Well, for Facebook, it’s about what’s in a Messenger.

And about transforming social media into social commerce — something Facebook has remained fairly tight-lipped about, until recently, when asked about its plans for monetizing Messenger.

A peek into that vision emerged last August when David Marcus, now Facebook’s Messaging VP, jumped ship from PayPal to join Mark Zuckerberg’s empire. Many perceived the move as a real head-scratcher, others as a not-too-subtle signal about Facebook’s interest in leveraging and monetizing the combination of mobile and payments — two skill sets that were conveniently found in Marcus.

“The exciting thing about messaging,” Marcus said in a brand new interview with Wired, “and the reason I let myself be convinced by Mark not to be the CEO of a $50 billion company to build this thing, is I believe this is one of the biggest opportunities in the next ten years, and this is the best place to make it happen. We live in a world shaped by the Web on mobile, but Web is a desktop, not a personal experience. We see the world as people-based. If we can recreate that, it reinvents mobile interactions from the ground up.”

As of its last quarterly count in July, Facebook Messenger had hit the 700 million user mark.

Advertisement: Scroll to Continue

So, now the big question for Marcus, Messenger and Facebook is whether Marcus, who believes that commerce can be streamlined by making it easy for consumers and merchants to interact in real time in the context of a commerce experience, will use those skills and experience to deliver a payments and commerce edge for Facebook. And, if he’s successful, what that will mean for his alma mater and every other mobile payments scheme vying for their fair share of the commerce pie.

In that Wired interview, Marcus sounds pretty convinced — and convincing — that Messenger will become Facebook’s global commerce platform, even if it takes a decade or so to get there.

“Helping people communicate more naturally with businesses will improve, I think, almost every person’s life because it’s something everyone does,” Zuckerberg said at a developer conference in March.

Even Marcus’ boss, Mark Zuckerberg, has admitted that messaging is more popular than interacting via his social media platform. And to stay ahead of the curve, Facebook’s team knows it has to deliver what consumers want, and they have to find a way to monetize that vision.

“The long-term bet is that by enabling people to have good organic interactions with businesses, that will end up being a massive multiplier of the value of monetization down the road when we work on that and really focus on that in a bigger way down the road,” the bullish CEO said at a conference in July.

But why the big push for Messenger? And why now?

“The messaging era is definitely now,” Marcus told Wired. “It’s the one thing people do more than anything else on their phone … I believe that messaging is the next big platform. In terms of time spent, attention, retention, this is where it’s happening. And it’s a once-in-a-generation opportunity to build it.”

Which is where payments and commerce come back into the mix. And as Marcus explained, Messenger is about both adapting to human behavior but also influencing how those humans — AKA consumers — interact with one another and interact with businesses.

Which is no different than the mobile payments game: changing how consumers think about payments and think about paying merchants — whether it be online or off. And as we’ve all seen from the data about mobile payments (re: Apple Pay), changing consumers habits from a swipe to a tap (and to a dip) isn’t easy; payments isn’t a problem, at least in the physical store, that consumers feel they have.

All bets are off though in-app and via mobile. The question is whether Messenger can be the catalyst to solve a commerce problem for the consumers and the merchants it loves.

Connecting consumers to commerce opportunities, Marcus believes, is the first step in enabling that innovation for Facebook through Messenger. Making it easier for people to send money to a friend, to book a table at a restaurant or to book an airline ticket changes the end-to-end commerce experience that may get consumers over the hump.

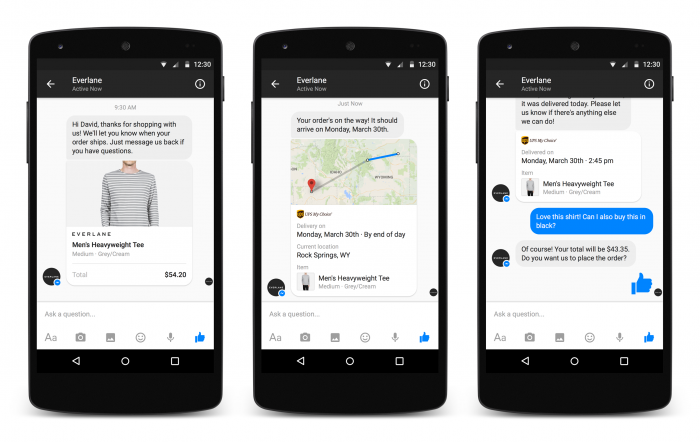

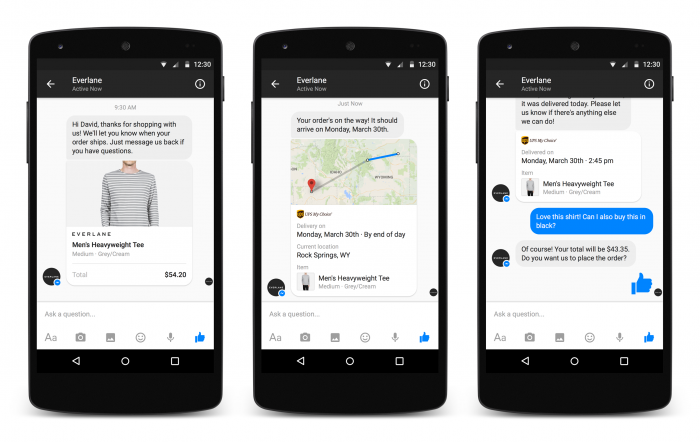

“Once you interact with a business, you open a thread that will stay forever. You never lose context, and the business never loses context about who you are and your past purchases. It removes all the friction,” Marcus said, explaining how Facebook will be doing just that via deals like its airline partnership with KLM.

But enabling payments and commerce, Marcus said emphatically, doesn’t mean getting into payments.

“We don’t want to build a payments business,” Marcus noted, “but we absolutely need to build a frictionless payment experience when people are in threads. If I have a flight open with KLM, I should be able to book my next flight and have a one-tap purchase experience. Same for eCommerce. The first baby steps are peer-to-peer payments in the U.S., which will expand into different countries.”

So, what is his non-payments payments vision?

Enabling better commerce experiences across the Facebook Messenger platform by creating better experiences and richer interactions. Then, from there, the rest fills in the gaps.

“We want the maximum number of transactions on the platform, while enabling the best possible mobile experience for commerce. The margins on payments aren’t that high, and we want the broadest reach. Businesses will want to pay to be featured or promoted, which is a bigger opportunity for us.”

And that’s, apparently, what’s in a Messenger.

Commerce. Engagement. Experience. Loyalty. Payments.

Sounds awfully similar to the chatter in the payments and commerce industry today.