PYMNTS Intelligence: Slow Payments Drag Contractors’ Cash Flows

Slow payments are more than a waiting game for the construction industry. They contributed to 12% of total construction costs last year, dipping into firms’ profits. As a result, almost 1 in 3 firms surveyed must finance gaps in cash flow, adding carrying costs such as interest to their balance sheets that eat into the 10% profit margin construction firms typically report.

An estimated 1 in 4 commercial contractors and more than 1 in 3 government contractors report waiting more than 90 days to receive retainage payments, an issue cited as a “very important” or “the most important factor” in cash flow management. Twenty percent become cash flow negative after just 40 days.

Pandemic intensified need to reduce B2B payments friction

With banks reporting that the pandemic added friction to business-to-business (B2B) invoice and payments management, there are a plethora of pain points for the construction industry to address. These frictions have indicated a need for modernizing and upgrading legacy payment processing systems. There are 67% more construction firms using software for payment paperwork now than there were before the pandemic.

Firms are using software in key areas, with 62% using it to track and process payments, 55% to coordinate sending and tracking payment paperwork, 54% for task management and job site coordination and 44% for plan management and reviewing.

Firms are using software in key areas, with 62% using it to track and process payments, 55% to coordinate sending and tracking payment paperwork, 54% for task management and job site coordination and 44% for plan management and reviewing.

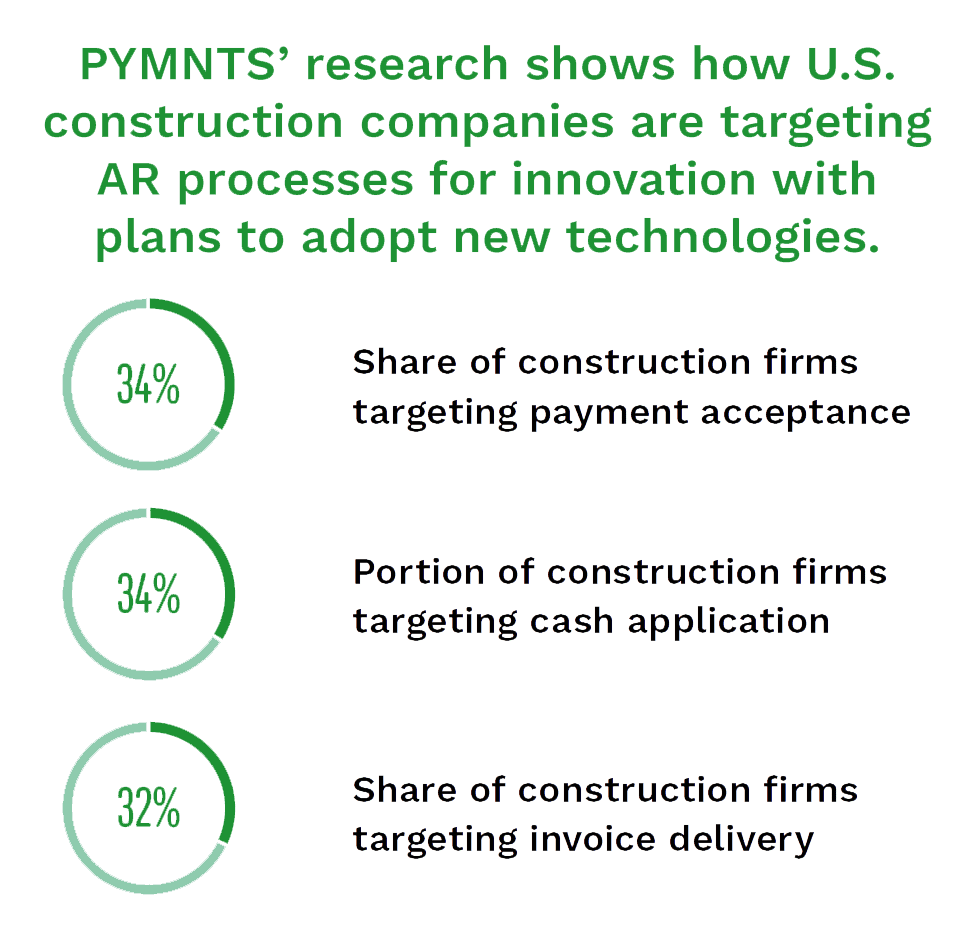

Construction industry leads the way in innovation

Construction firms are out in front of other industries when it comes to upcoming innovations. According to PYMNTS’ research, the construction industry is averaging roughly five technologies to be rolled out in the next year. One in 4 construction companies are eyeing innovation in accounts payable (AP) and accounts receivable (AR) integration and enterprise resource planning (ERP), for example. These contractors are overwhelmingly aiming for faster payments and easier cash flow management. PYMNTS’ research found 33% were planning to adopt integration between AP and AR and 31% plan on adding instant bank verification and virtual cards for making payments to suppliers.

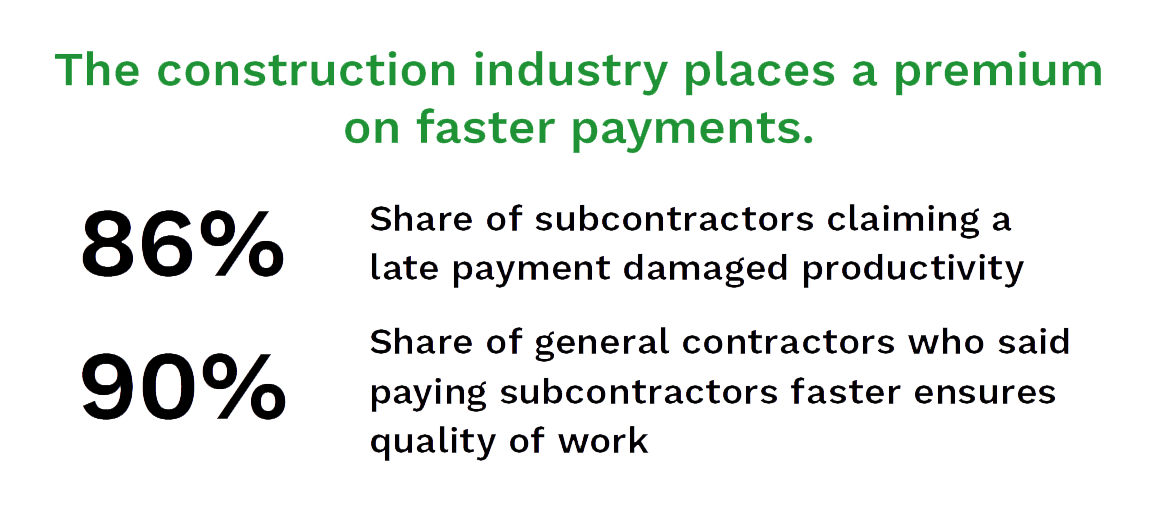

Faster payments relieve pressure

Subcontractors demonstrate that faster payments create as much value as alleviating financing costs, according to one study. While the cost of floating payments is up almost 3%, subcontractors said they would discount payments made within 30 days by an average of 5%, a decrease from the previous year’s average discount of 6%.

Faster payments matter so much to subcontractors that even for those who did not get hit with costs related to floating payments in the previous year, nearly 6 in 10 would offer a discount. Contractors also see the value of credit cards: 49% of general contractors use and accept credit cards to cover projects.