Payments are the lifeblood of any business, especially those that work with vendors to transact for goods and services.

United States companies conduct more than $25 trillion in business-to-business (B2B) payments annually, and B2B transactions account for $120 trillion globally each year. This figure is expected to increase in the coming years as the health crisis eventually abates and the world economy emerges from its pandemic-related downturn.

This recovery cannot happen soon enough for business owners, who cite a plethora of issues that make payments slow, error-prone and frustrating. PYMNTS’ research found that 70% of chief financial officers (CFOs) said payments were delayed by the pandemic, while 61% said the health crisis increased days sales outstanding (DSO), a key metric that measures the average number of days it takes a company to collect payment after a sale closes.

CFOs are looking for any solution that can reduce payment delays and improve their DSO, and automated and digitized payments systems show immense promise. This month, PYMNTS explores why B2B payments are prone to delays and errors, and how automation can drive faster and more accurate B2B payments experiences.

Causes and Consequences of Payments Delays and Errors

Payments delays and errors stem from many sources, but a leading factor is a reliance on manual payments processes such as checks. One PYMNTS study found that 25% of B2B payments are made via paper checks, though the exact rate varied by industry, with commercial real estate taking the top slot at 34%. Errors can crop up at any point when paper checks are involved in the payments process, from mailing to receiving to processing. These issues can range from typos to post office delays to improper data entry.

Further complicating the use of paper checks is the record number of employees now working from home. Ninety-seven percent of accounts payable (AP) departments said they were affected by the shift to remote work, with 28% reporting “extraordinary” or “significant” impacts. Fifty-three percent of businesses were forced to change how and when suppliers were paid as a result.

These payment delays can have massive downstream consequences that damage businesses’ relationships with their vendors and suppliers. A survey of 200 finance and 200 procurement professionals in the U.K. found that 73% of companies have strained corporate relationships due to payment delays.

These payment delays can have massive downstream consequences that damage businesses’ relationships with their vendors and suppliers. A survey of 200 finance and 200 procurement professionals in the U.K. found that 73% of companies have strained corporate relationships due to payment delays.

Delays also can cause them to miss out on perks: 59% of suppliers that had been paid late reduced or halted discounts, and 62% withheld goods or services that were ordered until invoices were paid. More than half said a supplier refused to work with them again because of those late payments.

These consequences are simply unacceptable for many businesses and have forced them to look for alternative payments solutions. Automation and digitization could be the ticket to salvaging these damaged supplier relationships.

Automating and Digitizing Payments

Payments digitization could go a long way toward reducing delays and minimizing errors by delegating day-to-day processes, such as payables, invoice processing and record-keeping, to artificial intelligence (AI)-based solutions. This could significantly reduce the capacity for human error and accelerate complex calculations that tend to be tedious and time-consuming for human accountants. Studies project that by 2025, half of all B2B invoices across the globe will be issued, processed and paid without any human intervention.

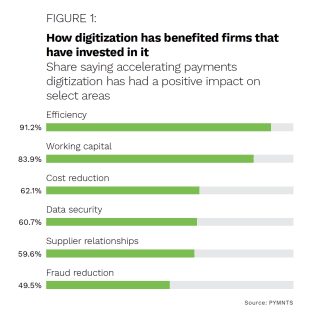

Shifting payments away from checks to automated digital transactions can provide a multitude of improvements throughout a business’s operations. A recent PYMNTS survey of wholesale trade and manufacturing CFOs found that 91% of organizations reported improved efficiencies when digitizing their payments, while 84% reported improved working capital management and 62% reported cost reductions.

While 60% of CFOs reported improved supplier relationships, digitization can improve customer relationships, as well. Sixty-eight percent of real estate CFOs, 50% of wholesale trade CFOs and 77% of industrial/manufacturing CFOs said payments digitization can make their payments operations more transparent — allowing them to implement online portals that help customers view their payments journeys more holistically.

More than 77% of CFOs in these industries elaborated on customer relations, saying they could become more collaborative through this digitization, fostering an improved sense of loyalty and potentially driving improved conversion rates.

B2B payments are such a ubiquitous, day-to-day reality for businesses that they stand to gain innumerable benefits by taking these payments digital. Automating and digitizing payments — and the processes that surround them — could allow accounting staff to focus more on big-picture operations, improving the company as a whole.