With more than 8 in 10 companies still seeing delayed payments rise in 2023, concerns about the global economy remain high.

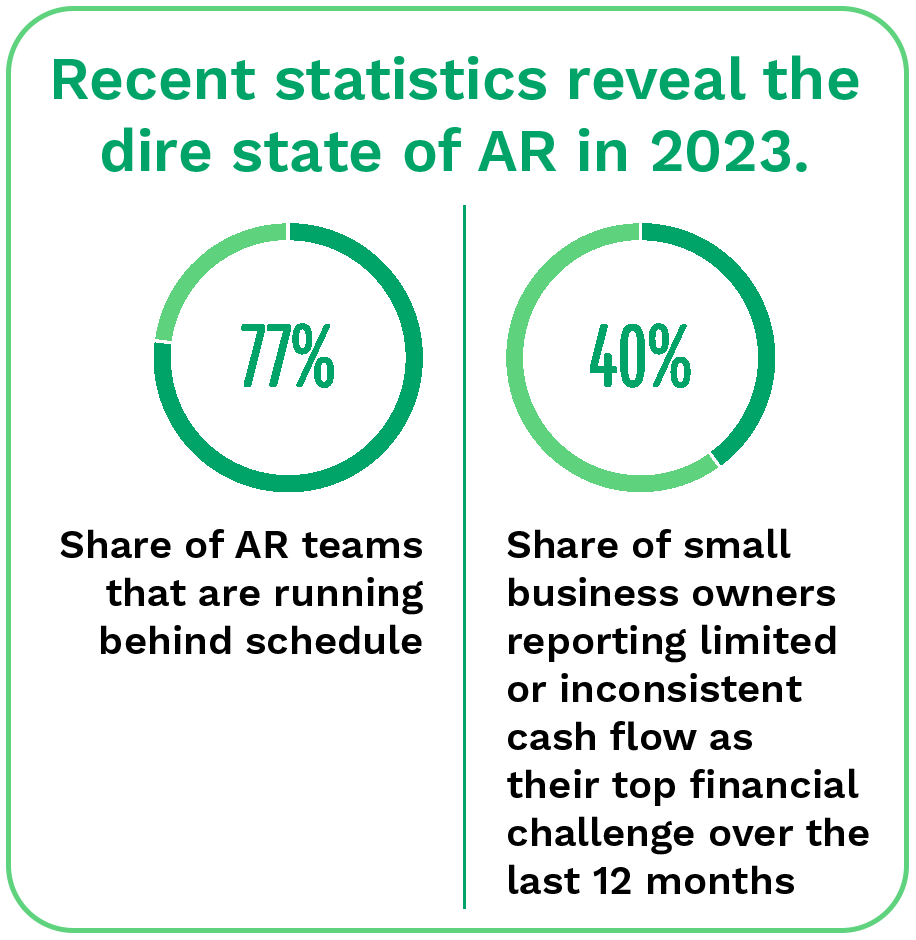

Small business owners’ top reported financial challenges over the last 12 months were limited or inconsistent cash flow, at 40%, and no cash reserves for emergencies, at 29%. In addition, 58% of business owners disclosed that cash flow worries had affected their personal well-being, citing stress, anxiety and sleepless nights as the top three impacts they experienced.

It is no surprise that an equal share of companies — 8 in 10 — therefore see their accounts receivable (AR) teams as more crucial now, with 64% of chief financial officers saying they need more automation in their AR processes. Nevertheless, manual methods still prevail, with 81% of companies using paper payments for commercial purchases. Why are B2B payments taking so long to go fully digital? The current economic environment may be just the wake-up call organizations need to prioritize AR modernization.

Lifeblood in Jeopardy

One reason for B2B’s slow digital transformation is that companies are not assigning AR operations the priority they deserve due to legacy notions about AR’s importance — or lack thereof.

“It’s a part of the business that is sort of forgotten, misunderstood, when really your AR practitioners are the lifeblood of your cash flow,” Russell Lester, CFO of Versapay, told CFO Dive, which reported that more than three-quarters of AR teams are running behind schedule. “I think modern CFOs are realizing they hold the tip of the spear in generating healthy cash flow: The No. 1 way [to achieve it] is [by] getting paid for what you did.”

As a result of these misplaced priorities, the typical in-house AR program runs the same way it has for the last 20 or 30 years — using tools and processes that are manual and clunky, not just for merchants but also for their customers.

This customer side of the B2B equation, however, is precisely what is making AR automation so urgent, as making it difficult for B2B customers to do business can put relationships at risk.

Collaborative Communication: Bridging the AR-AP Gap

At the heart of effective B2B relationships is AR teams’ ability to collaborate with customers’ AP teams to speed invoices’ processing and payment. Even if payment portals are available, communication silos are a major contributor to AR logjams, according to a study, with companies having approximately $4 million in outstanding invoices every month due to disputes and lapses in communication between B2B partners. Improving communication reduces cash flow delays by enhancing customers’ ability and willingness to pay.

Standard payment portals generally do not allow for two-way communication between AR teams and customers’ AP teams, permitting only the viewing of invoice and account statuses. Cloud-based collaborative AR portals, on the other hand, offer the added dimension of communication in real time to negotiate invoice disputes at the line-item level within the application. Without this dimension, businesses must resolve these disputes manually, jeopardizing both staff time and customer experience.

Combining automated technology with customer communication can bridge the divide that so frequently disrupts cash flow. With newer, cloud-based systems offering highly effective solutions, companies can no longer afford to hesitate.