AMZN vs WMT Weekly: Fulfillment, Fairness and Food

As much as Amazon feels it is being singled out by proposed legislation in Congress, that it claims would hurt small businesses that rely on its order fulfillment services while also disrupting the value and variety of products on its platform that consumers love, that threat has not sunk in on Wall Street — at least not yet.

While the Senate mulls revisions to the “American Innovation and Choice Online Act,” and similar legislation makes its way through the House, Amazon took matters into its own hands this week when it proactively blasted the antitrust legislation saying it would carry unintended negative consequences for American consumers and small businesses alike.

The legislation “targets just a handful of American companies — Amazon, Apple, Facebook, Google, and Microsoft — which have very different business models,” Amazon Vice President of Public Policy Brian Huseman wrote in a June 1 blog post that sparked both criticism and support for the online giant’s efforts.

“In reality, Amazon’s Consumer business (which this proposed legislation is largely aimed at) has much more in common with thousands of other retailers, like Walmart, Target, and Costco, all of which would be mysteriously excluded from the bill’s proposed regulations,” Huseman added, before attacking the pending bills’ “broad, vague, and undefined language.”

Right or wrong, there are at least two indicators right now that might suggest otherwise. First is the fact that Wall Street investors, who battered Amazon shares to a two-year low over the past six months, have recently been able to overlook the slowing growth rate story and have suddenly found value where most recently, largely fear existed. As such, Amazon’s stock has risen over 20% in the past week and half, although its year-to-date performance is still sharply negative by over 22%.

The Market Share Reality

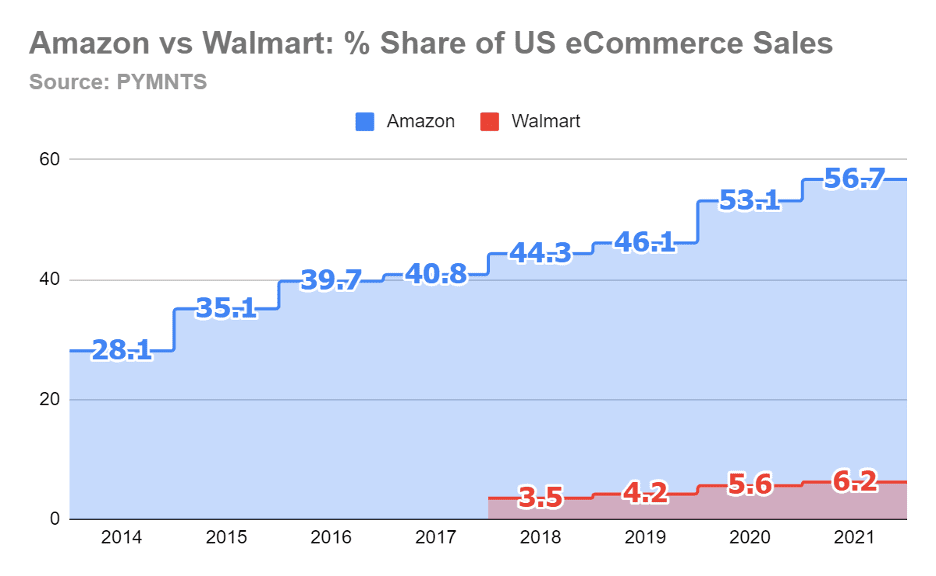

As much as Amazon compares its business to numerous traditional and omnichannel rivals, another area of opposition to the eCommerce leader’s open letter is the fact that PYMNTS new research recently found that the Seattle-based company’s share of U.S. online sales hit a record high last year of 57%.

That dominant share of domestic digital sales has been trending-up for more than a decade, and has literally doubled over the past seven years, at a time when its increasingly digital rival Walmart has remained in the mid-single-digit range — despite its significant effort to grow its non-store sales.

Shoppable Fulfillment Centers

All of this is happening at a time when Walmart’s own long-term leaders concede the company is almost unrecognizable from what it was 20 years ago, as its digital efforts both deepen and diversify.

Not long ago, Walmart’s unmatched base of 4,700 large physical stores in the U.S. was the source of derision and proof that the Arkansas-based retailer was out of touch and out of sync with the new economy.

Fast forward to the present, and that narrative is rarely heard anymore — in fact, the most common thing said about Walmart’s roster of Super Centers is, “How can we get more out of these lucrative community magnets for commerce?”

“The store is becoming a shoppable fulfillment center, and if the store acts like the fulfillment center, we can send those items the shortest distance in the fastest time,” Walmart’s newly appointed e-commerce chief Tom Ward told CNBC in his first interview since he took the job in February.

The Power of Partners

In addition to better utilizing its real estate to attempt to slow Amazon’s ascent and chip away at its lead, Walmart and other retailers are increasingly partnering up to seize the benefits of combined branding power.

This as Walmart’s partnership with the Gap continues to deepen as the two retailers said this week in a blog post that they were extending their venture to include home products for kids.

“At Walmart, we believe great style doesn’t have to be expensive,” wrote Anthony Soohoo, executive vice president, Home, Walmart U.S. “We have spent the past several years on a mission to democratize style by building our home assortment with high-quality, stylish — and often exclusive — home goods at an incredible value.”