Banks Tap Virtual Cards to Help Businesses Streamline Expense Management

Businesses have long relied on debit and credit card transactions, but digitization is ushering a new era of more secure electronic payment options, such as virtual cards, in the business-to-business (B2B) payment landscape.

Findings detailed in a PYMNTS Intelligence report titled “B2B Digital Payments: Virtual Cards Help Improve Remote Accounts Payable Efficiencies” show that the global value of virtual card transactions is expected to grow from about $2 trillion to hit $6.8 trillion by 2026, indicating a growing recognition of their simplicity and security compared to outdated methods like paper checks.

When it comes to security, virtual cards provide an added layer of control for businesses as the unique and randomly generated card numbers used for each transaction significantly reduce the risk of fraud. And virtual cards are not linked to a business’s main account but to a digital wallet, minimizing exposure of sensitive data.

“There’s less fraud in virtual cards. The numbers are something like 40% for ACH attempted or actual fraud, and for virtual cards, it’s around 3%,” David Bork, head of AR solutions at Boost Payment Solutions, told PYMNTS in a July interview.

Additionally, “virtual cards can drive a significant amount of efficiency for an organization,” according to R.J. Ancona, vice president and general manager of B2B product, partner and client management at American Express, noted in the research study.

“Virtual cards [also] provide a tangible return to the organization through rewards or cash-back rebates. Companies can earn the benefits of their traditional physical cards and optimize float not offered on debit cards — all while in a 100% virtual environment,” Ancona said.

In the hospitality sector, for example, virtual cards have become a popular choice for expense management and accounts payable operations, the study notes. By keeping cards on file with vendors, businesses can expedite future purchases and reduce time spent entering payment details at the point of sale. This has led to a 300% increase in virtual card use among hospitality clients since the start of the pandemic.

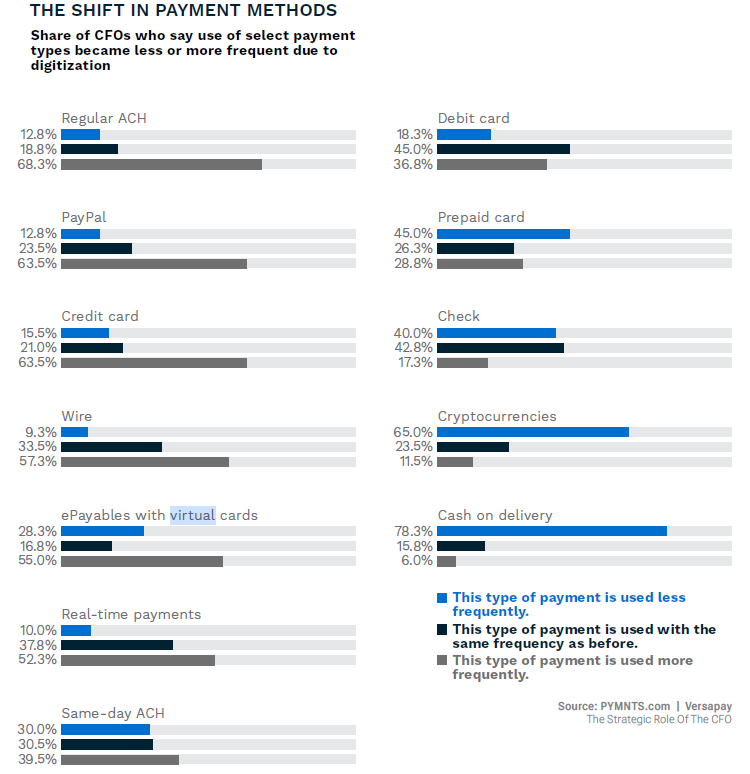

Currently, B2B payments account for the majority of virtual card transactions, an indication that CFOs must adapt to this trend.

Banks Embrace Digital-Forward Trend

The recent collaboration between Visa and Lloyds Bank indicates the virtual card trend is here to stay. On Wednesday (Sept. 27), Visa announced that it is joining forces with Lloyds to launch a virtual card solution for businesses, giving employees instant virtual card access to make work-related purchases such as subscription payments or business travel.

“The virtual cards — which can be single or multi-use — adopt existing approval workflows and include the business’s own unique reference fields,” Visa noted in a news release, adding that the cards “can be issued individually or by batch and offer real-time control, allowing business administrators and managers to closely manage spending within their teams.”

Lloyds Bank Head of Commercial Cards James Sykes said the U.K. financial institution has “worked hard to create a solution that offers a secure, simplified process that enables businesses to pay their suppliers earlier while protecting their working capital.”

The partnership comes at a time when other industry experts have noted the potential of virtual cards to transform B2B working capital management.

“The movement to [virtual cards] is moving faster because it’s a matter of straight-through processing,” Alan Koenigsberg, Visa’s senior vice president and global head of large, middle market, treasury and working capital solutions, told PYMNTS CEO Karen Webster in a recent interview. “The payments are easier to reconcile, and the whole process is more holistic.”

Dan Hanks, vice president of global product development at i2c, also discussed the growth in virtual card adoption, highlighting the capability of virtual card technology to replicate various traditional commercial card offerings. This customization, he said in a July interview with PYMNTS, empowers companies to tailor virtual cards for specific purposes, ensuring precise and efficient allocation of expenses.

“Virtual cards are a great tool for getting all that friction out of the B2B process; vendors can process them immediately with no wait,” Hanks said, noting that “it comes down to simplification and flexibility for companies.”

Boost’s Bork has a similar view, telling PYMNTS that businesses are increasingly looking to tap into the opportunities offered by commercial virtual cards as working capital becomes more important in shifting and uncertain economic times.

“Having a facility for virtual card acceptance can be very powerful. It can be deployed in a widespread manner. It can be very surgically deployed. It can be deployed with different rates,” Bork said.