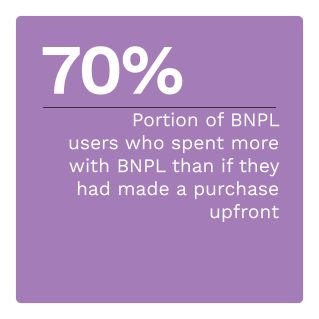

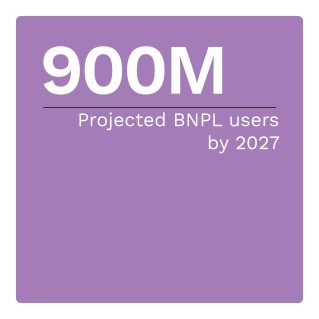

Buy now, pay later (BNPL) payments have exploded in popularity in the past several years, now with more than 360 million users worldwide. While BNPL offers no interest on payments made by the due date, users who fail to make payments on time can face massive fees. Further, concerns about consumer data privacy have arisen, as at least one high-profile BNPL provider has been subject to hefty fines for data privacy violations.

Despite BNPL’s already-deep market penetration, the payment method’s novelty and rapid rise have kept it largely outside the consumer credit regulatory framework thus far. Just in the past year or so, BNPL regulation has been considered on a widespread basis. Most of these regulations involve bringing the BNPL industry in line with traditional credit options. Opinions on these regulations are mixed, however: While some BNPL providers work with governments to enact these rules, others feel that regulatory measures will unnecessarily impede the industry’s rapid growth.

The “Buy Now, Pay Later Tracker®” examines why governments across the globe are considering BNPL regulations to bring the industry in line with traditional credit options.

Around the Buy Now, Pay Later Space

One of the most wide-ranging BNPL regulations in progress comes from Australia, where the government is considering several proposals to bring the industry in line with its credit counterparts.  Some BNPL providers, such as PayPal, back the proposed regulations, while others worry it will damage the quickly growing industry.

Some BNPL providers, such as PayPal, back the proposed regulations, while others worry it will damage the quickly growing industry.

The United Kingdom is also proposing new BNPL regulations, having recently asked BNPL industry leaders to provide feedback during an eight-week consultation period. Like Australia’s, the British regulation aims to bring the industry in line with traditional credit, including requiring eligibility checks before lending.

For more on these and other stories, visit the Tracker’s News and Trends section.

Why Standardization Could Aid BNPL Customers

BNPL has long been considered a valuable gateway for populations traditionally underserved by legacy credit options. While many considered this the first time such credit was available, it already existed in riskier options such as overdraft facilities, payday loans and pawn loans. A certain level of regulatory oversight is called for to prevent predatory practices by some unscrupulous BNPL providers.

To get the Insider POV, PYMNTS spoke with Omri Flicker, Splitit’s chief legal and risk officer, to learn more about how this legislation could protect consumers.

To get the Insider POV, PYMNTS spoke with Omri Flicker, Splitit’s chief legal and risk officer, to learn more about how this legislation could protect consumers.

Governments Around the World Explore BNPL Regulation

The BNPL market has operated largely free of government oversight since its launch, following in the footsteps of many of its counterparts in the tech world. Much like ridesharing, streaming media subscriptions or short-term property rentals, the BNPL market exploded in popularity while governments debated how — and if — the market should be regulated. This laissez-faire environment could quickly be ending, however, as governments across the globe consider regulations that would apply many of their existing credit laws to the BNPL market.

This month, PYMNTS explores pending regulations in the U.S. and the European Union and how they could affect BNPL providers.

About the Tracker

The “Buy Now, Pay Later Tracker®,” a collaboration with Splitit, examines why governments around the world are considering BNPL regulations to bring the industry in line with traditional credit options.