle for consumers’ paychecks. As of 2020, Walmart had a 9.5% share of overall retail spending compared to Amazon’s 9.2% share, marking a three percentage point increase year over year in the latter’s share.

PYMNTS data show that Amazon had nearly 50% of the eCommerce market as of the second quarter, compared to Walmart’s 6% share.

PYMNTS data show that Amazon had nearly 50% of the eCommerce market as of the second quarter, compared to Walmart’s 6% share.

It’s a Bird, It’s a Plane…

Walmart also this week continued the expansion of its logistics capabilities, launching autonomous drone delivery in Northwest Arkansas in partnership with Zipline. The new service will make on-demand deliveries of select health, wellness and consumable items from the Walmart Neighborhood Market in Pea Ridge, Arkansas.

Related news: AMZN vs. WMT Weekly: Amazon, Walmart Sharpen Fight to See Who Can Deliver Faster

At full capacity, Zipline’s drones can service a 50-mile radius, which the company says is nearly the size of the state of Connecticut. Tom Ward, senior vice president of last mile delivery for Walmart U.S., said in a news release that the drone delivery service can help provide access to health products for both hard-to-reach and at-risk populations, such as rural communities and elderly customers.

“By bringing this game-changing technology to the rural community of Pea Ridge, Arkansas, we’re continuing to look for ways to make shopping with Walmart convenient and easy for everyone,” Ward said.

Walmart and Zipline have been preparing for and testing the drone service in Pea Ridge for about a year, building a 25-foot platform behind the Neighborhood Market for take-off and landing. The platform houses several of Zipline’s drones as well as the flight operations crew.

Read more: Walmart Revs up Second Test Program for Drone Delivery

“The past two years have proven the need to bring health products closer to home, where they are more accessible,” Keller Rinaudo, co-founder and CEO of Zipline, said in the release. “Working with Walmart, we’re able to bring this type of service to Northwest Arkansas, showcasing what the future of health access looks like.”

Healthcare accounts for about 16% of average household spending, with health and personal care items making up 5.7% of consumers’ retail spend; food and beverage accounts for just over 9% of retail spending.

PYMNTS data show that Walmart still holds the lead in health and personal care over Amazon, despite the global pandemic pushing the majority of sales in 2020 online. Walmart has 5.8% of the health and personal care category, while Amazon has a 3.6% share — which is still a full percentage point higher than in 2019.