Education and Healthcare Seen Driving Next Round of BNPL Growth

Buy now, pay later (BNPL) services have matured significantly in the past several years, branching out from retail to encompass services of all types. Merchandise is not the only thing customers are looking to make more readily affordable through BNPL, however. Education, medicine, dentistry and a host of other services are following close behind as the current inflation crisis exacerbates ongoing cost concerns in all parts of daily life. BNPL has become an everyday-purchase solution for millions of consumers, making its extension to new use cases a logical move to solve a broad spectrum of financial issues.

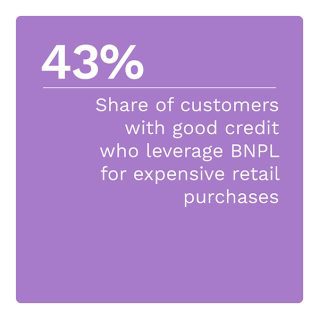

BNPL offers consumers financial flexibility, and the current economy is challenging for all income classes. Consumers’ reasons for using BNPL for services vary significantly. Forty-three percent of consumers said they would be interested in leveraging BNPL for services such as travel, 43% would use it for home remodeling services, 42% would use it for medicine and prescriptions and 38% would use it for education and certifications.

This edition of the “Buy Now, Pay Later Tracker®” explores how consumers leverage BNPL to pay for services and the benefits of doing so for both merchants and consumers.

Around the Buy Now, Pay Later Space

Consumers have long used BNPL for retail shopping, but dozens of new use cases are popping up by the day. One important application is dentistry, to which BNPL provider CareCredit plans to extend its financing services. PYMNTS research found that one-third of United States consumers have gone without medical care. Another study found that 74 million Americans lack dental coverage, with dental offices across the country turning away hundreds of potential patients each month who cannot afford their services.

Another study found that 74 million Americans lack dental coverage, with dental offices across the country turning away hundreds of potential patients each month who cannot afford their services.

Healthcare affordability has been a long-standing issue in the U.S., which, unlike most industrialized nations, lacks a widespread public health system. Individuals in the U.S. currently possess more than $88 billion in medical debt, and many fear healthcare costs more than actual procedures. BNPL companies are looking to fill this gap, offering customers the ability to finance their health procedures in the same way they would retail purchases. One such BNPL provider, Splitit, partnered with medical payments firm Docpay to increase the number of healthcare deals by approximately 50% in the past six months.

For more on these and other stories, visit the Tracker’s News and Trends section.

Fortuna Admissions On Leveraging BNPL For Education Services

Education has long been an impetus for taking out personal loans, including those for tuition, books and room and board, making it a natural fit for BNPL. Education players beyond schools are dipping into BNPL, including Fortuna Admissions, a consulting and counseling service for prospective business school applicants.

In this month’s Insider POV, PYMNTS talked with Heidi Hillis, an expert coach at Fortuna, on how the company leverages BNPL in an educational context.

In this month’s Insider POV, PYMNTS talked with Heidi Hillis, an expert coach at Fortuna, on how the company leverages BNPL in an educational context.

BNPL Providers Take Aim At Medical And Education Payments

Twenty-nine million U.S. consumers leveraged BNPL to make purchases in 2021, and 59% of consumers said they would be willing to use third-party BNPL solutions. Americans are branching out to more unusual BNPL use cases, such as education and medicine. The lack of interest rates makes this an attractive option for big-ticket purchases beyond just merchandise.

This month’s PYMNTS Intelligence explores how consumers leverage BNPL to pay for services rather than retail and the benefits of doing so.

About The Tracker

This month’s “Buy Now, Pay Later Tracker®,” a collaboration with Splitit, examines how consumers leverage BNPL to pay for services such as education and healthcare.