Small business once employed 50 percent of all workers in the U.S. and created 65 percent of net new jobs. No more. Karen Webster says that for the last 30 years, the big got bigger and the small, well sorta disappeared. Changing that picture for retail, she says, isn’t about listening to its “walking dead” but the innovators creating new ways for retailers large and small to reimagine – and deliver – what’s next. She lays out a small business story that’s not really been told – and its impact on the future of retail. Check it out.

Here’s a question: Does the U.S. have a retail crisis — or a small business crisis?

Here’s an answer. We have both.

Which is why “fixing” retail must include giving SMB merchants the tools they need to compete in the very dynamic environment that now defines Retail U.S.A.

Let me explain.

Chevrolet may use “the heartbeat of America” as its advertising tagline, but it’s small business that everyone believes keeps the heart of the U.S. economy pumping. Twenty-six million strong, employing 50 percent of the workforce and creating 65 percent of all new jobs, SMBs and storefronts that line the side streets and main streets of our cities and towns are the fuel that keeps our economic engines humming, roughly 100 million Americans employed and what feeds a thriving middle class.

Well, that used to be the story line.

The truth is that America’s small business engine is sputtering and has been in a gradual decline for the better part of the last four decades.

That somewhat revised storyline has also been somewhat of a well-kept secret.

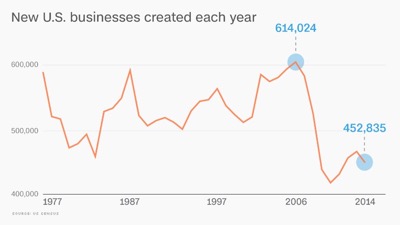

Between the late 1970s and the mid-2000s, like the sun rising in the East, the U.S. could count on between 500,000 and 600,000 new businesses opening every year. Things went off the rails, not surprisingly, in 2008 — courtesy of the financial crisis.

Between the late 1970s and the mid-2000s, like the sun rising in the East, the U.S. could count on between 500,000 and 600,000 new businesses opening every year. Things went off the rails, not surprisingly, in 2008 — courtesy of the financial crisis.

But unlike the comeback stories of past recessions, small businesses haven’t come back this time. After a high of 614,024 SMB openings in 2014, the Census reported that only 452,835 firms were started in the U.S. that year.

Only, you say, but that’s not too shabby — and at least it shows forward progress, right?

Economists don’t think so.

They’re troubled by these numbers because they believe we’ve had adequate time as an economy to get the SMB growth engine revving again. And they fear that the impact on the vitality of the local economies that this void has created won’t be fully felt for a decade or more.

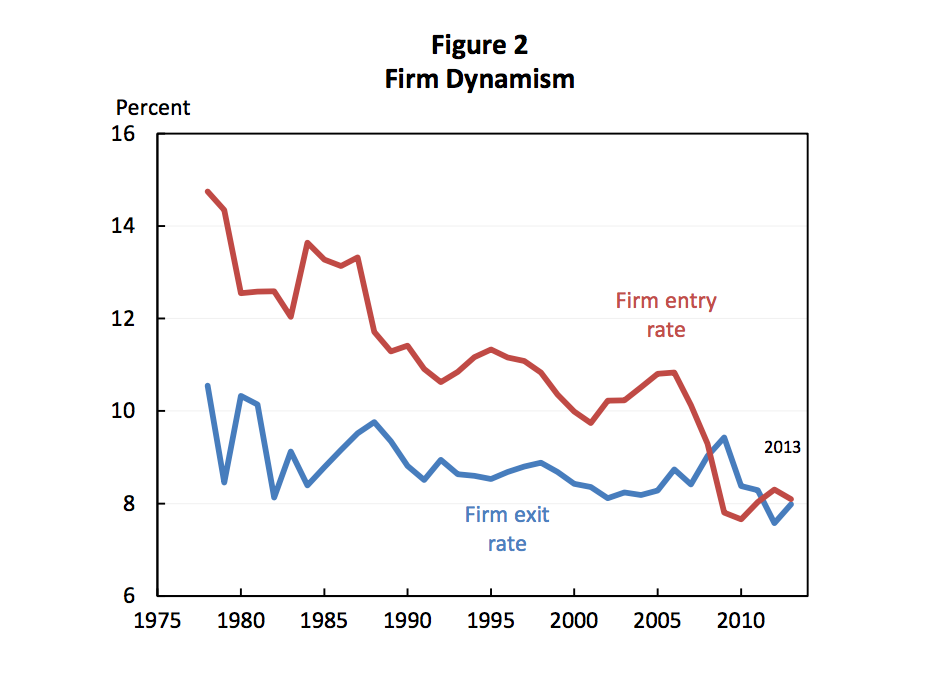

Of course, business openings are just one part of this story: Business exits (AKA failures) are the flip side of that small business coin — and where those same dismal scientists say there’s even more cause for concern.

Small businesses are also risky businesses, and the Small Business Administration tells us that 60 percent of them won’t make it past their first birthday, never mind reaching their second, third or magic five-year milestones. Only a third, they say, will ever cross into double-digit territory and celebrate a decade of being in business.

Source: Beyond Antitrust: The Role of Competition Policy in Promoting Inclusive Growth Jason Furman Chairman, Council of Economic Advisers

Historically, that failure rate was eclipsed by the sheer number of new business starts each year. More businesses opened than closed — until 2008. That year, for the time in more than 30 years, SMB closings outnumbered openings — and by a big margin. That year, the country was left with a deficit of roughly 100,000 small businesses. And that trend line really hasn’t reversed course all that much since then.

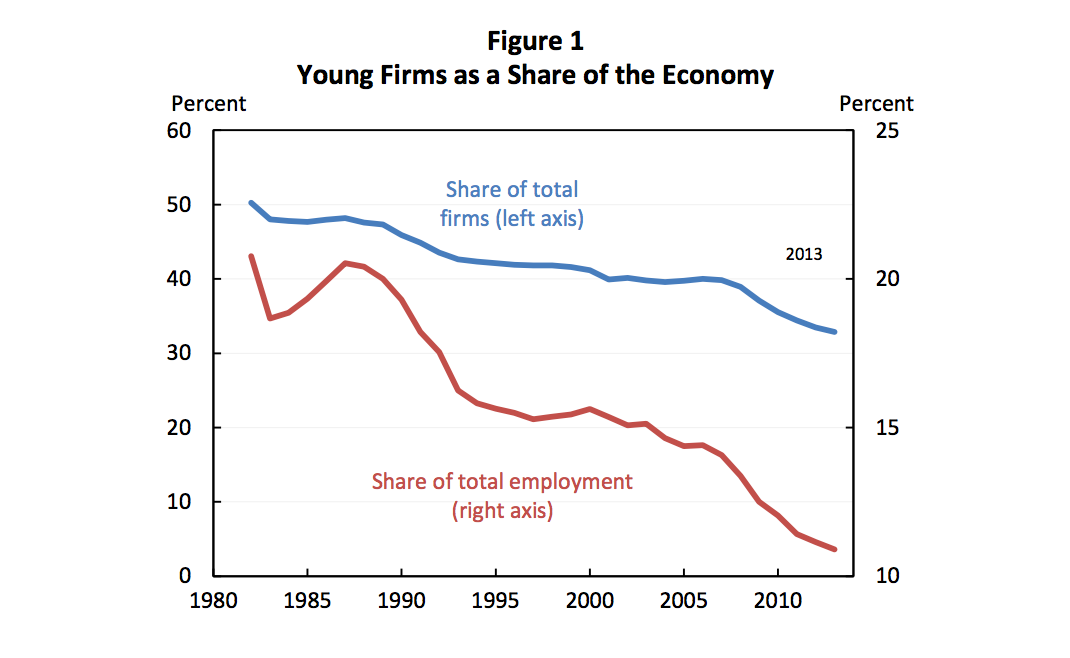

Taken together, this marks a very different small business scene in the U.S. today — one that Jason Furman, the chairman of President Obama’s Council of Economic Advisors, detailed in a speech he delivered in Chicago last fall. In addition to telling the story of small business in a 30-plus year tailspin, he also burst the bubble of of small business as the employment engine that it was once touted to be.

Source: Beyond Antitrust: The Role of Competition Policy in Promoting Inclusive Growth Jason Furman Chairman, Council of Economic Advisers

In 1982, he reported, firms that were five years or younger accounted for roughly 50 percent of all firms and a fifth of all employment. By 2013, those numbers had deteriorated — and by a lot. Those same tenured businesses accounted for only one-third of all firms and only one-tenth of all employment.

And in a lot fewer places than they used to be.

Census data reports that, in the early 1990s, 125 counties in the U.S. collectively generated 50 percent of the new businesses in the U.S. — a period of time that followed the late 1980s recession. In the aftermath of 2008, only 20 counties — most of them rimming major cities and tech hubs — drove 50 percent of small business formation.

The mix of these businesses is also very different. The businesses that we track and profile in our Store Front Index — the home remodelers, salons, spas, small retailers, delis, coffee shops and restaurants that contribute to the health and vitality of the local communities — are not only declining, they’re not even getting off the starting blocks. No small businesses in those areas means no SMB jobs in those markets. Brookings reports that the 100 largest metro areas in the U.S. had recovered all of the jobs lost in the 2008 recession — plus, added 6 million new ones. The rest of the country, combined, added 300,000.

The same economists who paint such a dismal picture of small business are also hard-pressed to pinpoint precisely why the once-vibrant SMB sector in the U.S. has suddenly dimmed. But parsing through the many reports on this topic, there are a couple of clues that emerge, ranging from an onerous regulatory environment that makes it harder, longer and more expensive for new businesses to get started (even retail storefronts), to banking regulation that has cut off the supply of capital to small businesses, to what I call “The Darwin Theory” — the survival of the fittest.

Economists increasingly point to a concentration of businesses now across just about every sector. Furman, in his speech, said that an Economist report published in 2016 showed that the top four companies in more than 40 percent of the 900 industries they examined controlled more than a third of the market. That was up 28 percent from just two decades earlier.

So, what does this all have to do with retail?

The “crisis” in traditional retail is one we’ve documented very well over the years — flagging the issue of retail’s death spiral some three years ago when reports about the decline in foot traffic over the holiday season in 2013 surfaced. While it was easy to chalk things up then to the financial crisis and the consumer spending hangover that resulted, we dug deeper and discovered the enormous shifts in buying online from physical stores that had been underway. And, like the turmoil facing small business, also unreported.

Department stores, sporting goods stores, specialty retail, jewelry, books and music — the list goes on and the shift online more dramatic by the year. The percentage of sales lost by those physical store franchises can be seen not only in the pretty charts and graphs that we produce and share on a regular basis but the ongoing drumbeat of the national and regional store closings for those brands that can no longer keep up.

And just like every other industry, there’s concentration. More than 38 percent of the market is the domain of 50 large firms, up 11 percent from 1997.

But maybe that’s the good news.

Call me crazy, perhaps, but I’m looking at the glass half-full here and pointing to the 62 percent of the market up for grabs — ready to be reinvented by the creative minds of entrepreneurs who can tackle the retail sector now with an arsenal of tools and platforms that help level that playing field and give them a fighting chance.

In 1997, or even 2007 or 2008, there weren’t very many well-developed aggregators to help small merchants with a great product or a service be discovered by a customer in their ‘hood.

Or marketplaces where a retailer with something to sell had a place to get tons of eyeballs on those products. Or for buyers and suppliers more generally — tradespeople, hair stylists, therapists, fitness classes — to find each other and do business.

It also wasn’t easy for any of that to happen in reverse. There weren’t platforms that made it easy for online retailers to easily extend their product selection to include unique products and services from a myriad of independent businesses and to become their own marketplaces.

There weren’t easy ways to innovate retail business models. Today, subscription commerce platforms make “box of the month” businesses a manageable reality. Installment credit options also help convert more shoppers to buyers by financing a single product — instead of having to rely on a credit card.

There also weren’t eCommerce platforms that made putting up an online storefront easy, cheap and professional or advertising platforms that made it possible to serve targeted ads to likely buyers. It also wasn’t easy for consumers to check out online (hey, it still isn’t perfect — we have a long way to go), particularly when doing so on their mobile devices, or acquirers who did more than just throw a terminal on the counter and a rate card at the owner and wish them good luck.

But SMBs today have all of those options — and more — thanks to a cadre of innovators who see the power and potential of giving them new tools to start and grow their businesses — at the same time, contributing to the health and vitality of their local communities.

It’s that optimism, that belief in the power of how small and medium and large retailers take advantage of these innovations to transform retail, that is one of the reasons that we, at PYMNTS, were inspired to create National Merchant Day.

We believe that the future of retail won’t be defined, or even inspired, by retail’s “walking dead” — so, why bother to listen? National Merchant Day (NMD) is our annual focus on the innovators and innovation that will help the storefronts that line those main streets and side streets of our local communities survive by giving them a hands-on way to experience how innovation can create new models and new experiences that delight consumers and strengthen the retailers eager to embrace it.

After all, every large merchant started out as a small one.

Starbucks was a single storefront that didn’t even brew coffee back in 1971. Shake Shack was a food cart in Madison Square Park when it opened in 2004. Clover Food Labs was one food truck with a Square reader in Boston in 2008. Sunglass Hut was a kiosk in a Miami mall in 1971, and H&M was one store for decades after it first opened in 1947.

Sure, for every Shake Shack, there are 1,000 Shake Teardowns. But we can’t wait to meet the merchants on Thursday who are committed to delivering “what’s next” in retail and the innovators who share that view of the future.

So, I hope that you’ll join me on Thursday in giving all of the innovators who are dedicated to defining “what’s next” a shoutout — especially those small and medium-sized merchants who are jumping in with both feet your gratitude and support. And if you’re in the City — New York, that is — stop by. Who knows — maybe you’ll meet the next Shake Shack or Jet.com or Amazon.

You’ll, for sure, meet the innovators determined to give them life.