PYMNTS Intelligence: Deploying Behavioral Analytics to Smooth Friction Points in the Customer Journey

Protecting against digital fraud is a top priority for organizations, considering the cybercrime threats arrayed against them. The average American has been harmed by at least seven data breaches since 2004, according to one study, and there have been more than 2.3 billion account compromises in the country during that same time. Any measure to reduce this massive tide of cybercrime is potentially a step in the right direction when it comes to protecting businesses and consumers.

Nevertheless, many of the existing measures designed to fight digital fraud ultimately end up doing more harm than good. Consumers are continually frustrated by obtrusive identity checks, verification interfaces and other measures aimed at ensuring they are who they say they are, with many would-be customers jumping ship for businesses with easier experiences. These simpler verification measures are often less effective at fighting fraud, however, resulting in increased cybercrime metrics.

Businesses must find a way to reduce these authentication obstacles without compromising security, and behavioral analytics offers a compelling double-edged solution. This month, PYMNTS Intelligence examines common friction points in the customer journey and how behavioral analytics can identify and adjust them while providing robust security.

Authentication Complications

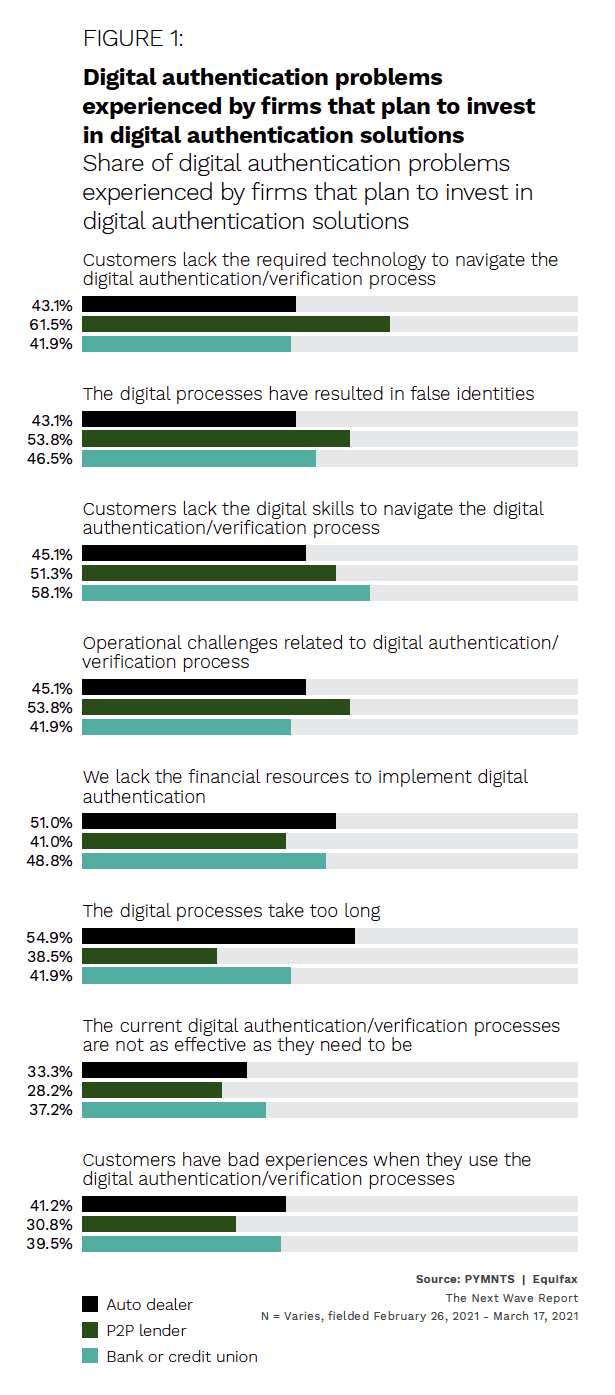

Firms experience a range of challenges when authenticating their customers’ identities. PYMNTS’ research found that 55% of auto dealers, for example, said digital authentication processes take too long, and 54% of peer-to-peer (P2P) lenders said their digital authentication processes often created false identities.

Other complications included a lack of efficacy in digital authentication processes, operational challenges during authentication and a lack of customer knowledge when it came to verification. The most condemning finding, however, was that 41% of auto dealers, 31% of P2P lenders and 40% of banks and credit unions (CUs) said their customers had bad experiences when using digital authentication processes.

This last statistic is especially worrisome for merchants because of customers’ propensity to abandon purchases — or businesses entirely — after subpar experiences. A study found that 83% of potential customers would leave a website that had a complex login process, with 49% saying such processes leave them frustrated and 21% saying they are too time-consuming. Cart abandonment is a particularly pressing issue among eCommerce merchants, with approximately 70% of transactions abandoned before the finish line. With a growing cornucopia of shopping options available to consumers, finding a new merchant is often much easier than navigating a complex authentication procedure.

Streamlining authentication processes is thus a key priority for businesses looking to reduce customer attrition. Behavioral analytics delivers on this need, not only due to its more seamless authentication procedure but also because of its ability to pinpoint customers’ trouble spots and mark them for improvement.

Leveraging Behavioral Analytics to Solve Authentication Woes

Behavioral analytics systems can offer a much more streamlined authentication approach than systems requiring active input from customers. The technology works by scrutinizing users’ digital habits to separate genuine customers from fraudulent ones by deducing user intent based on behavior. It examines factors such as typing speed and mouse movement to determine if users are who they claim to be, detecting fraudsters with high accuracy.

In addition to making the authentication process easier, behavioral analytics systems can drill down on the exact friction points customers are grappling with and provide actionable data for company staff to improve them. The systems analyze how long it takes to fill out various forms, including which ones were left incomplete. The company can thus devote resources to streamlining these forms, such as by adding credit card autofill options or removing extra password entries. One company was able to reduce friction in a specific data field by 20%, for example, reducing cart abandonment, in turn, by 40%.

Providing a smooth user experience and protecting against fraud are often perceived as diametrically opposed goals, but this does not have to be the case. Behavioral analytics meets both objectives to score a win-win for businesses and customers.