Bank-Owned Travel Portals Proliferate as Banks and Cardholders Seek Direct Relationships

Decades of earning miles and points for booking travel on various credit cards has led to the inevitable rise of bank-owned travel portals to use those points more directly, cutting out middlemen and taking friction out of points redemption in the process.

News broke Monday (March 20) that Citi has partnered with Booking.com to launch the Citi Travel portal, making Citi the latest bank to launch its own booking capabilities for cardholders and bypass the many online travel agencies (OTAs) where points can be redeemed, delivering a more direct customer experience while saving marketing dollars needed for external platforms.

J.P. Morgan Chase has gotten busy in recent years on this front, acquiring luxury and corporate travel agency Frosch last February after its 2020 acquisition of cxLoyalty Group, whose digital platform has been powering major card rewards programs for years.

“A key rationale J.P. Morgan had for buying the operations was that by gaining cxLoyalty’s technology, it will own both ends of a two-sided platform,” CNBC reported at the time of the JPMC-cxLoyalty deal. “With millions of credit card users and direct relationships with hotel and airline companies, the bank can eventually command unique deals from those partners.”

In December 2021, Capital One launched Capital One Travel in partnership with booking site and app Hopper.

“We had several conversations with different travel companies, viewed countless demos, and found that Hopper was really doing things differently,” said Capital One Head of Travel Rewards Jamie Nettles in a press release at the time. “Not only were they extremely data-driven and design-forward, but they were customer friendly, which aligns completely with Capital One. We felt that together we could create a unique travel booking experience for cardholders and combat existing pain points in the current booking process.”

Those pain points typically revolve around cardholders knowing they are getting the best value for the points they redeem through various OTAs, which issuing banks are alleviating by offering portals of their own to improve customer experience and confidence when booking.

When booked through issuer portals, travel rewards are often boosted with value-adds like more favorable rates on hotels, car rentals, and even attractions and cruises. Timing is fortuitous for such offers as consumers otherwise beset by inflationary pressure have shown a remarkably resilient attitude toward traveling over the past 15 months.

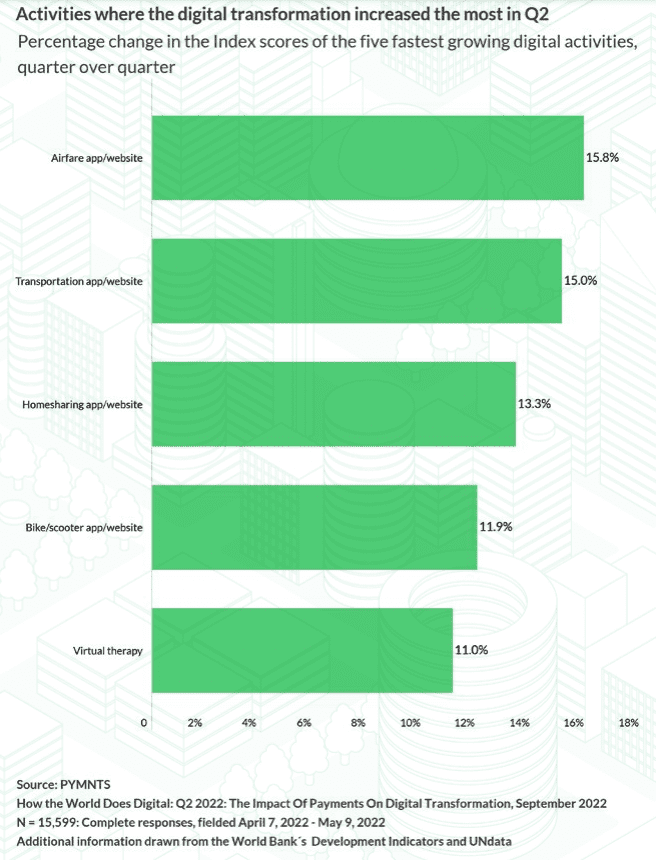

The PYMNTS study “How The World Does Digital: The Impact of Payments on Digital Transformation,” found a 16% rise in the digital transformation of consumers across all 11 countries studied for the report “in booking airfare and accommodations online,” showing the strength of what’s been called “revenge travel” in response to two years of travel restrictions.

Bank of America has also operated its Bank of America Travel Center for several years, linked to its Bank of America Travel Rewards Credit Card, which has no annual fee and offers attractive introductory rewards and higher travel points when using the card for everyday purchases.

Meanwhile, new travel rewards cards are springing up amid renewed travel demand.

In February, U.S. Bank and Mastercard announced the launch of the U.S. Bank Business Altitude Connect World Elite Mastercard.

“With benefits including 5x back on prepaid car and hotel bookings via the U.S. Bank Rewards Center and a 4x reward for other travel expenses — such as airfare and hotels, plus gas and EV charging — this card is specifically designed for growing small businesses planning frequent and ongoing travel, from flying to driving,” a U.S. Bank press release stated.

Steve Mattics, head of retail payment solutions for U.S. Bank, said in the same release: “We expect that business travel will continue to bounce back in the coming year, and as business travel continues to accelerate, ‘road warrior’ companies will appreciate a tool that can help them earn accelerated rewards on travel spend. This card, along with our full suite of integrated payments and banking solutions, truly powers the potential of our business clients.”