Nine Things Payments Execs Need to Know for Their 2025 Business Plans

Summer should get a speeding ticket, a wise person once said, and that’s a reality that all of us living in the Northern Hemisphere came to grips with last weekend. The Labor Day weekend marked the unofficial end of summer, and the start of the four-month sprint to the end of the year.

Along with the rituals of putting away the summer wardrobe and sending kids back to school comes the strategic reflection: what’s now, what’s next and what becomes part of the 2025 business plan.

And the onramp to the second half of the decade.

Those plans have rich context to consider.

New data from PYMNTS Intelligence finds that consumers in the U.S. engage in an average of 14 different digital activities each month: paying bills online, conducting telehealth visits, streaming music and videos, and shopping and paying for groceries and retail products using digital payments and apps.

The U.S. may not be as digitally-forward as Brazil, according to our 11-nation study about How the World Does Digital, but its consumers are embracing a digital-first economy. Digital-native generations like Gen Z and Zillennials will fast-track that reality for the businesses they shop with and work at — bringing their parents, grandparents and corporate colleagues along for the ride.

Advertisement: Scroll to Continue

| Success won’t be measured by the products a business makes or sells, but how well they create and monetize ecosystems that connect activities across traditional industry sectors. |

New cutting-edge technologies are a part of those plans, especially GenAI, and innovations in digital payments change where and how consumers and businesses find each other and do business; making those transactions faster and more efficient. Our connected, soon smart voice-enabled, digital economy is moving commerce to any internet-enabled endpoint, anywhere in the world. That will force business models to change and foster an adapt-or-die subtext in strategic plans.

As digital becomes the DNA of business, success won’t be measured by the products a business makes or sells, but how well they create and monetize ecosystems that connect activities across traditional industry sectors.

As I have written many times, payments is the cornerstone for this digital transformation.

Networks will become the catalyst for growth, profits and scale because they have the power to connect stakeholders and simplify and monetize value exchange. Networks give innovators a way to enrich their value. Those themes run through the PYMNTS Intelligence findings we’ve reached based on tens of thousands of surveys and millions of data points.

This is not an altogether new story, but the combination of cutting-edge technologies and payments makes it a different one.

We see evidence of new networks being formed or contemplated as businesses take stock of their customer assets. Payments introduce new ways to create and monetize engagement.

Technology paves that path.

Business models become the source of competitive differentiation, scale and platform ignition in a timeframe that works for customers, investors and the network operators. It’s the challenge that has vexed platform businesses for millennia. It remains the siren song that beckons business executives and innovators to try anyway.

Looking back at the summer of 2024, and the strategic plans that will soon grace the pages of a thousand PowerPoint decks, here are nine trends that businesses should consider as cornerstones for planning for success in an economy undergoing intense disruption from new technologies.

One: Embedded Everything

Embedded is the prefix for most of the innovations we talk about now in payments. We embed payments into software (something we’ve been doing ever since the dawn of eCommerce), identity into payments, lending into checkout flows, banking into virtual accounts, point solutions inside of tech stacks, GenAI into software, offers into banking apps, and networks into networks.

According to PYMNTS Intelligence, nearly all software platforms, PayFacs and marketplaces have plans to either embed or enable embedded solutions inside of their ecosystems either this year or next.

A lot of what was called invisible at the dawn of the 2010s with the introduction of Uber is now described as embedded. I guess we’ve evolved. Embedded is a given, tablestakes, the key to conversion. But it’s not enough to just “embed” something into something else. Embedding should be almost invisible and frictionless.

Looking ahead, embedding is the beginning, not the end — making the application of embedded about the how and the what instead of just the why.

Two: Power Shifts to Issuers

Payments processing is a commodity — a low-margin race to the bottom. Regulators in the U.S. and worldwide want to see it commoditized further, threatening the economics of the traditional four-party model. At the same time, banks and corporates watch every day as payments are a one-way ticket out of their customer’s bank accounts and into someone else’s — billions, and even trillions of dollars a year.

| Non-banks will become issuers of virtual accounts with feature-rich functions that go well beyond a one-time-use virtual card that is just another transaction. |

Those dynamics should force a shift in the conversation about payments towards a strategic source of value, an opportunity to create and monetize new account relationships, turning a one-way ticket out of one bank account into an opportunity to create a new account relationship with added value. Non-banks will become issuers of virtual accounts with feature-rich functions that go well beyond a one-time-use virtual card that is just a way to complete a transaction.

New payments economics beyond interchange — and new ways to incent the right behaviors and stickiness — will matter as much as the technology that makes all this possible. That will shift the power to the issuer, who holds the deposits and can monetize them inside of these closed-loop ecosystems. And the business models that bring it to life.

Three: The Monetization of Instant

We live in an on-demand economy: What we want, we want right now. And when it comes to money, right now means in an instant.

Yet there is an assumption that, when it comes to money, “right now” also means free — even though consumers pay for “right now” in almost every other part of the on-demand world.

It costs money to order food from Uber Eats or aspirin from Door Dash to get it delivered in 30 minutes. Amazon’s same day or overnight delivery isn’t free — there is an annual subscription fee and often a minimum basket size. Consumers can binge watch movies or TV shows on Netflix, on demand, provided they are a subscriber.

For consumers and small businesses, instant payments become much needed cash flow. We have plenty of evidence that both will pay for speed because it is cheaper and more predictable (and safer) than filling cash flow gaps any other way.

Maybe they won’t pay for instant all the time, but they will when it is most necessary or when it gives the receiver peace of mind that the money is there just in case; PYMNTS Intelligence finds that to be the case for medium-size small businesses as well as parents who are constantly juggling the expenses of raising a family, to take two examples.

Instant is offered to consumers and small businesses much less often than they’d like, according to our research. Nearly 80% of consumers and SMBs would pick instant if they could, it’s offered less often than receivers say they’d like. Finding ways for payors to monetize instant could change that.

Four: From Cards to Credentials

Ten years ago next month, Apple Pay was launched. It was hailed as a digital payments innovation, a new form factor that would make plastic cards irrelevant.

It hasn’t.

Far more important than turning a phone into a form factor was the tokenization of card credentials, the mobile wallet superpower that transcends using the mobile “Pays” to complete a transaction at the physical point of sale.

| Tokenization creates a more inclusive environment for distributed commerce. |

Tokenization makes online checkout easy, secure and customer-friendly and recurring payments reliable. It expands payments acceptance to all end points that accept cards, overcoming wallet POS acceptance barriers.

Tokenization breaks the consumer, issuer and merchant dependence on wallet acceptance and wallet fees, creating a more inclusive environment for distributed commerce — cross-channel, cross-platform, cross-operating system.

We see innovators using tokens to reinvent user journey and flows, making it one-click, and sometimes no-click. And embedding shopper identity and preferences into those credentials to make them smart, personalized and relevant.

The shift from cards to credentials isn’t just a consumer play. It is also a powerful B2B innovation that creates frictionless commerce opportunities between trading partners. It is already changing the utility of wallets and how they are used, making them less about payments and more about the digital hub for doing business in a digital world, giving corporates new ways to engage their stakeholders across complex financial supply chains.

Five: Fraud Forces Focus on Finding Source of Truth

Good data delivers new insights that help businesses see around the corner. Here is one of them. The fear of “getting it wrong” slows company growth for businesses of all sizes, when getting it wrong means deciding not to enter new markets or segments for fear of fraud.

Businesses have every reason to be wary.

AI-powered fraudsters create sophisticated schemes to trick consumers and businesses into funneling money their way. The risk of getting it wrong is now very high, and unless something is done, it could get worse as AI rapidly improves.

The battle lines are being drawn over the source of truth: what is it and who has it? Businesses want answers.

What is the source of truth for consumer and business identity? The UnitedHealthcare hack, combined with the hack of background check database National Public Data, gives fraudsters nearly everything necessary to create an identical, digital twin of sorts on the web.

For customer data, what is the source of truth about preferences and use cases? The water is muddied by ad blockers and far too many paper-based records and data silos in businesses.

For lenders, what is the source of truth for assessing the risk of a consumer or a business? Credit scores for consumers are a rear-view mirror look, and for businesses there is a lack of standardization for business credit reporting.

Networks and consortia are emerging to create certainty about people, businesses and transactions in a world where onboarding speed is critical and face-to-face is either impractical or illusive. For the nearly half of businesses that turn away new business, solving that problem will help them drive top-line performance.

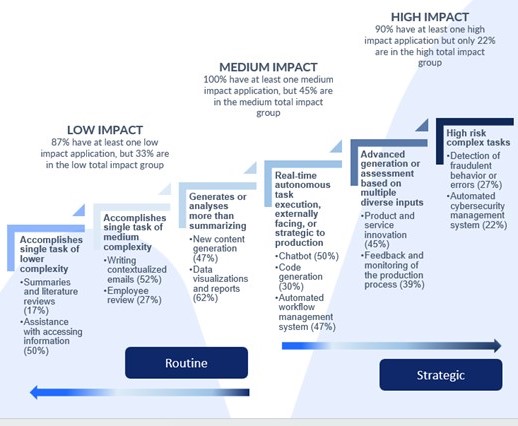

Six: GenAI Moves Up and to the Right, Even Without Knowing the ROI

PYMNTS Intelligence has studied roughly 450 C-Suite executives since January to get a read on GenAI sentiment across the enterprise, its application, and the ROI of those efforts. CFOs, especially, say that GenAI is the most significant technology innovation of their lifetime. That’s pretty good news, since they ultimately sign the checks for those investments across the business.

More interesting is how the enterprise uses GenAI. Here we find that large corporates apply it to more strategic areas of the business – moving from GPT-ing emails and reports to fraud (where AI has been a force for many years), product innovations and process improvements.

Source: PYMNTS Intelligence

These execs are committed even though we’ve seen a shift over those eight months in the importance of ROI when making those investments. We’ve observed a simultaneous increase in investment and application of GenAI to the business in support of more strategic initiatives, and the decrease in expectations for a more immediate payback.

The C-Suite recognizes that GenAI and AI more broadly will change their business and the competitive landscape. Not being able to measure outcomes right now, or estimate ROI reliably, isn’t stopping them from using it, and investing in it, and rethinking how their own business will do business in the years ahead.

Based on the conversations I’ve had with C-Suite execs, they believe that the return on not-investing — waiting to get all the answers first — could be highly negative, maybe fatal, to their business.

Seven: Uncertainty Is the Invisible Tax on Business

Uber’s biggest innovation in 2009 wasn’t making payments invisible, it was monetizing certainty. Not knowing how long it might take to find an empty taxi during rush hour, or any hour, or wondering whether one would show up at 5 AM for a ride to the airport was its central value proposition — eliminating the uncertainty that defined the taxi industry for decades. Certainty (and invisible payments) is the foundation for the $154 billion business that is Uber today.

More generally, not knowing costs businesses money, opportunity and confident decision making. Data in real time creates certainty, but getting data ready is complex; data silos are hard to crack. Decision makers devolve into “analysis/paralysis” – as they pore over incomplete data and make risky assumptions to fill in the gaps.

The PYMNTS Intelligence team has been running The Certainty Project study since January to size the cost of uncertainty for middle market companies.

It’s not nothing.

| CFOs will invest in workflows and tools to reduce uncertainty, giving them visibility in data and payments flows. |

We estimate that uncertainty costs about 4% of annual sales and 8% of sales for the middle market firms on the smaller end of the sales spectrum. Waiting, not knowing, cost middle market firms opportunities, clients and staff.

Not surprisingly, uncertainty’s ripple effect can be felt up and down the financial supply chain. Companies with higher degrees of uncertainty pay slowly — creating cash flow issues for receivers that then create cash flow for their suppliers.

CFOs will invest in workflows and tools to reduce uncertainty, giving them visibility in the data and payments flows that offer a clear line of sight into their business and market dynamics, and the tools to help them fill the gaps.

For most businesses, the greatest source of uncertainty is not knowing when they’ll be paid, when the money will hit their bank account. Knowing, with certainty, when money will arrive is almost, with the emphasis on almost, as good as getting it. At least those CFOs know when and can plan.

Eight: Legacy Has a Renaissance

Legacy is a funny word. When the world lost Berkshire Hathaway’s Charlie Munger at the age of 99 earlier this year, the media spoke of the rich legacy that he left behind. His writings, his investment theses and his authentic called-it-like-he-saw-it approach are all part of Munger’s indelible imprint on business strategy and investing.

His legacy.

| FinTechs are embracing their inner legacy to help legacy tech innovate outside of their core. |

When we talk about legacy in payments and financial services, it isn’t usually that flattering. The conversation is about tech debt and slow movers, systems that are out of step with the times. The expiration date for legacy is also getting shorter. Tech that is 60 years is prehistoric. Tech that is 20 years old might as well take its final victory lap right now before riding off into the sunset.

What’s missing in the conversation about legacy is the part that isn’t about the tech. It’s the part about the rules of the game. The regulatory and compliance part. It’s the unit economics of the business part. It’s the complexity of building a financial network part, and coloring within the lines that regulators have drawn and keep redrawing part.

We were forced to take another look at legacy as the payments and financial services industry melted down over the antics of several bad actors playing in the Banking-as-a-Service sector.

Durbin-exempt banks could be part of the cool FinTech ecosystem, get those deposits and change their business. FinTechs could work with those banks, offer banking services to consumers and businesses, share in the interchange fees, without being one. Everyone could live happily ever after.

A few really didn’t. And the happily-ever-after story is looking less happy for a large swath of BaaS innovators forced to change their models and hope for the best. Even more fallout is expected. Consolidation is inevitable.

Regulators aren’t shy now about aggressively examining and sanctioning FinTechs and FinTech models. Banks and payments ecosystem reassess FinTech partnerships. Sponsor banks turn down more deals and take longer to look at the ones that they’ll green light in the end.

Legacy is starting to look like the wise elders — but now with better tech and rock-solid compliance. And more heavily-regulated FinTechs aspire to look like the best parts of legacy — with better tech and buttoned-up compliance. There is a new happily-ever-after-story in the making, as FinTechs are embracing their inner legacy to help those wise elders innovate outside of their core.

Nine: Simplicity Is the New Business KPI

Inertia remains a seemingly incurable disease in many pockets of business today.

Take checks. In 2023, there were 3.1 billion commercial checks written and cleared in the U.S., according to the Federal Reserve, worth about $8.4 trillion. The average check amount was $2,662. That’s about 7% fewer than the 3.3 billion checks written in 2023 and the $8.9 trillion in value they represented.

Here’s the stunner.

Businesses in the U.S. are writing half as many checks as they did in 2012, but the average value of the checks has more than doubled. The average value of a check then was $1,273; in 2023 it was $2,652. That’s been the trendline ever since: smaller numbers of checks, higher value of the checks being sent.

What?

Well, mobile deposit and mobile check cashing makes depositing a check easier for consumers and businesses. They may not want to get them, but it’s money all the same. Corporates need a better reason to kill the check, and a less complicated way to do that without killing their payments workflow in the process.

Complexity powers the status quo.

When something is too hard or takes too long or has an uncertain payoff, it’s easy for a business executive to say no, not now. Easier for a customer to find an alternative that’s easier to do business with.

Simplicity is the appeal of embedded everything — making four steps into one drives conversion, satisfaction, trust and preference. It’s the value proposition of everything from payments orchestration to PayFacs, neobanks to new payments flows.

Intermediaries will use new technology and business models to make complexity invisible to the user and to the bank or business that wants to make it possible for their customers. Digital economy winners will make commerce a one-touch experience that abstracts the complexity of identity, eligibility and payments for key stakeholders. Millennials and Gen Z will force that change.

KPIs are the linga franca of the board room and strategy decks. They measure every aspect of business performance. Except one.

How easy is it for people and businesses to do business with me?

Answering that comes back to an understanding of the frictions that get in the way of “doing business,” which becomes an opportunity to make it easier. And an assessment of the capabilities that exist or could make yours an attractive option to consider.

Cool tech and embedded everything are one part of the answer. Keeping it simple is ultimately the one that will get you the business.

A Final Thought

C-Suites and Boards that account for these nine trends in their 2025 plans can ride through the turbulence caused by disruptive innovation and the emergence of new critical technologies in the second half of decade. They stand a chance of coming out on top. Those who don’t may not have much to celebrate in 2030.