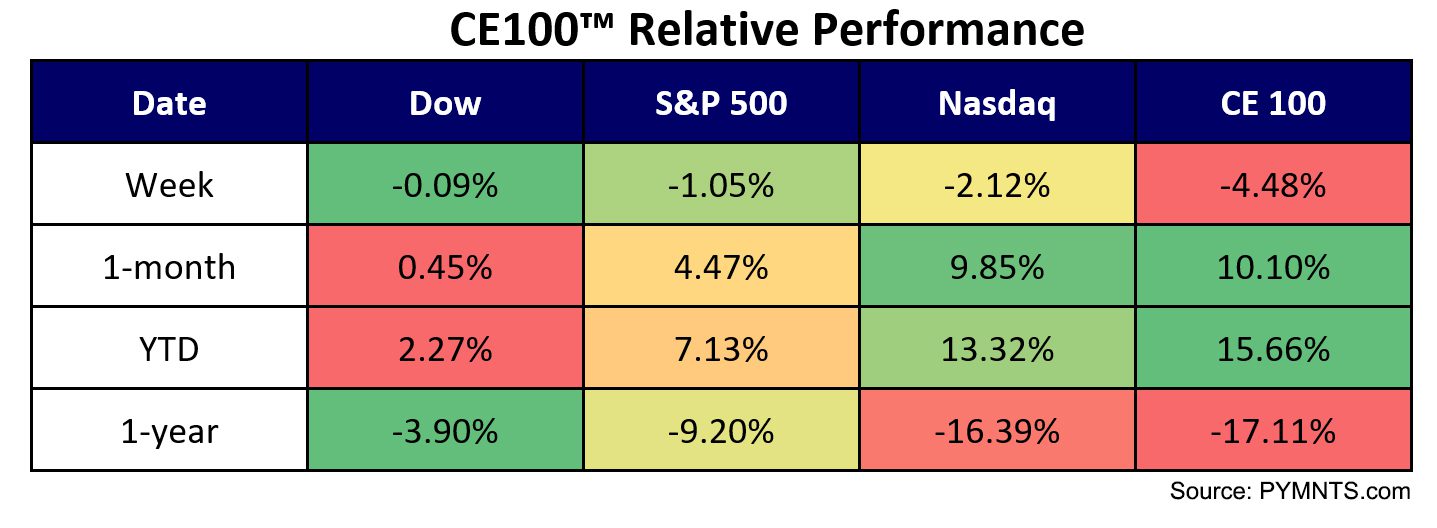

The CE 100 Index slipped in a week dominated by earnings, retracing gains made earlier in the month.

The Index was down 4.5% overall, yet still has made a strong showing thus far in 2023, up more than 15.6% year to date through Feb. 10.

But earnings reports and worries about consumer spending did their part to chip away at those gains. The payments pillar of our coverage was 8.5% lower for the week.

Affirm led declining stocks in our pantheon, as the company’s results showed decelerating growth and the company had slashed staff. The company also noted in its earnings materials a sequential decline in active merchants offering BNPL as the smallest merchants in its pantheon churn.

Management said on the earnings call that discretionary spending slowed or fell in various categories. Gross merchandise volumes growth rates to 27% in the FY 2023’s second quarter, whereas a year ago, that rate had been 115%. Revenue growth was 11%, at $400 million, and had been 77% last year. CEO Max Levchin said in a letter to investors that sporting goods and outdoor categories were down 49% year over year (due to a decline in Peloton GMV), and the electronics category was down 11% year over year. Consumers are digesting the purchases they made during the pandemic, management said.

And as Levchin said on the call, “These are not transactions that will disappear forever, but they’re probably going to remain muted for what we expect is at least a few quarters.”

Even where companies are in growth mode — where they’re expanding rather than cutting staff — investors were swift to sell their shares on the heels of disappointment over margins and profits. Adyen lost 19%. The company said this week that its continued investment in staff and global efforts have weighed on its margins.

“Adyen is operating at an increasingly global scale,” the Dutch FinTech said in its half-year earnings report. “To sustain this rate of expansion, we spent H2 building our team at an accelerated pace.”

The company reported earnings of 372 million euros (about $399 million) for the second half of 2022, up 4% from 2021. However, that figure was markedly lower than the consensus of $477 million, we noted, and operating expenses were up 64% year on year.

This past week, PayPal gave up a bit more than 5%. PayPal’s growth, too, is slowing,

But even as the macro environment is uncertain, the active users that are in place are transacting more often — and transactions per active account were up 13% year on year. The supplemental materials accompanying earnings show that total payments volume (TPV) was up 9% on a foreign exchange-neutral basis to $357 billion in the latest quarter.

“One of the things that is important to realize is digital wallets in general, including PayPal, have been growing share,” retiring CEO Dan Schulman said. “Overall, we grew share on over a hundred basis points during the pandemic … but we continue to take share from manual card entry.”

Looking ahead, Schulman said, “our baseline assumption is that discretionary spend will remain under pressure and global eCommerce growth will be slightly positive year over year. That said, we are seeing signs that inflation is beginning to cool and it’s logical to expect that discretionary spend versus nondiscretionary spend will begin to increase.”

The Move segment lost 3.8%, as Uber’s 3.6% gain was not enough to offset a general downdraft in the segment. Uber’s move higher came amid an earnings report that underscored the resilience of its broad platform model. As noted here, CEO Dana Khosrowshahi said, “the pandemic’s impact on our mobility business is now well and truly behind us.” Gross bookings were up 26% year on year in the most recent quarter and trips grew by 19%.

Uber One, the company’s cross-platform membership program, also saw gains. The member base, according to Wednesday’s stats and commentary, saw the installed base nearly double to approximately 12 million members.

Those members now generate more than a quarter of Uber’s total Gross Bookings and 40% of Delivery bookings, per commentary on its earnings call.

Separately, and in non-earnings-related news, shares in WeWork plunged 22.8%. Bloomberg reported during the week that co-founder Adam Neumann offered up some details about residential real estate company Flow. In footage released by VC backer Andreessen Horowitz — tied to a November 2022 event — Neumann reportedly discussed how Flow would “simulate” the experience of homeownership for the tenants while the company maintains control of the actual properties.

Flow, he said, will seek to “find a way to share with the resident a portion of the value that they create.” That value “is going to make them feel ownership. And it’s not just ownership — ‘I feel like I’m part of something’ — it’s ‘I actually own part of something.’” Per Neumann’s commentary, the entity will feature a branded property management company that runs its buildings, a real estate fund that owns the buildings, a financial services company and a “mechanism that’s going to take some of the value and share it with the value creators.”