Nearly 60% of US Consumers Want to Manage Savings via an Everyday App

With an overwhelming number of apps competing for user attention, consumers are experiencing app overload. As a result, the appeal of a unified platform or everyday app that consolidates shopping, banking and other daily digital tasks is fast growing.

In the “Consumer Interest in an Everyday App” report, PYMNTS Intelligence draws on a survey of over 3,300 consumers to explore the rising demand for an all-in-one finance and shopping app among consumers in the United States and Australia as well as to assess how security features and trust in the provider affect their views.

Findings detailed in the study done jointly by PYMNTS and PayPal show that an increasing number of consumers are seeking ways to simplify their routine shopping and banking experiences, with approximately 60% of U.S. consumers interested in managing their banking through an everyday app.

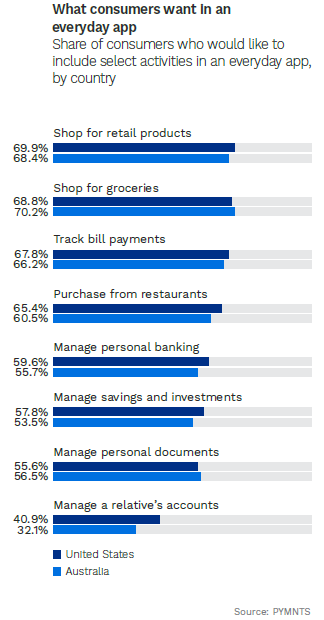

Drilling down into the data further reveals the desire of consumers in both countries to consolidate their app-based retail and grocery shopping into an everyday app. In fact, nearly 7 in 10 respondents in the U.S. expressed a strong desire for an app that combines their retail and grocery shopping activities.

Additionally, managing personal banking as well as managing savings and investments are the features that nearly 60% of consumers would like to include in an everyday app.

Analyzing these findings by different user profiles reveals some notable trends. Convenience-focused consumers want an all-in-one solution that offers a wide range of features. These consumers prioritize efficiency and accessibility, expressing a desire for an app that encompasses not only grocery shopping and bill tracking but also restaurant orders, banking, investment management and retail shopping.

On the other hand, a significant majority of shopping-focused consumers in the U.S. expressed a strong interest in an everyday app that streamlines their retail shopping, grocery and restaurant activities. Approximately 9 in 10 consumers in this group desired an app that includes these three activities.

Overall, the survey results indicate a growing demand among U.S. consumers for ways to simplify their routine shopping and banking experiences. And as technology continues to advance, more people are likely to embrace convenient and efficient all-in-one apps that can cater to their everyday needs.