Walmart’s Customer ‘Switching’ Shows Inflation Hitting the Paycheck-to-Paycheck Consumer

For Walmart, the paycheck-to-paycheck economy — and its pressures — dictate how the retailing giant’s fortunes will fare, especially over the near term.

At this writing, shares are slumping more than 11% on the heels of an earnings report that clearly shows the impact of inflation. Certainly within the company’s supply chain (and thus some negative margin impact), and rippling down to the consumer level.

“I think it’s important to recognize that there’s more than one consumer. We serve the whole country, [and] we’ve got a breadth of customers, and they behave differently,” said CEO Doug McMillion. And as discussed on the earnings call, beyond the spending on some higher ticket items such as gaming consoles and grills, there’s also been a marked shift to what the executives on the earnings call termed “switching” to private label offerings for at least some of the key staples of daily life, particularly in groceries.

Read also: Walmart Sees Demand Shift for Low-Priced Bacon and High-Ticket Game Consoles

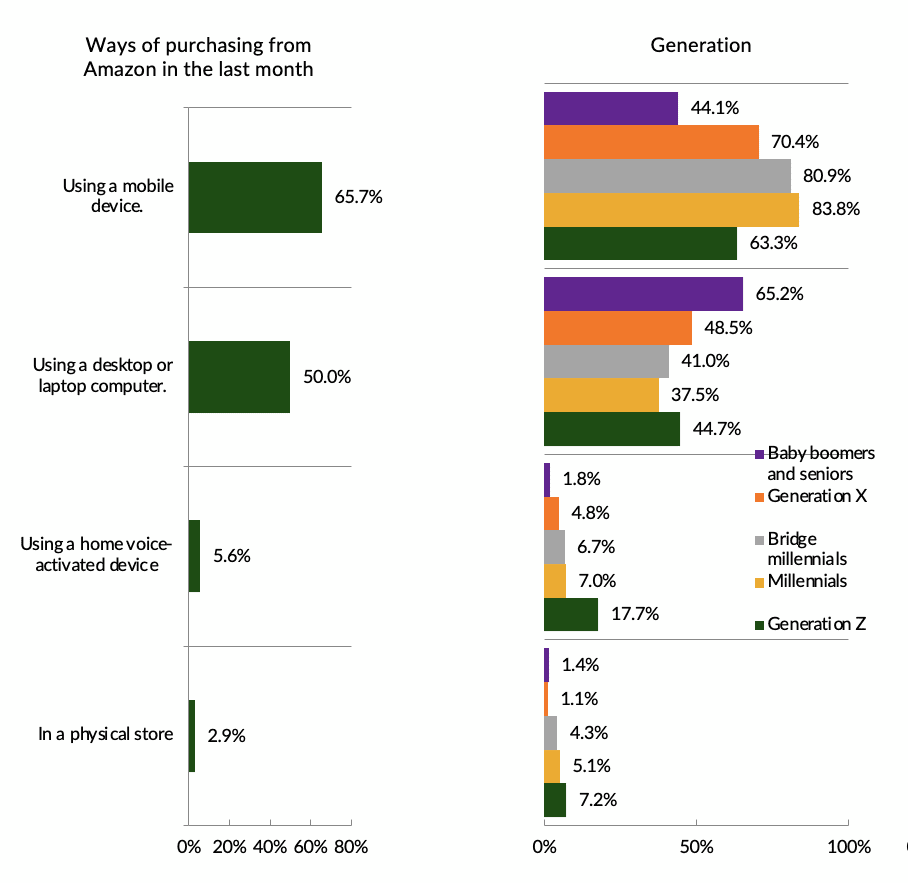

The read across here is that the macro headwinds are having at least some impact. Overall, recent PYMNTS research has shown that 79% of consumers have made purchases at mass retailers in the past month. And there’s at least some cross-pollination between Amazon and Walmart, across generations, and across income levels.

Drill down into PYMNTS data — as evidenced in the charts below — underscore a few shifts that mark the great reopening. An overwhelming percentage of Walmart’s consumers shop in store, at more than 84% — across all generations. That means that they are coming to the brick-and-mortar setting to browse, yes, and fill up their proverbial baskets, in one place, across a range of needs. Indeed, online sales growth was one percent in the most recent quarter, which shows just how much we are all crowding the aisles.

SOURCE: PYMNTS

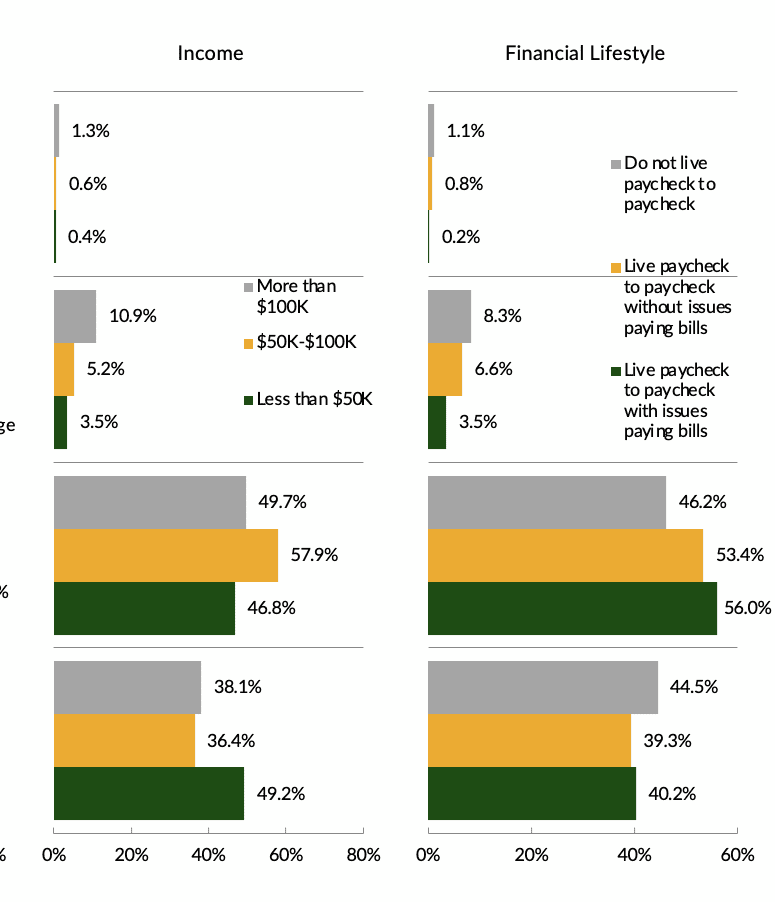

Walmart is a favorite of the paycheck-to-paycheck economy’s consumers. Some 86% of consumers make more than $100,000, most of the rest make between $50,000 to $100,000. In those demographics, a mid-teens percentage rate of consumers live paycheck to paycheck and have trouble paying the bills.

SOURCE: PYMNTS

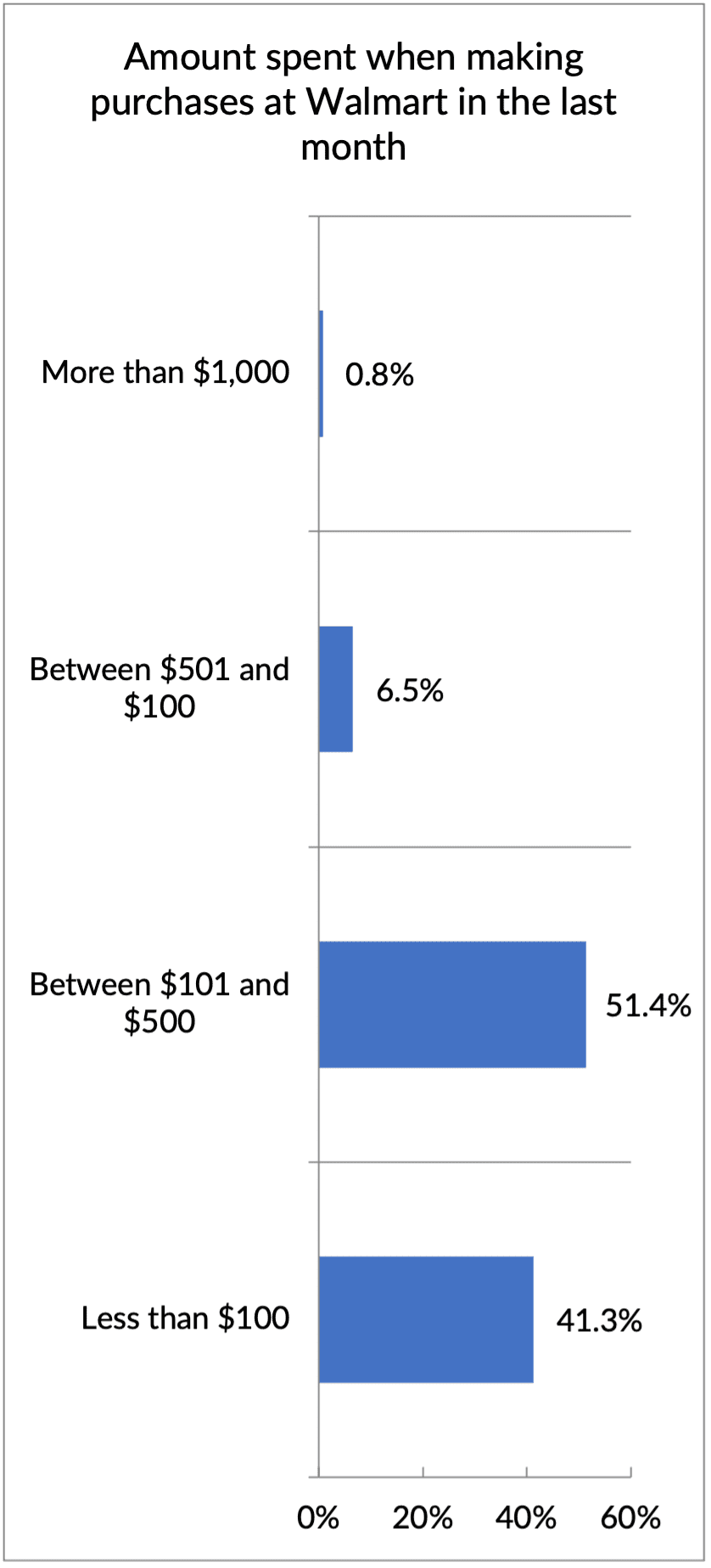

It might make sense, then, that by and large these consumers would stick to some of the essentials of daily life, where price-consciousness cuts across income levels and age groups. Thus the basket sizes reflect some of those relatively lower ticket items, evidenced by the amounts spent when making purchases at Walmart through the last month.

SOURCE: PYMNTS

As to what’s in the baskets — food reigns supreme, healthcare and personal items trail a bit:

SOURCE: PYMNTS