Insiders Reveal How Telecom Payments Can Boost Banking Access

Individuals with mobile phones outnumber those with bank accounts in the most underbanked regions of the world, offering the telecom industry a prime opportunity to fulfill a vital role. In this month’s “Telecommunications Payments Tracker®,” four telecom providers tell PYMNTS how the industry is ideally positioned to provide financial access to unbanked households.

T-Mobile Explains How Telecom Payments Make Banking More Accessible

One of the key issues that many households in financial straits face is a lack of access to traditional banking services. They may have neither enough savings to open an account at many traditional banks nor the means to visit these banks in person to apply for loans or access other services. This may be especially true for households in which English is not the primary language.

“The pandemic worsened the situation for millions who live paycheck to paycheck, and rising inflation has only made things worse, causing many to dip into savings for everyday expenses,” said Kevin McLaughlin, senior vice president, consumer group, CMO at T-Mobile. “Language can also be a barrier to traditional financial services. Hispanic households are more than twice as likely as the average U.S. household to be unbanked.”

Telecom banking allows consumers to access financial services from anywhere, and its digital nature makes switching to other languages much easier. While many traditional banks have deployed mobile apps for these purposes, they still largely rely on in-person visits for many functions.

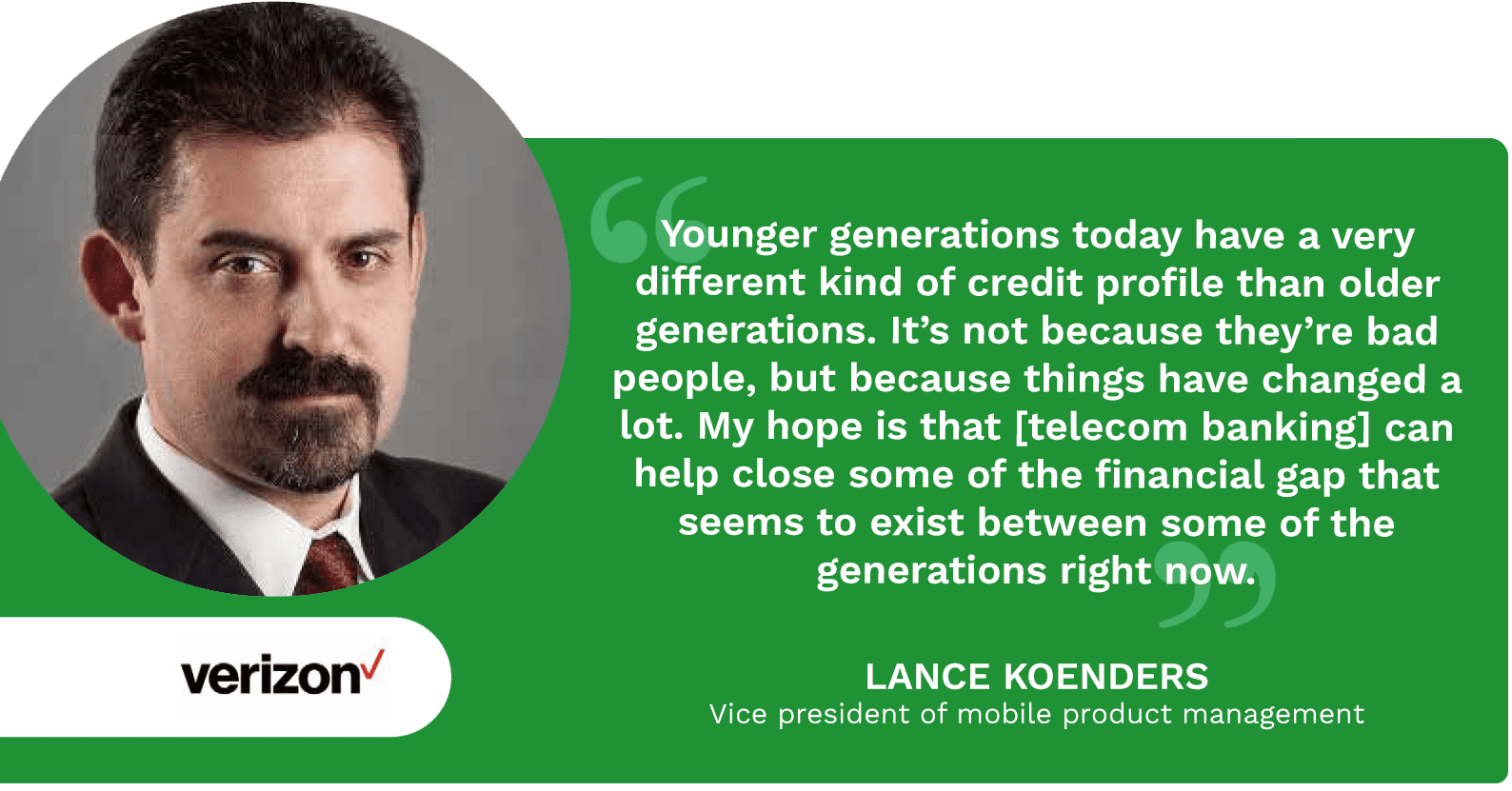

Verizon on Telecoms’ Relationship Advantage in Providing Payment Capabilities to Customers

Telecoms have an inherent banking advantage over traditional banks based on the nature of their relationship with their customers. Banks might interact with consumers only when they deposit or withdraw money or check the value of their accounts, but telecoms interact with their customers every time they make a call or send a text.

“It comes down to the strength of the relationship with the telecom,” said Lance Koenders, vice president of mobile product management at Verizon. “In many value segments, customers may not have strong relationships with banks and, in many cases, they have very negative relationships with banks, whereas they have a positive relationship with their wireless provider.”

This relationship base allows telecoms to construct a highly personalized kind of banking with their customers. Many consumers have no need for certain services traditional banks provide, such as large-scale loans or enterprise banking. Telecoms can instead focus more on the day-to-day transactions that consumers use most, such as payments and credit, and harness the data they collect from customers to tailor their experiences.

Boost Mobile on How Telecom Banking Can Meet Underbanked Households Where They Are

Telecom payments are critical for improving access to valuable banking services for households that currently lack them. Often, it is physically onerous for these families to access bank branches, and once there, they might find these services too expensive.

“In traditional banking, there are costs associated with account ownership,” said Boost Mobile CEO Stephen Stokols. “For example, in rural communities, people may need to travel a great distance to reach the nearest brick-and-mortar branch. Not only does mobile banking provide remote access to financial products, but the elimination of in-store and other overhead expenses drastically reduces the cost of entry for the consumer.”

With the proliferation of mobile banking apps, traditional banks certainly have the ability to reach these underbanked households, but they often decline to do so. Banks have often viewed providing access to underbanked populations as a high-risk proposition, choosing instead to pursue customers with a higher likelihood of a positive return on investment. Telecom banking has much lower upfront costs than traditional banking, so these companies are much better suited to providing banking services to underserved households.

BEYON Money on Leveraging Telecom Payments to Help the Underbanked

Underbanked individuals face vast institutional difficulties, especially considering their likelihood of being in dire financial straits. It is crucial for these unbanked households to have an easy time of onboarding for telecom payments, or else they could find themselves locked out of telecom banking just as they were locked out of traditional financial options.

“We wanted to make sure that clients can onboard in less than two minutes just with face ID recognition,” said BEYON Money CEO Roberto Mancone. “The ID scan technologies can also verify if the face is the real one from their ID documents, which allows you to have a seamless journey and ensure that the clients are onboarding really fast.”

Easy onboarding is not the be-all and end-all of telecom payments, however. Mancone pointed out that current regulations in many countries do not standardize data transmission, so telecoms in these regions often lack the quality of customer data that banks can harness to provide targeted services to their customers. World governments will need to step up their regulation to allow telecom payments to help citizens to their fullest potential.