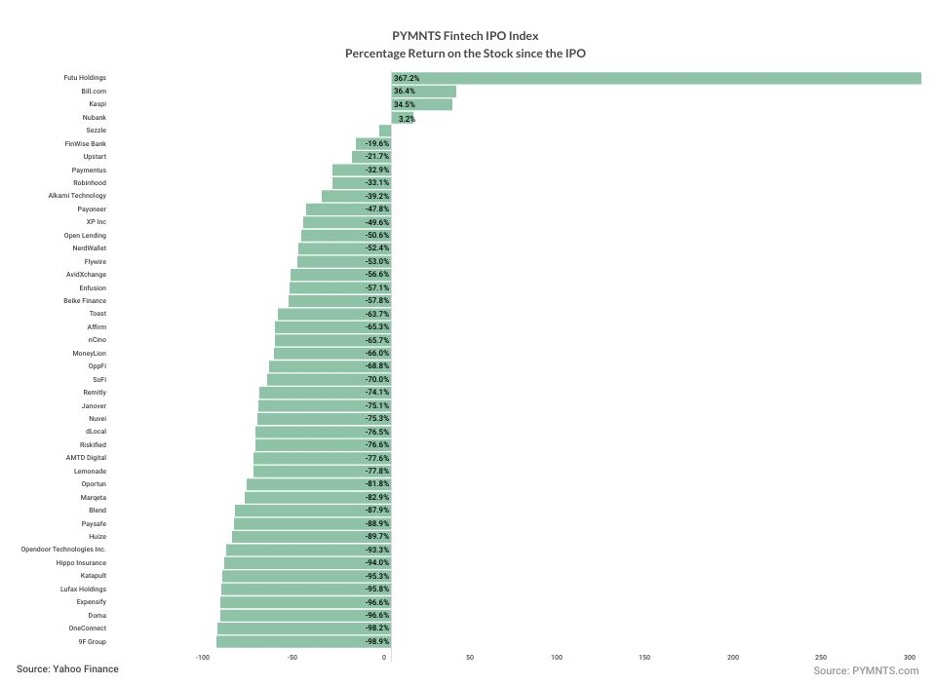

FinTech IPO Tracker Loses 3.8% Despite Affirm’s Rally on Apple Pay Tie-up

Affirm saw its stock rally 7.8% this past week, but the overall trend for the FinTech IPO Index was down, as the group sank 3.8%.

Affirm Gets a Bump from Apple

Apple said that Apple Pay users in the United States will be able to apply for buy now, pay later (BNPL) loans through Affirm during checkout. The announcement was among several new features being added to Apple Pay later this year.

Affirm disclosed the new offering in a Tuesday (June 11) filing with the Securities and Exchange Commission, saying: “Affirm does not expect this partnership to have a material impact on revenue or gross merchandise volume in fiscal year 2025.”

PYMNTS Intelligence found that Apple Pay has surpassed PayPal as consumers’ preferred in-store mobile wallet. As of the second quarter, roughly 6% of consumers made their last retail purchase using Apple Pay, compared to 4% who opted forPayPal.

Separately, Affirm said earlier this month that it had debuted Pay in 2 and Pay in 30, designed to offer customers more flexibility and affordability. The new offerings let consumers split the cost of their purchase into two interest-free payments each month, or to pay in full interest-free within 30 days of their purchase. It joins Affirm’s Pay in 4 and monthly installment plans.

The company pointed to Bureau of Labor Statistics data showing that more than 30% of non-farm workers are paid either semi-monthly or monthly. According to the release, Affirm has seen an uptick in cart conversion within its app since offering its Pay in 2 and Pay in 30 options. The company plans to test and roll out these options more broadly to its merchant partners in the months ahead.

Other Names Were Mixed

Huize said it has partnered with PICC Property and Casualty Company Limited to launch “WarmTreasure No.3,” a customized child outpatient and emergency insurance product in the “WarmTreasure” series.

“With optimized reimbursement, expanded coverage and additional benefits, the upgraded version delivers enhanced cost-effectiveness and product value to families with children,” the company said. The offering enables expandable reimbursement for self-paid drugs and reimbursement of up to 100% for medical expenses covered by China’s social insurance system, among other features.

Huize’s shares gained just under 2%.

Robinhood posted its May operating data, and said that its funded customers at the end of May were 24.1 million, up approximately 120,000 from April 2024, and up 960,000 from a year ago.

Assets under custody at the end of May were $135 billion, up 9% from April and up 65% year over year. Net deposits were $3.6 billion in May, translating to a 35% annualized growth rate.

The company said that total cash sweep balances at the end of May were $20.3 billion, up 6% from the end of April and up 81% YoY. Total securities lending revenue in May was $23 million, up 53% from a year ago.

Robinhood shares were up 1.5%.

BILL shares gave up 5.4%.

As PYMNTS reported Wednesday (June 12), Regions Bank has launched a new digital payments solution designed to streamline payment and billing processes for its commercial clients. Powered by BILL’s financial operations platform for small- to medium-sized businesses, the new Regions CashFlowIQ provides advanced accounts payable and accounts receivable capabilities, the companies said.

With Regions CashFlowIQ, businesses can use a single portal — the Regions OnePass portal — to initiate bill payments, create and send customized invoices, track payment information, streamline workflow approvals and automate payments.

Nuvei’s stock was 0.3% lower. The company said this week it had struck a partnership with ViaPlus, a subsidiary of VINCI Highways.

The partnership will integrate ViaPlus’ mobility back office, which processes and financially reconciles large volumes of transactions, with Nuvei’s global acquiring and processing reach and capacity to manage a wide variety of digital applications through extensive Alternative Payment Methods integrations, according to this week’s announcement.

ViaPlus’ integration to Nuvei’s payment technology platform introduces over 700 new payment types to the ViaPlus system to form a new digital payment network called ViaPlus Nexus, the companies said.