Apple’s Glasses May Re-spark Interest in Virtual Reality but Roadblocks Remain

Cost of entry is just one barrier as consumers continue to express interest in alternate reality platforms.

First, it seemed like Google’s glasses would be the next big tech breakthrough, given the company’s popularity and ubiquity in 2014. That was not enough to keep its first version from going on and off the market within one year due to customer backlash over privacy concerns and the then-high price of hardware at $1,500 for the wearable. Revived for enterprises in 2019 but never seeing the broad popularity Google had hoped for, the company finally stopped selling all versions of its Glass in 2023.

Next forecasted as the major consumer-facing breakthrough was the metaverse. Seeing sales opportunities, Disney jumped in with both feet, along with Walmart, Bloomingdale’s and others. Despite these promising opportunities for platform monetization, by the first quarter of 2023, the metaverse as originally envisioned was on life support. This may be due to the cost of headsets, ranging from $500 to $1,500 at launch, per Reuters. While that pricing represents a drop from Google Glass’s cost at launch, even the lower end of that range may be too much for many consumers.

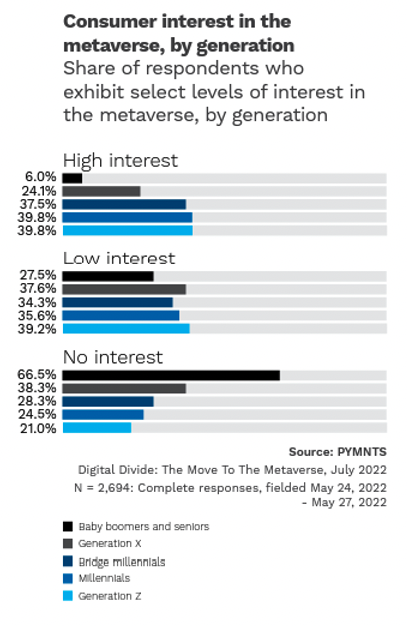

“Digital Divide: The Move to the Metaverse,” a PYMNTS and Paytronix collaboration, found that even though the metaverse didn’t see broad adoption, consumers were still interested.

Consumers surveyed across generations reported interest in the metaverse, from one-third of baby boomers and seniors expressing some level of interest to 79% of Generation Z saying the same. And as more than one-third of Gen Z, millennial and bridge millennial consumers exhibited high interest, one wonders if a lower hardware cost could have sparked broader uptake.

Apple is not going in that direction with its Vision Pro. Announced with much fanfare, the headset combining virtual and augmented reality will be priced at $3,500 and, as CEO Tim Cook said, it’s “the first Apple product you look through and not at.”

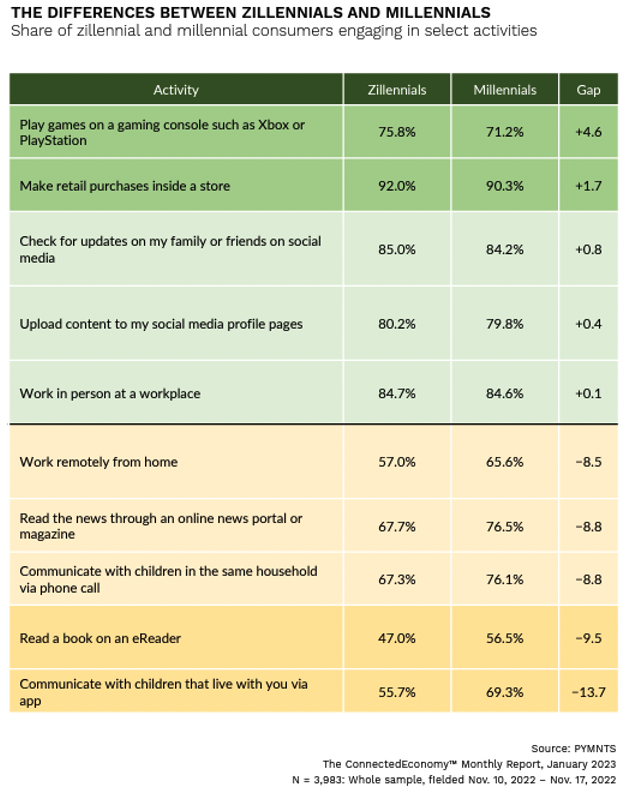

With over 100 games planned to be introduced in the coming year, Apple may be betting that it hooks tech-savvy, game-playing consumers. This may include the zillennial and millennial age cohorts, which are largely gaming console fans. A respective 76% and 71% regularly play, as illustrated in PYMNTS’ January “ConnectedEconomy™ Monthly Report.”

Apple’s fan base and others who can afford Vision Pro’s hefty price tag may be waiting for the product’s eventual launch, but it is too soon to say if the broader consumer population will buy in. Given the similar concerns about high consumer costs for Vision Pro’s predecessors — and their relatively low costs in comparison to Apple’s offering — the wearable’s prospects for future success are murky, even though many of the augmented reality innovations stemming from these wearables could have real-world benefits.

Apple’s fan base and others who can afford Vision Pro’s hefty price tag may be waiting for the product’s eventual launch, but it is too soon to say if the broader consumer population will buy in. Given the similar concerns about high consumer costs for Vision Pro’s predecessors — and their relatively low costs in comparison to Apple’s offering — the wearable’s prospects for future success are murky, even though many of the augmented reality innovations stemming from these wearables could have real-world benefits.

Perhaps there is a compromise between the total immersive experience Apple and Meta suggest and shunning the technology altogether.

“Generative AI models and voice, combined with visual applications, have the potential to turn a series of discrete activities into one seamless experience powered by AI, voice and visual tech,” PYMNTS’ Karen Webster wrote earlier this year. “Smart, voice-enabled virtual assistants capable of handling increasingly complex tasks will be commercially viable in a matter of a few years.”

“None of these use cases, and the many more that will evolve in the years to come, require people to give up the real world to live in a fake one, or even to live in a fake one at all,” Webster added. “But all of them improve the quality and efficiency of the outcomes that real people and real business have for the problems they face in the real world right now.”