BNPL’s Surge in 2023: Impact, Adoption and Regulatory Crossroads

From its nascent stages to its maturing as a force reshaping retail and eCommerce, installment plans, particularly buy now, pay later (BNPL) services, marked a pivotal chapter in 2023.

Amid high inflation and rising costs, the payment method allowing consumers to access goods through short-term, interest-free loans proved invaluable. In April alone, 16% of consumers in the U.S. — equivalent to 40.5 million people — used BNPL for at least one payment.

“Whether you have customers who are using BNPL because they need to or because they are using it for budgeting, there are multiple ways to use it, and that’s why BNPL is so successful and why it’s here to stay,” Sezzle CEO Charlie Youakim told PYMNTS’ Karen Webster in an August interview.

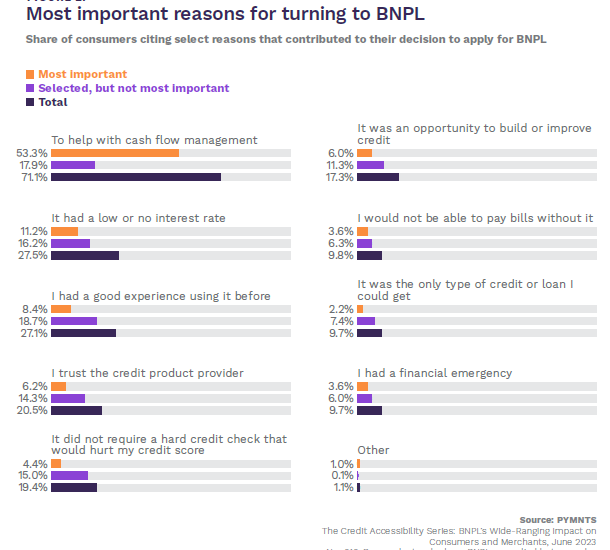

Youakim said BNPL has shifted into a “budgeting tool” for most consumers, who no longer perceive it as a traditional credit product. Instead, they view it as a means to effectively manage their cash flow, aligning precisely with how they prefer to use this payment option.

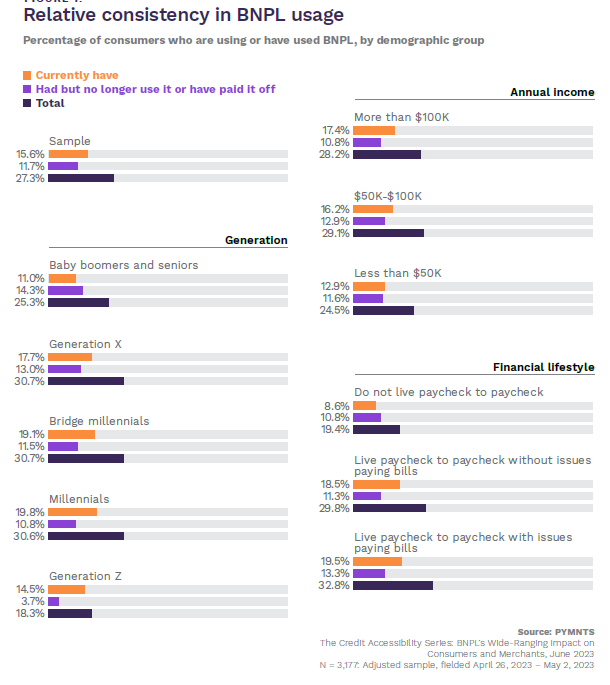

In 2023, the widespread adoption of BNPL cut across age demographics and income levels, encompassing both high-income individuals and young consumers navigating paycheck-to-paycheck lifestyles. Notably, millennials and bridge millennials emerged as the most frequent users, with almost half of this segment leveraging BNPL at least once monthly.

BNPL, and installment plans in general, were also indispensable resources during peak periods like the end-of-year holidays, facilitating purchases that might have otherwise been financially out of reach for budget-conscious consumers.

Against this backdrop, retailers who overlooked the significance of offering BNPL as a credit option likely experienced sales declines this year. This is particularly evident considering that over 40% of BNPL users indicated that the absence of this option would compel them to either postpone a purchase or opt for a cheaper product.

Capitalizing on this trend, some subscription merchants, attuned to attracting cash-strapped consumers, integrated BNPL. PYMNTS Intelligence data found that 11% of surveyed subscription merchants responded to this rising demand for flexible payment solutions, reflecting the trend within the subscription commerce sector.

Among the various BNPL providers, Afterpay emerged as the most preferred option among U.S. consumers, with 42% of survey respondents using it. Affirm followed closely with 37%, and Klarna with 34%.

Although PayPal Pay in 4 was not the most widely used system, it had the highest level of awareness among consumers, with 46% recognizing it as a BNPL solution. Other providers, such as Sezzle, Splitit, Four, Shop Pay Installments and Zip, also had a significant presence among specific consumer segments.

Regulating the BNPL Market

In 2023, the largely unregulated BNPL market faced imminent changes as governments globally began considering stringent regulations. Both the U.S. and the EU aimed to subject BNPL services to existing credit laws, signaling a shift from the previous laissez-faire environment.

In the U.S., the Consumer Financial Protection Bureau (CFPB) undertook a study highlighting the risks associated with BNPL, hinting at forthcoming regulations that might align BNPL services with traditional credit companies.

Meanwhile, the EU has progressed further, planning to integrate BNPL under the Consumer Credit Directive. This includes new protections to cater to mobile-first markets, such as banning pre-ticked contract boxes and mandating mobile-friendly contract presentations.

In the U.K., draft legislation was proposed earlier this summer, giving the Financial Conduct Authority (FCA) power to oversee interest-free installment credit and protect consumers from excessive lending.

Overall, the impact of regulations on BNPL providers will not be uniform. Providers using customers’ existing credit cards for purchases, rather than independent applications, already adhere to similar credit regulations as standard payment cards.

Consequently, these organizations are expected to experience minimal change with the introduction of new rules. In contrast, other BNPL providers must proactively adjust to forthcoming regulations to sidestep potential challenges.

What’s Next?

As 2023 draws to a close, the landscape of installment plans, particularly BNPL services, has undergone a significant shift. This year’s evolution wasn’t just about numbers and statistics; it was about the intrinsic role BNPL played in consumers’ lives.

It evolved beyond being merely a credit product, transforming into a versatile tool for budgeting and managing cash flow for consumers spanning various ages, income levels and demographics.

Heading into 2024, the industry braces for pivotal changes. Concerns loom large on the regulatory front as governments contemplate stringent regulations, aiming to safeguard consumers. This uncertainty casts a shadow on the future of this burgeoning industry.

Whether these shifts will stifle innovation or forge a more secure, consumer-centric landscape remains to be seen.