Nearly 40% of Credit Unions Say No to Installment Loans

Traditionally, consumers have relied on their primary financial institutions (FIs), such as banks or credit unions (CUs), for credit products like credit cards, mortgages, auto loans and personal loans. However, increased competition from non-bank and non-credit union financial entities has led consumers to shop around for better deals.

In “Credit Union Innovation: How Credit Product Rates Impact FI Selection,” PYMNTS Intelligence drew on insights gathered from a survey of over 4,000 consumers, 100 credit union executives and 50-plus FinTech executives to examine consumer criteria for choosing credit products, which in turn determines their choice of financial institutions (FIs).

According to the joint PYMNTS-PSCU study, more than 75% of account holders say their primary FIs offer one or more of these major credit products, and 63% report having at least one of these products from their primary FI. However, when it comes to mortgages and auto loans, consumers were willing to explore different options to secure the most favorable interest rates and payment terms.

The study also found that across all credit products, rates and terms are the most important factors for consumers when selecting an FI and the main reasons for switching accounts to another FI with better offerings. Notably, at 32%, CU members were more likely to switch FIs, compared to 26% of non-CU members.

In addition to rates and terms, consumers also value the speed with which funds become available after applying for a credit product. And while CUs have made progress in reducing setup times for many of the products they offer, they face competition from FinTechs who are pitching installment payment plans directly to consumers. These products, such as buy now, pay later (BNPL) plans, have become more attractive and popular, particularly among younger groups, under tightening credit and economic conditions.

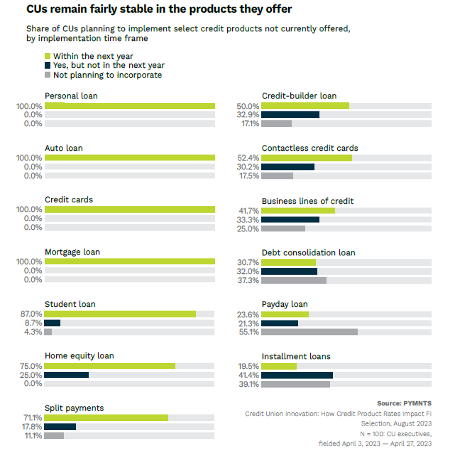

But despite the increasing demand for installment payment plans, the study found that 39% of credit unions do not plan to offer these options to their members. Even among the 41% of credit unions that do plan to offer installment loans, none of them intend to roll out the product within the next year.

This “reluctance to offer products that are in demand among demographic groups that are in the prime earning years may impact their ability to attract or retain members,” the study noted, adding that CUs may need to invest in payment innovation and technology to provide a wider range of credit products directly to their members to maintain a competitive edge in the industry.

On the upside, more than half of CUs are planning to offer credit-builder loans within the next year, a move that tackles a pressing need in today’s financial landscape, given the pivotal role credit scores play.

As separate PYMNTS research has found, few consumers have a good understanding of how credit scores work or how to improve their scores. Credit-marginalized consumers, who tend to resort to high-interest payday loans and riskier financial products to obtain credit, seem slightly more knowledgeable at 29% compared to credit-secure consumers, who stand at 28%.

“Credit-avoidant consumers are even less likely to fully comprehend the system, at 17%,” the report added, pointing out that “more than two-thirds of each group has a shaky understanding of the credit score system.”