Shoppers Spend Twice as Much with General Purpose Credit Card Installment Plans than BNPL

Pay later plans break up the cost of purchases into smaller scheduled payments over time. These plans have gained popularity with consumers. However, PYMNTS Intelligence data reveals that some confusion on the part of merchants lingers as to which plans best meet the needs of their customers.

According to “Unpacking Merchant Strategies and Consumer Demand for Flexible Payment Plans,” a report in collaboration with Splitit based on a study of 100 merchants, 30% of consumers want to know their pay later plan options before they buy. However, we found that very few merchants are actually set up to offer the options most consumers want. For instance, 18% of merchants lack buy now, pay later (BNPL) options, which are especially popular with today’s consumers.

Data reveals that consumers exhibit a preference for installment plans using general-purpose credit cards for larger purchases, whereas they prefer BNPL plans for smaller purchases. The data shows that 80% of customers prefer BNPL for purchases of less than $100, while only 10% prefer BNPL when spending more than $1,000.

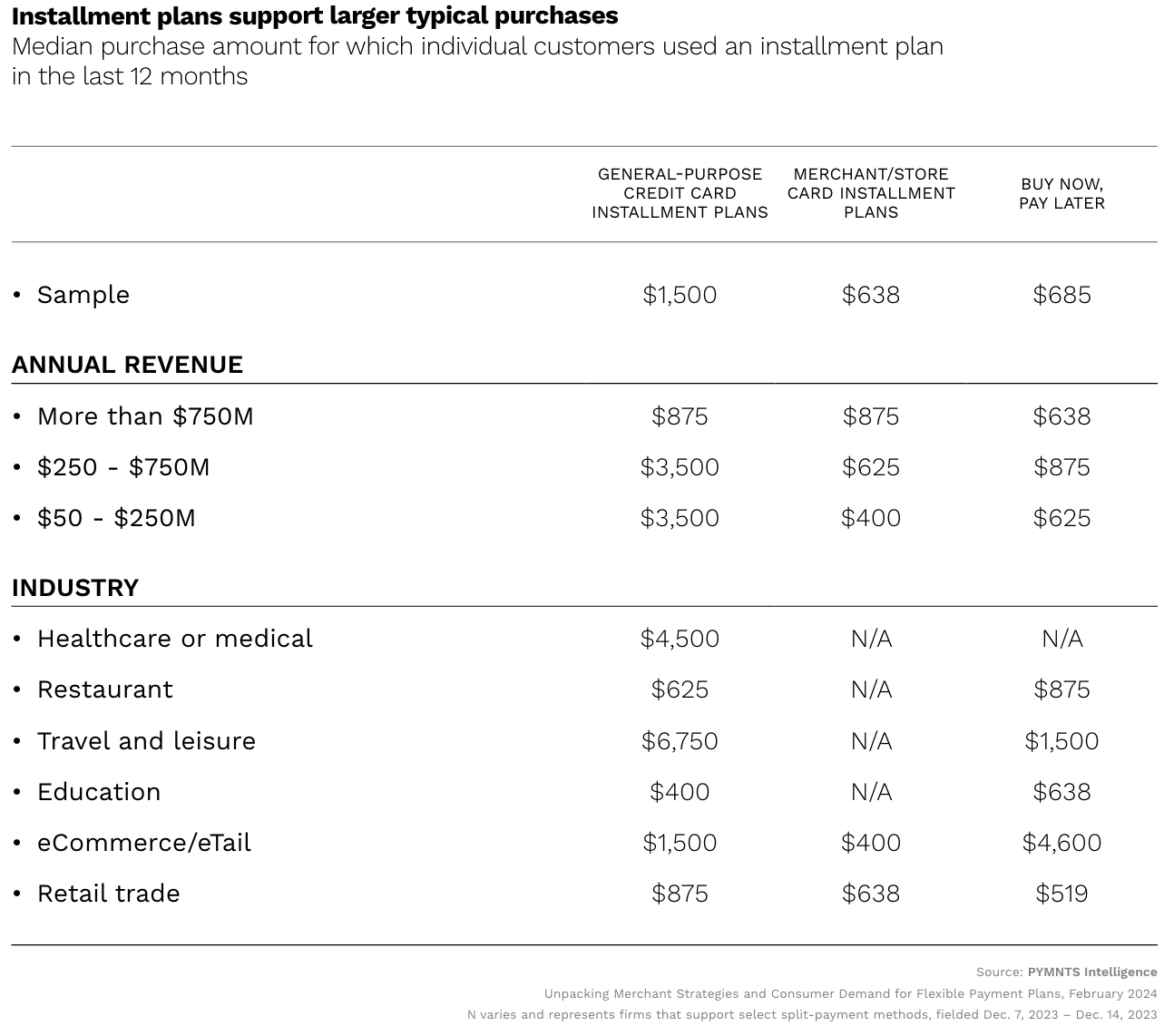

These spending patterns inspire merchants to offer split-payment options, because data suggests that offering such plans encourages customers to spend more. The typical purchase made with a general-purpose credit card plan in the last 12 months was $1,500 — more than double the median $685 purchase made with BNPL. Meanwhile, when using specialized merchant or store card installment plans, they spent even less: $638 on average.

But, with larger price tags come longer repayment timelines. This explains why consumers use general-purpose credit card installment plans for big-ticket items. The typical credit card-based purchase plan in the last year was paid down over 18 monthly installment payments, while the average merchant/store card installment plan purchase was spread out over 14 months. Eight months was the average timeframe for consumers to pay for BNPL-powered purchases.

As the chart above illustrates, a merchant’s annual revenue and the industry they serve are two key factors shaping their preferred installment plan choice.

For merchants on the high-end of annual revenues ($750 million or more), general purpose and merchant/store card installment plans meet customer needs, with median purchase amounts of $875 for each category. BNPL purchases for these merchants, meanwhile, have a median of $638. These high-revenue companies appeal to a wide range of consumers, whereas boutiques and luxury spots are more specialized, generating less revenue, but selling much more expensive products.

When shoppers frequent merchants with smaller annual revenues ($50 million to $250 million) and mid-sized revenues ($250 million to $750 million), they use general purpose card installment plans but spend $3,500, although shoppers of these smaller revenue firms spend only $400 per purchase when using merchant or store cards.

This could suggest that general-purpose card-linked installment plans are typically more available at luxury merchants, or that many store card-linked plans target purchases that may be smaller. Those mid-sized merchants, by the way, see the most BNPL spend ($875) on purchases, on average.

These spending patterns suggest that consumers select installment plan options based on the purchase price and payoff periods. Knowing this should help merchants strategically align the payment options they offer with what their customers want.