Financial institutions (FIs) are rising to the challenges of business clients seeking and doing more business in overseas markets, requiring a rethink — and in many cases, an upgrade, with services like automated account validation and digital lockboxes to address security issues.

New data finds that FIs serving cross-border payments customers and large enterprises are leading in providing more digital solutions than those serving middle-market companies and small businesses, although the trend is advancing rapidly to firms of all sizes.

For Meeting The Challenge Of Payments Modernization: Understanding Customer Needs, a PYMNTS and FIS collaboration, we surveyed over 300 executives leading treasury services or wholesale banking at FIs serving B2B clients in small businesses (under $20 million in annual revenues), middle-market firms ($20 million to $1 billion in annual revenues), enterprises with over $1 billion in annual revenues, and corporates making B2B cross-border payments.

Get Your Copy: Meeting The Challenge Of Payments Modernization: Understanding Customer Needs

- 93% of FIs serving cross-border payments customers are likely to offer account validation, and 95% of FIs serving large enterprises are likely to offer digital lockboxes

With the increase in cross-border commerce, more FIs are offering solutions to reduce frictions for cross-border payments, with account validation and digital lockboxes leading methods.

Per the study, “FIs serving cross-border payments customers are most likely to offer account validation, at 93%. FIs serving large enterprises, on the other hand, are the most likely to offer digital lockboxes, as 95% do so. Those serving cross-border payments customers offer 7.1 digital solutions on average, and those serving large enterprises provide an average of 6.8 solutions to streamline B2B payments.”

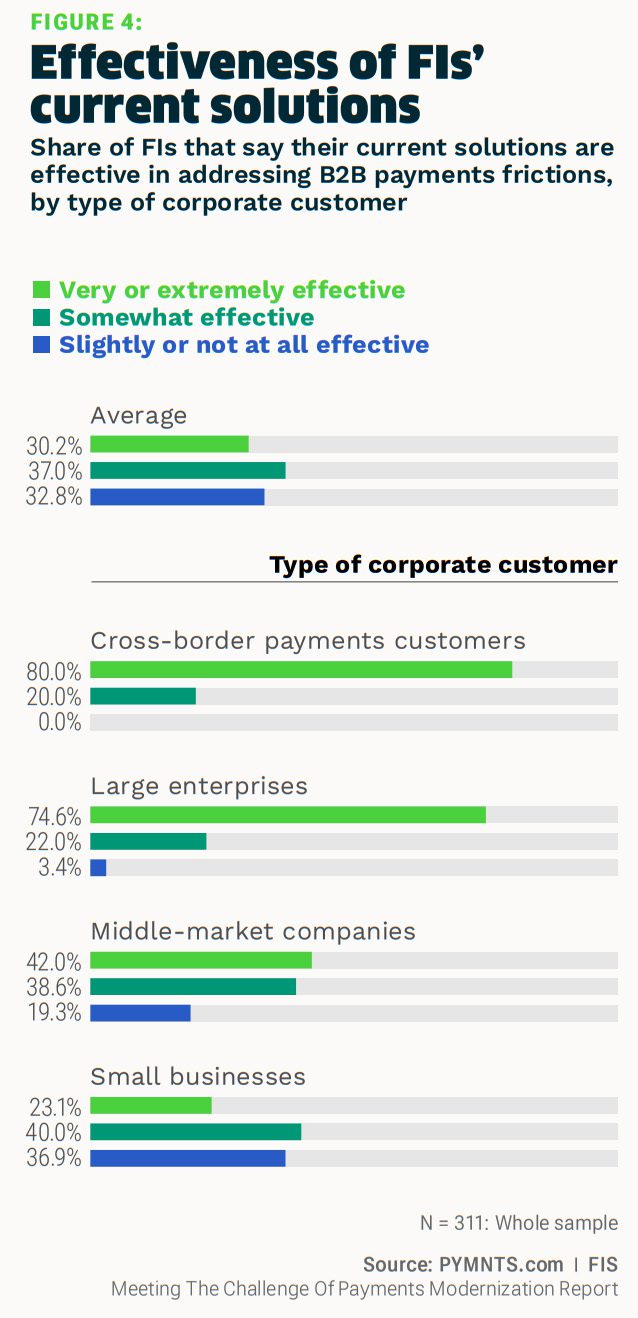

- Just 30% of all executives surveyed say the digital solutions their FI currently offers are “very” or “extremely” effective in addressing B2B payments frictions

PYMNTS research found that “at least three-quarters of FIs serving cross-border payments customers and large enterprises say their solutions are ‘very’ or extremely’ effective,” while adding that only 30% of all executives surveyed say their FI currently offers digital solutions that are “very” or “extremely” effective in addressing B2B payments frictions.

Interestingly, 80% of FIs serving cross-border payments customers and 75% serving large enterprises say their digital solutions are “very” or “extremely” effective, indicating that “large enterprises and cross-border payments customers tend to have more experience pursuing payments innovation to address B2B payments frictions.”

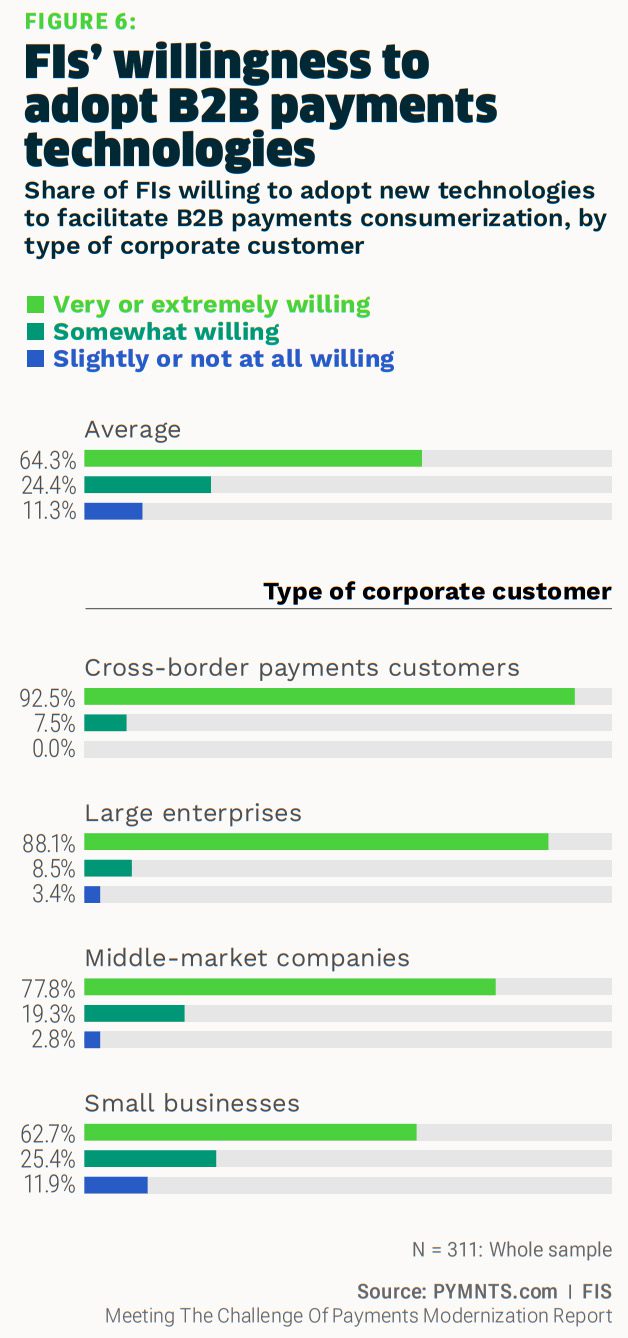

- 64% of all executives surveyed are “very” or “extremely” willing to adopt new technologies to facilitate B2B payments consumerization

The appetite for new tech to improve cross-border B2B payments is healthy, given the benefits firms of all sizes reap from these innovations.

We found that 64% of all executives surveyed saying they’re “very” or “extremely” willing to bring in new tech to solve cross-border pain points. Per the study, “institutions serving cross-border payments customers and large enterprises are leading the way, as 93% of the former and 88% of the latter say they are ‘very’ or ‘extremely’ willing to adopt new technologies to facilitate B2B payments consumerization.”

Read It: Meeting The Challenge Of Payments Modernization: Understanding Customer Needs